Vancouver, B.C. May 29, 2017 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global and agricultural leader in the natural zero-calorie sweetener industry, committed to the sustainable development of high-quality zero-calorie natural sweeteners, is pleased to announce the voting results from its Annual General and Special Meeting of Shareholders held on May 29, 2017, in Richmond, British Columbia.

BOARD OF DIRECTORS RE-ELECTED

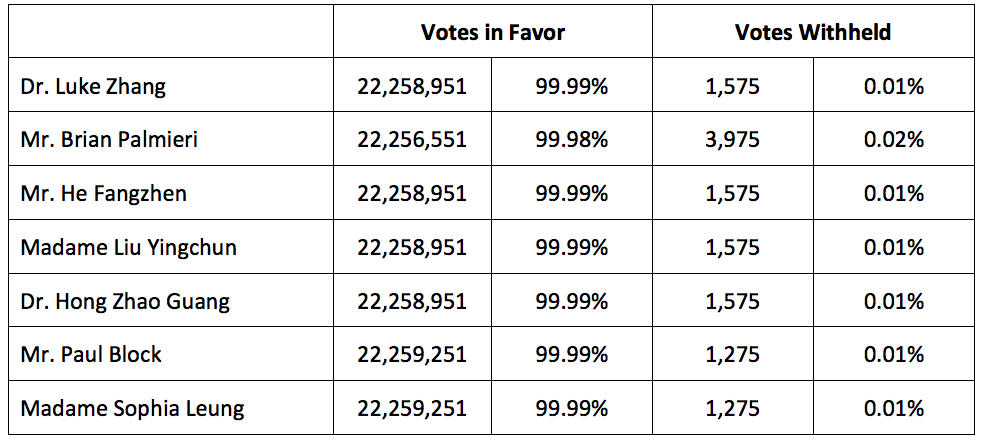

The director nominees, as listed in the Management Proxy Circular dated April 21, 2017, were elected as directors of the Company at the meeting. According to proxies received and voted by ballot, with over 58% of outstanding shares represented at the meeting, the results are as follows:

PROPOSED DEBT RESTRUCTURING TRANSACTION APPROVED BY SHAREHOLDERS

As part of the Special Shareholder Meeting, shareholders were asked to vote on the first phase of a twophase plan to eliminate the Company’s Chinese-held debt. The first phase is a related party transaction (the “Transaction”) that will eliminate approximately $17.8 million of the Company’s related party debt held by the Company’s Chairman and CEO and family members; in exchange, they will receive minority equity ownership in GLG’s primary Chinese subsidiary (the “Subsidiary”). As a related party transaction, under TSX rules, the Company was required to obtain majority shareholder approval from disinterested shareholders. The Company is pleased to report that of the eligible votes cast, 18,037,225 eligible voting shares, representing 99.64% of the eligible votes cast, voted in favor of the Transaction. The Company expects to complete this Transaction within the first half of June. Obtaining shareholder approval on this Transaction was not only important for reducing the Company’s related party debt; more significantly, it was a prerequisite of the Chinese bank debtholders to proceed with the second phase of the debt restructuring plan. As President and CFO Brian Meadows commented after the meeting: “We are pleased to have the required approval to complete this first phase of our debt restructuring plan. We will now turn our attention to completing the second phase, whereby we expect to eliminate the substantial debts held by Chinese banks and state-owned capital management companies. As our Board’s Independent Special Committee concluded, we view this restructuring plan as very beneficial for our shareholders and for our Company’s plans for growth.” As previously reported by the Company, the second phase involves restructuring the debt owed to these non-related party China-based lenders. Under the proposal, their debt holdings of $64.4 million, along with accrued interest and penalties of $19.6 million, will be eliminated in exchange for a proposed 25% stake in equity ownership in the Subsidiary. Together, the two-phase plan will eliminate over 80% of the Company’s outstanding debt and interest. Such substantial reduction in debt will greatly improve the Company’s balance sheet and its ability to generate new sources of working capital to fund sales expansion. The Company expects to retain over 50% ownership and management control of the Subsidiary after these two phases of debt restructure are complete. The Company encourages shareholders and interested investors to read the full transaction description available in the Company’s Management Proxy Circular, available at the Company’s website (www.glglifetech.com/investors) and on SEDAR.

ADDITIONAL MATTERS

The results of the other matters considered at the meeting are reported in the Report of Voting Results as filed on SEDAR on May 29, 2017. These included re-approval of the Company’s stock option plan and re-appointment of the Company’s auditor, which were both approved.

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 285-2602 ext. 101

Fax: +1 (604) 285-2606

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2016. In light of these factors, the forwardlooking events discussed in this press release might not occur. Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply