Vancouver, B.C. May 12, 2017 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global and agricultural leader in the natural zero-calorie sweetener industry, committed to the sustainable development of high-quality zero-calorie natural sweeteners, announces financial results for the three months ended March 31, 2017. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

FINANCIAL HIGHLIGHTS

- International stevia sales more than doubled year-over-year

- Over 500% improvement in gross profit year-over-year

- SG&A expenses cut by 25% year-over-year

- EBITDA margin improved 20 percentage points on higher sales growth

- First phase of $100 million debt restructure proposal to be voted on at shareholder meeting

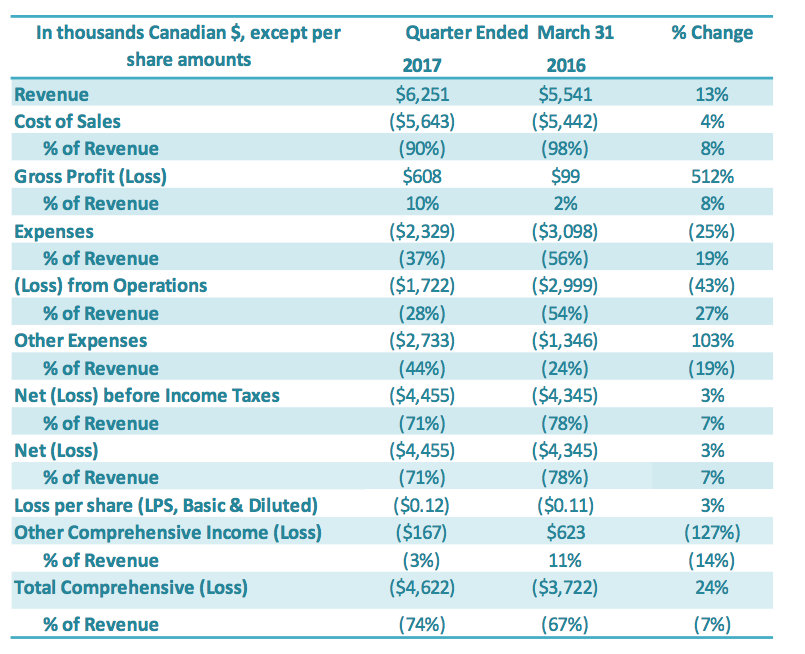

International stevia sales growth increased by 104% in the first quarter of 2017, relative to the comparable period in 2016, reflecting the increasing demand for GLG’s stevia extracts. The Company had previously forecast its first quarter international stevia sales to double, based on the strength of its product portfolio and product demand from its global distribution partner. Revenue for the three months ended March 31, 2017, was $6.3 million compared to $5.5 million in revenue for the same period last year, an increase of 13%. The revenue increase was driven by the twofold increase in stevia sales, which was partly offset by a decrease in monk fruit sales and China domestic stevia sales. International sales continue to be the dominant component of consolidated revenues, at 94% in the first quarter of 2017 (compared to 85% for the comparable period in 2016) – a result of both the Company’s continued focus on higher-purity stevia extract sales internationally and a decline in lowerpurity extract sales in China. Gross profit for the first quarter of 2017 improved by over 500%, at $0.6 million versus $0.1 million in the comparable period in 2016. The primary driver for this increase was the doubling of international stevia sales in the first quarter of 2017. Gross profit margins on international sales of high purity stevia were lower compared to the margins for same period in 2016; however, the significant increase in stevia volumes provided an increased gross profit contribution from international stevia sales. The Company was also successful in reducing its SG&A expenses, having reduced these expenses by 25% in the first quarter of 2017 relative to the comparable period in 2016. This improvement results from the Company’s continued focus on tight cost controls on administrative expenses while simultaneously growing its revenues. EBITDA for the first quarter of 2017 was negative $0.4 million or negative 6% of revenues, compared to negative $1.4 million or negative 26% of revenues for the same period in 2016. The $1.0 million or 20 percentage point improvement in EBITDA was driven by the higher gross profit on international stevia sales and the decrease in sales, general and administrative expenses. The Company is also making progress in its debt restructuring efforts. The Company’s Board of Directors appointed an Independent Special Committee to oversee the debt restructuring process, which has led to a two-phase plan to eliminate over 80% of the Company’s outstanding debt and interest. At the Company’s upcoming shareholder meeting, to be held on May 29, 2017, shareholders will be asked to vote on the first phase of the debt restructuring – a proposed related party transaction that will significantly reduce the Company’s related party debt. This proposed transaction is a mandatory requirement for successful completion of the second phase of the restructuring – eliminating the Company’s debt owed to the Chinese banks and state-owned capital management companies. If approved by shareholders, the first phase of the debt restructuring will eliminate approximately $17.8 million in related party debt held by the Company’s Chairman and CEO and family members; in exchange they will receive minority equity ownership in GLG’s primary Chinese subsidiary. Once that step is complete, the Company expects to finalize the second phase of the debt restructuring. The second phase involves restructuring the debt owed to the China-based lenders; under the proposal, their debt holdings of $64.4 million, along with accrued interest and penalties of $19.6 million, will be eliminated in exchange for a proposed 25% stake in equity ownership in the same subsidiary. Together, this two-phase debt restructuring plan would eliminate approximately $82.2 million in debt principal, have waived approximately $19.6 million in accrued interest and penalties, and save approximately $8 million in annual interest expenses. The Company expects to retain over 50% ownership and management control of the Subsidiary after these two phases of debt restructure are complete.

