Notice of No Auditor Review of Interim Consolidated Financial Statements

The accompanying unaudited condensed interim consolidated financial statements have been prepared by management and approved by the Board of Directors. The Company’s independent auditors have not performed a review of these condensed interim consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) for a review of interim financial statements by an entity’s auditors

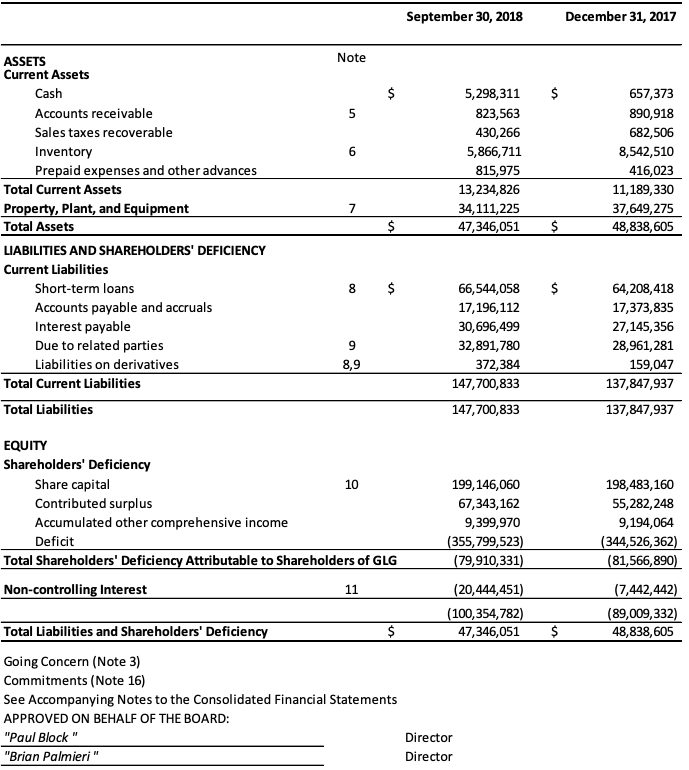

GLG LIFE TECH CORPORATION

Condensed Interim Consolidated Statements of Financial Position

As at September 30, 2018 and December 31, 2017

(Unaudited – Expressed in Canadian Dollars)

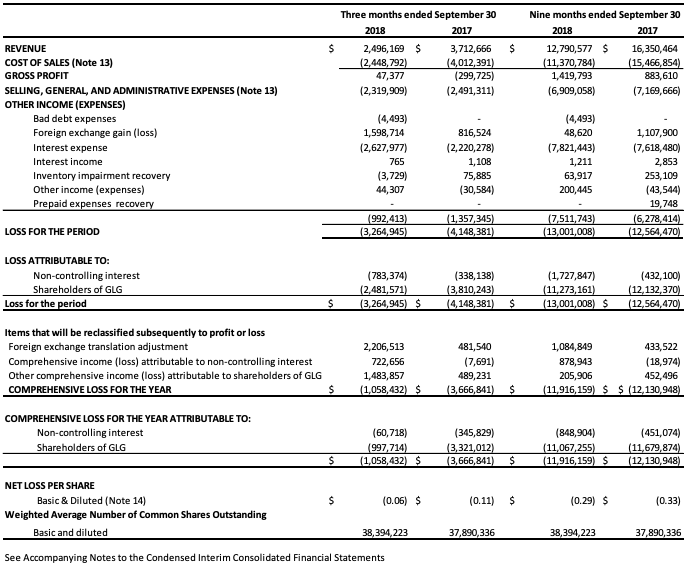

GLG LIFE TECH CORPORATION

Condensed Interim Consolidated Statements of Operations and Comprehensive (Loss)

For the Periods Ended September 30, 2018 and 2017

(Unaudited – Expressed in Canadian Dollars)

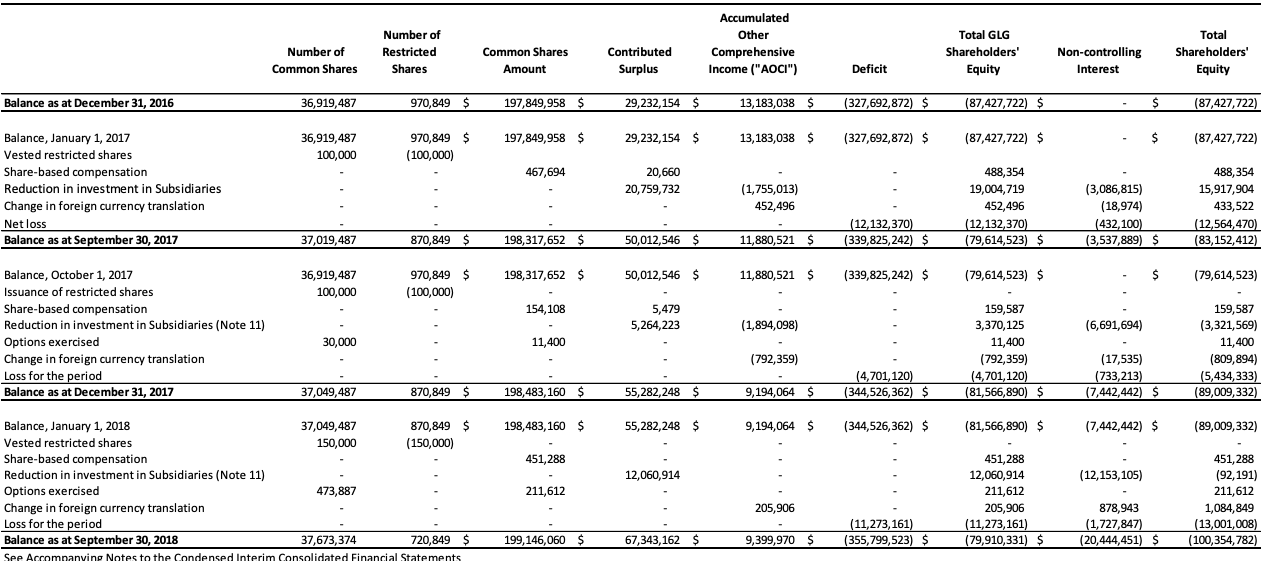

GLG LIFE TECH CORPORATION

Condensed Interim Consolidated Statements of Changes in Shareholders’ Deficiency As at September 30, 2018 and 2017

(Unaudited – Expressed in Canadian Dollars)