Outlook

We continue to expect significant growth in our international stevia and monk fruit sales in 2017, driven by our partnership with our global distributor. Considering our distributor’s size and distribution reach, we expect that the partnership will continue to deliver significantly higher sales to GLG. As our global distributor leverages its existing customer relationships, distribution channels, and ingredient expertise in the food and beverage space, we expect international stevia revenues to continue to grow. We see significant sales opportunities arising from this partnership. Moreover, the partnership presents opportunities to develop and deliver new stevia products that have not historically been part of our portfolio. Between new products, immediate product demand from our distribution partner, and the global sales potential to supply many more customers worldwide, we expect to see continued growth in the next twelve months. We also continue to see good sales opportunities for our monk fruit business. We believe that our ClearTaste Monk Fruit product line offers the best tasting monk fruit extract in the market today. This unique product removes citrus and astringent notes that otherwise complicate product formulators’ efforts to use monk fruit as a prime sweetener. We have received a lot of positive feedback from a variety of customers who prefer ClearTaste Monk Fruit over regular monk fruit extracts. We now have a pipeline of customers who are actively trialing this product, including some who have begun ordering our ClearTaste Monk Fruit products. We are on track to exceed our 2016 monk fruit sales volumes; however, the price of monk fruit has declined significantly from 2016, such that even with increased sales volumes in 2017, revenues may be similar to those of 2016. In addition, GLG is succeeding with its own direct sales efforts in the dietary supplement market, distinct from the food and beverage space covered by our distribution partnership. We have been successfully landing new accounts in this market for both stevia and monk fruit products. This new business stream began placing orders starting in the fourth quarter of 2016 and we continue to expect significant growth in the dietary supplement sector. We continue to grow the number of customersinterested in ClearTaste Stevia, and have successfully added a number of new customers in the first quarter, with a growing pipeline of prospective customers, and we expect to convert a percentage of these into paying customers. Our ClearTaste Stevia products provide better tasting stevia extracts that remove a number of the taste issues typically associated with stevia extracts, including bitter and astringent notes. With respect to our Naturals+ product line, we expect to develop sales with new/differentiated products such as our P-Pro Plus product as well as select natural ingredients that our customer base is currently sourcing. Finally, the Company has developed a two-phase plan designed to eliminate approximately $100 million in outstanding debt and interest, and subject to shareholder approval, the Company expects to complete the first phase in the second quarter of 2017. The Company then aims to finalize the second phase in the third or fourth quarter of 2017. Please see the Financial Highlights section above and our Management Proxy Circular, available on SEDAR and on the Company’s website (www.glglifetech.com), for further details.

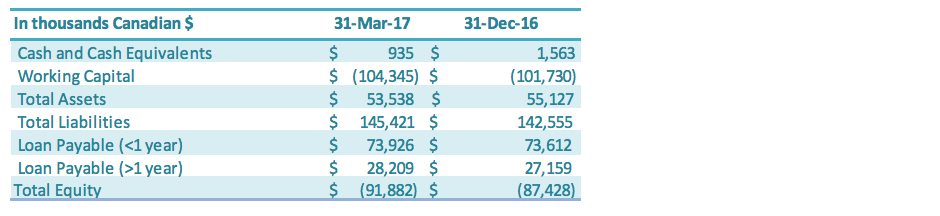

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the three months ended March 31, 2017, are available on SEDAR and on the Company’s website at www.glglifetech.com

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2016 and the condensed interim consolidated financial statements for the three-month period ended March 31, 2017.

Revenue

Revenue for the three months ended March 31, 2017, was $6.3 million compared to $5.5 million in revenue for the same period last year. This 13% increase in revenues was driven by an increase in international stevia sales of 104%, which was offset by a decrease in monk fruit sales of 74% and a decrease in China domestic stevia sales of 55%. International sales represented 94% of total sales, which is an increase of 9 percentage points over first quarter 2016 (85% of sales). Cost of Sales For the quarter ended March 31, 2017, the cost of sales was $5.6 million compared to $5.4 million in cost of sales for the same period last year ($0.2 million or 4% increase). Cost of sales as a percentage of revenues was 90% for the first quarter 2017, compared to 98% for the comparable period, an improvement of 8 percentage points. The decrease in cost of sales as a percentage of revenue for the three months ended March 31, 2017, compared to the prior comparable period, was driven by improved monk fruit margins and lower capacity charges in the first quarter of 2017. Capacity charges were $0.4 million in the first quarter of 2017 compared to $0.7 million in the prior period. The lower capacity charges for the quarter were driven by a significant increase in international stevia deliveries. In Q1 2017, compared to the prior period, the Company more than doubled its international stevia delivery volumes. Capacity charges charged to the cost of sales ordinarily would flow to inventory and are a significant component of the cost of sales. Only two of GLG’s manufacturing facilities were operating during the first quarter of 2017, and capacity charges of $0.4 million were charged to cost of sales (representing 8% of cost of sales) compared to $0.7 million charged to cost of sales in the same period of 2016 (representing 13% of cost of sales). The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period include:

- Capacity utilization of stevia and monk fruit manufacturing plants.

- The price paid for stevia leaf and monk fruit, and their respective quality which is impacted

by crop quality for a particular year/period, and the price per kilogram for which the stevia

and monk fruit extracts are sold. These are the most important factors that will impact the

gross profit of GLG’s stevia and monk fruit business. - Other factors which also impact stevia and monk fruit cost of sales to a lesser degree include:

- water and power consumption;

- manufacturing overhead used in the production of stevia and monk fruit extract,

- including supplies, power and water;

- net VAT paid on export sales;

- exchange rate changes; and

- depreciation and capacity utilization of the extract processing plants.

GLG’s stevia and monk fruit businesses are affected by seasonality. The harvest of the stevia leaves typically occurs starting at the end of July and continues through the fall of each year. The monk fruit harvest takes place typically from October to December each year. GLG’s operations in China are also impacted by Chinese New Year celebrations, which occur approximately late-January to mid-February each year, and during which many businesses close down operations for approximately two weeks. GLG’s production year runs October 1 through September 30 each year.

Gross Profit (Loss)

Gross profit for the three months ended March 31, 2017, was $0.6 million, compared to $0.1 million for the comparable period in 2016. The gross profit margin was 10% in the first quarter 2017 compared to 2% for the same period in 2016, an 8 percentage point improvement. This increase in gross profit for the first quarter of 2017, relative to the comparable period in 2016, was attributable to the significant growth (over 100% growth relative to first quarter 2016) in international stevia volumes. The increase in gross profit was also supported by decreased idle capacity charges in the first quarter of 2017, relative to the comparable period. Gross profit margins on international sales of high purity stevia were lower compared to the margins for same period in 2016; however, the significant increase in stevia volumes provided an increased gross profit contribution from international stevia sales compared to the prior period. Gross margins on monk fruit increased over the comparable period in 2016.