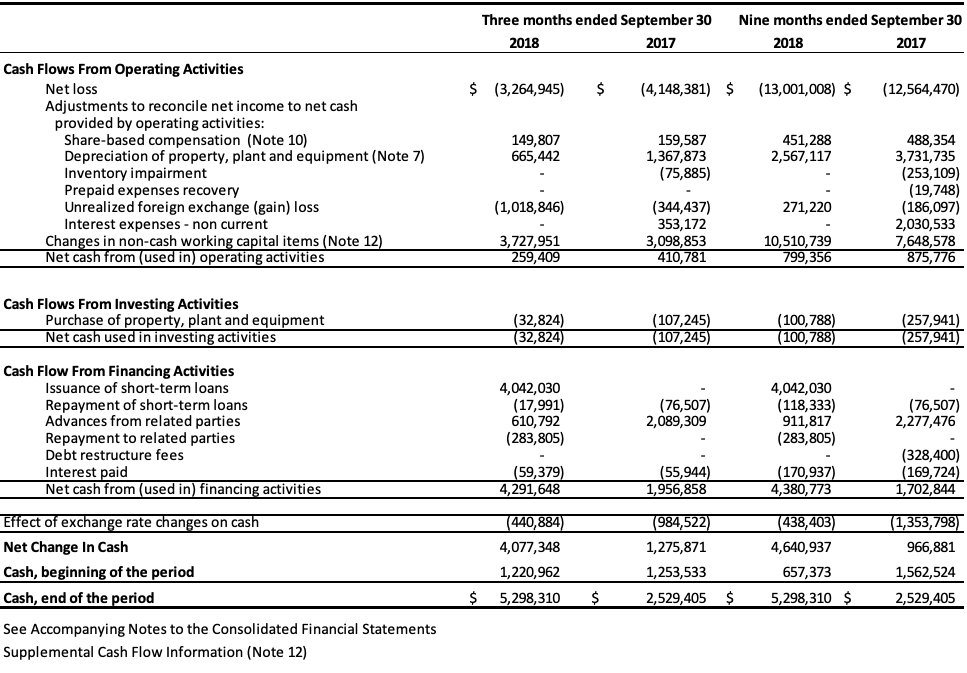

GLG LIFE TECH CORPORATION

Condensed Interim Consolidated Statements of Cash Flows For the periods ended September 30, 2018 and 2017

(Unaudited – Expressed in Canadian Dollars)

GLG LIFE TECH CORPORATION

Notes to the Condensed Interim Consolidated Financial Statements

Nine Months Ended September 30, 2018 and 2017

(Unaudited – Expressed in Canadian Dollars)

-

- NATURE OF OPERATIONS

GLG Life Tech Corporation (the “Company” or “GLG”) was incorporated under the Business Corporation Act (British Columbia), Canada. The registered office of the Company is located at Suite 100, 10271 Shellbridge Way, Richmond, British Columbia V6X 2W8. The Company’s shares

trade on the Toronto Stock Exchange (“TSX”) under the symbol “GLG”.The Company is a vertically integrated producer of high-grade stevia and monk fruit extracts. The Company’s business operates primarily through the manufacturing and sales of refined forms of stevia and monk fruit, and has operations in China and North America. - BASIS OF PRESENTATION

These unaudited condensed interim consolidated financial statements for the nine months ended September 30, 2018, including comparatives, have been prepared in accordance with International Accounting Standards (“IAS”) 34 (“Interim Financial Reporting”).

The notes presented in these unaudited condensed interim consolidated financial statements include only significant events and transactions occurring since the Company’s last fiscal year end and they do not include all of the information required in annual financial statements in accordance with International Financial Reporting Standards (“IFRS”). As a result, these unaudited condensed interim consolidated financial statements should be read in conjunction with the Company’s 2017 annual financial statements which have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”). These unaudited condensed consolidated financial statements have been prepared on a historical costs basis. In addition, these financial statements have been prepared using the accrual basis of accounting. These unaudited condensed interim consolidated financial statements are presented in Canadian dollars, except when otherwise indicated. The condensed interim consolidated financial statements of the Company for the nine months ended September 30, 2018, were authorized for issue by the Audit Committee on behalf of the Board of Directors on November 13, 2018. - GOING CONCERN

These unaudited condensed consolidated financial statements have been prepared in accordance with IFRS accounting policies, which contemplate the realization of assets and settlement of liabilities in the normal course of business as they become due. For the nine-month period ended September 30, 2018, the Company incurred a net loss attributed to the company’s shareholders of $11,273,161 (2017 – $12,132,370). As at September 30, 2018, the Company had an accumulated deficit of $355,799,523 (December 31, 2017 – $344,526,362), working capital deficiency of $134,466,007 (December 31, 2017 – $126,658,607) and cash inflow from operating activities of $799,356 (2017 – cash inflow $875,776).