Selling, General, and Administration Expenses

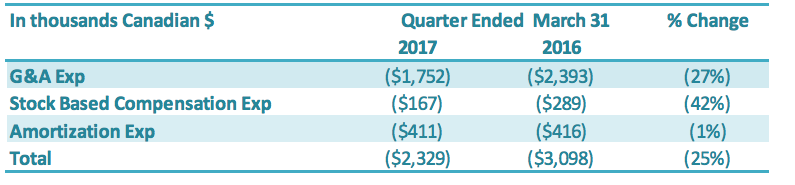

Selling, General and Administration (“SG&A”) expenses include sales, marketing, general and administration costs (“G&A”), stock-based compensation, and depreciation and amortization expenses on G&A fixed assets. A breakdown of SG&A expenses into these components is presented below:

G&A expenses for the three months ended March 31, 2017, was $1.8 million compared to $2.4 million in the same period in 2016. The $0.6 million decrease in G&A expenses was due to decreases in (1) professional fees ($0.2 million), (2) research and development expenses ($0.1 million), (3) office expenses ($0.1 million) and (4) salary expenses ($0.2 million). Stock-based compensation was $0.2 million for the three months ended March 31, 2017, compared with $0.3 million in the same quarter of 2016. The number of common shares available for issue under the stock compensation plan is 10% of the issued and outstanding common shares. During the quarter, compensation from vesting stock-based compensation awards was recognized, due to previously granted options and restricted shares. G&A-related depreciation and amortization expenses for the three months ended March 31, 2017, were $0.4 million compared with $0.4 million for the same quarter of 2016.

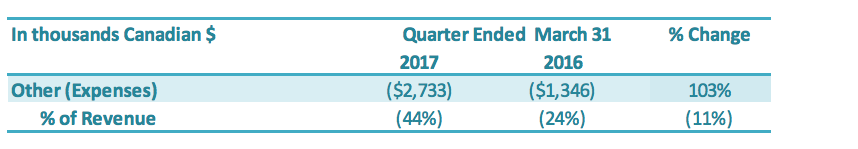

Other Expenses

Other expenses for the three months ended March 31, 2017, was $2.7 million, a $1.4 million increase compared to $1.3 million for the same period in 2016. The increase in other expenses for the first quarter of 2017 of $1.4 million is attributable to decrease in (1) bad debt recovery ($0.5 million) and (2) foreign exchange gains ($0.9 million).

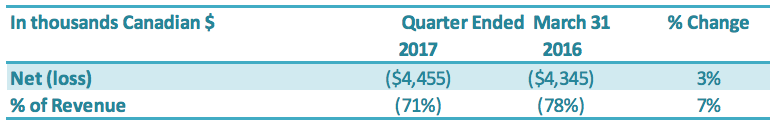

Net Loss Attributable to the Company

For the three months ended March 31, 2017, the Company had a net loss attributable to the Company of $4.5 million, an increase of $0.1 million or 3% over the comparable period in 2016 ($4.3 million). The basic loss and diluted loss per share from operations was $0.12 for the three months ended March 31, 2017, compared with a basic and diluted net loss of $0.11 for the comparable period in 2016.