These condensed interim consolidated financial statements do not include the adjustments that would be necessary should the Company be unable to continue as a going concern. Such adjustments could be material. The Company’s operating assets and primary sources of income and cash flows originate in China; the Company is therefore subject to the considerations and risks of operating in China. These include risks associated with the political and economic environment, foreign currency exchange and the legal system in China. Changes in the political and economic policies of the People’s Republic of China (“PRC”) government may materially and adversely affect the Company’s business, financial condition and results of operations and may result in the Company’s inability to sustain growth and expansion. There is also no assurance that the Company will not be adversely affected by changes in other governmental policies or any unfavorable change in the political, economic or social conditions, laws or regulations, or the rate or method of taxation in China.

The PRC economy differs from the economies of most developed countries in many respects, including the extent of government involvement, the level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China are still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies. While the PRC economy has experienced significant growth in the past three decades, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall PRC economy, but may also have a negative effect on the Company. The financial condition and results of operations could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to the Company. In addition, the PRC government has in the past implemented certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently could have a material adverse effect on our business, financial condition and results of operations.

There are also uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. As noted above, most of the Company’s operations are conducted in the PRC, and are governed by PRC laws, rules and regulations. The Company’s PRC subsidiaries are subject to laws, rules and regulations applicable to foreign investment in China. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions may be cited for reference but have limited precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws, rules and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investment in China. However, China has not developed a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic activities in China or may be subject to significant degrees of interpretation by PRC regulatory agencies. In particular, because these laws, rules and regulations are relatively new, and because of the limited number of published decisions and the nonbinding nature of such decisions, and because the laws, rules and regulations often give the relevant regulator significant discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may be given retroactive effect. As a result, the Company may not be aware of a violation of these policies and rules until after the occurrence of the violation.

Furthermore, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention. Since the PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may impede the Company’s ability to enforce the contracts we have entered into and could materially and adversely affect the Company’s business, financial condition and results of operations. Regarding risk associated with financial instruments generally, as of September 30, 2018, and December 31, 2017, substantially all bank loans were held by Chinese banks and state-owned capital management companies (“SOCMC”). The Company has provided its banks and SOCMCs guarantees and collateral agreements which could enable the banks and SOCMCs to exercise their rights against the Company’s assets, because the Company has not made its principal or interest payments on time. Should the banks exercise their respective rights, it could have a significant impact on the Company’s ownership of its assets, and ultimately, its operations. The Company has provided collateral and guarantor agreements in multiple provinces in China, of which each is subject to local provincial rules. There is additional risk that the Company may be assessed additional interest and penalties. To the best of the Company’s knowledge, the banks have not taken any action on their assets to date.

The Company also relies heavily on related parties for funding and continued operations of the Company. Should the related parties not act in good faith, or decide to no longer fund the operations of the Company, there is a high risk that the operations of the Company could be significantly impacted adversely.

Finally, in the ordinary course of business, the Company is from time to time involved in legal proceedings and litigation. Presently, there are no legal proceedings and litigations that recently have had, or to the Company’s knowledge, are reasonably possible to have, a material impact on the Company’s financial positions, results of operations or cash flows. The Company did not accrue any loss contingencies in this respect as of September 30, 2018, and December 31, 2017, as the Company did not consider an unfavorable outcome in any material respects in these legal proceedings and litigations to be probable. The above matters indicate the existence of a material uncertainty about the Company’s ability to continue as a going concern. - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a) Statement of compliance and application of new International Financial Reporting Standards (“IFRS”)The unaudited condensed interim financial statements have been prepared using accounting policies consistent with those used in the preparation of the audited consolidated financial statements as at December 31, 2017. The unaudited condensed interim consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2017.IFRS 2 – Share-Based PaymentsOn January 1, 2018, the Company adopted the new accounting standard IFRS 2. The amendments eliminate the diversity in practice in the classification and measurement of particular share-based payment transactions which are narrow in scope and address specific areas of classification and measurement. The Company has concluded that there is no significant impact resulting from the application of the new standard on its consolidated financial statements.

IRFS 15 – Revenues from Contracts with Customers

On January 1, 2018, the Company adopted the new accounting standard IFRS 15 to all contracts using the modified retrospective approach. The Company has concluded that there is no significant impact resulting from the application of the new revenue standard on its consolidated financial statements. Under the new revenue standard, the Company’s revenue continues to be recognised when products are delivered to the customer, which is also the moment when control of the products is transferred, and when there is no unfulfilled obligation that could affect the customer’s acceptance of the products. Delivery occurs when the products have been shipped to the specific location, the risks of loss have been transferred to the customer and the customer has accepted the products in accordance with the sales contract.

IFRS 9 – Financial Instruments

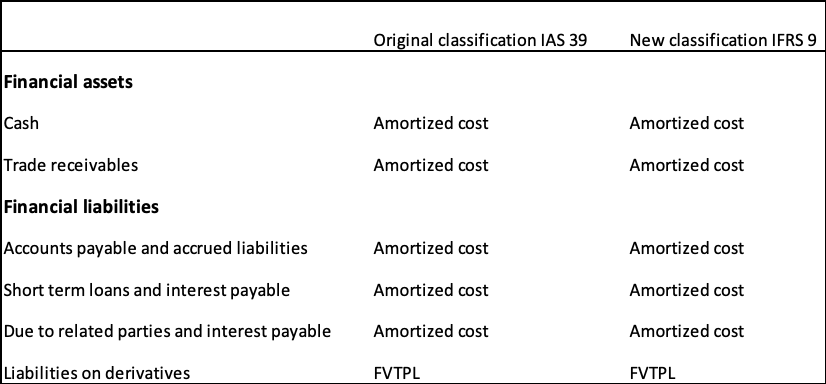

On January 1, 2018, the Company adopted the new accounting standard IFRS 9. IFRS 9 includes revised guidance on the classification and measurement of financial instruments, including a new expected credit loss model for calculating impairment on financial assets, and new general hedge accounting requirements. Most of the requirements in IAS 39 for classification and measurement of financial liabilities were carried forward in IFRS 9, so the Company’s accounting policy with respect to financial liabilities is unchanged. As a result of the adoption of this standard, the Company has changed its accounting policy for financial assets retrospectively, for assets that were recognized at the date of application. The change did not impact the carrying value of any financial assets on the transition date.

The following are new accounting policies for financial assets under IFRS 9.

Financial Assets

1.Classification and measurement

The Company classifies its financial assets in the following categories: at fair value through profit or loss (“FVTPL”), at fair value through other comprehensive income (“FVTOCI”) or at amortized cost. The classification depends on the purpose for which the financial assets were acquired. Management determines the classification of its financial assets at initial recognition.

The classification of debt instruments is driven by the business model for managing the financial assets and their contractual cash flow characteristics. Debt instruments are measured at amortized cost if the business model is to hold the instrument for collection of contractual cash flows and those cash flows are solely principal and interest. If the business model is not to hold the debt instrument, it is classified as FVTPL. Financial assets with embedded derivatives are considered in their entirety when determining whether their cash flows are solely payments of principal and interest. Equity instruments that are held for trading (including all equity derivative instruments) are classified as FVTPL, for other equity instruments, on the day of acquisition the Company can make an irrevocable election (on an instrument by-instrument basis) to designate them as at FVTOCI.

i) Financial assets at FVTPL

Financial assets carried at FVTPL are initially recorded at fair value and transaction costs are expensed in the statement of profit or loss. Realized and unrealized gains and losses arising from changes in the fair value of the financial asset held at FVTPL are included in the statement of profit or loss in the period in which they arise. Derivatives are also categorized as FVTPL unless they are designated as hedges.

ii) Financial assets at FVTOCI

Investments in equity instruments at FVTOCI are initially recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses arising from changes in fair value recognized in other comprehensive income. There is no subsequent reclassification of fair value gains and losses to profit or loss following the derecognition of the investment.

iii) Financial assets at amortized cost

Financial assets at amortized