Liquidity and Capital Resources

The Company continues to progress with the following measures to manage cash flow of the Company: paying down short-term loans, reducing accounts payable, negotiating with creditors for extended payment terms, working closely with the banks to restructure its loans, arranging financing with its Directors and other related parties, and reducing operating expenditures including general and administrative expenses and production-related expenses. Total loans payable (both short-term and long-term) is $102.1 million as of March 31, 2017, an increase of $1.3 million compared to the total loans payable as at December 31, 2016 ($100.8 million). The increase in loans was primarily driven by an increase in accrued interest ($1.2 million as of March 31, 2017) and the depreciation of the USD against the Canadian dollar ($0.1 million). The Company continues to work with its Chinese banks on restructuring its Chinese debt in 2017. In 2015, the Construction Bank of China successfully transferred GLG’s debt to China Cinda Assets Management Co. and the Agricultural Bank of China successfully transferred GLG’s debt to China Hua Rong Assets Management Co., each of which is a state-owned capital management company (“SOCMC”). The total of all China bank loans transferred to SOCMCs now account for approximately 74% of the Company’s outstanding Chinese debt. The nature of the business of these SOCMCs differs from banks, in that they take a long-term outlook on management of debt. For example, instead of simply requiring loan principal and interest payments, the SOCMCs aim to manage debts with greater flexibility, such as long-term loan terms, debt for equity arrangements, flexible debt retirement, and other long-term instruments. This debt is held at the Chinese subsidiary level, and any such potential arrangements would therefore be done at that level rather than at the corporate level. These SOCMCs could also be a source of possible future capital. The Company is still in discussions with these SOCMCs as to final terms – including interest rate and term of the debt – for the transferred debt. Until such terms are confirmed in a formal agreement, the terms of the original loan are represented in the financial statements. The assets of the Company’s subsidiaries including inventory and property, plant and equipment have been pledged as collateral for these bank loans. The Company continues to work with the Chinese banks and SOCMCs on restructuring its debt. The Corporate and Sales Developments section above describes a two-phase debt restructure plan. The first phase will involve the conversion of related party debt into equity into one of the Company’s subsidiaries. The second phase is expected to involve the conversion of bank/SOCMC debt into equity in that same subsidiary. Ultimately, this two-phase plan is designed to eliminate approximately $100 million in debt and accrued interest.

NON-GAAP Financial Measures

Gross Profit Before Capacity Charges

This non-GAAP financial measure shows the gross profit (loss) before the impact of idle capacity charges are reflected on the gross profit margin. GLG had only 50% of its production facilities in operation in the first quarter of 2017 and idle capacity charges have a material impact on the gross profit (loss) line in the financial statements. Gross profit before capacity charges for the three months ended March 31, 2017, was $1.0 million or 17% of first quarter revenues, compared to $0.8 million or 14% of first quarter revenues in 2016. Gross profit before capacity charges increased from the comparable period due primarily to a significant increase in international stevia sales in the first quarter of 2017 and improved monk fruit margins.

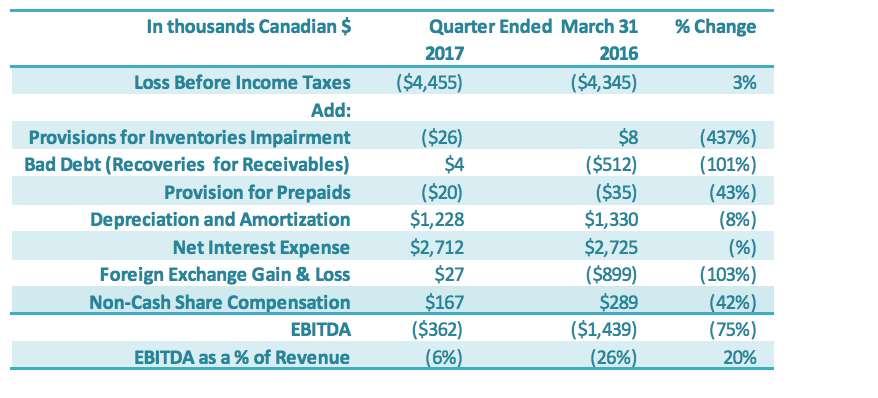

Earnings Before Interest Taxes and Depreciation (“EBITDA”) and EBITDA Margin

EBITDA for the three months ended March 31, 2017, was negative $0.4 million or negative 6% of revenues, compared to negative $1.4 million or negative 26% of revenues for the same period in 2016. EBITDA increased by $1.0 million or 20 percentage points for the three-month period ended March 31, 2017. The increase in EBITDA for the quarter is primarily attributable to higher gross profit on international stevia and monk fruit sales and a decrease in sales, general and administrative expenses.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on SEDAR (www.sedar.com). Additional information relating to the Company is also available on our website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 285-2602 ext. 101

Fax: +1 (604) 285-2606

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2016. In light of these factors, the forwardlooking events discussed in this press release might not occur. Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply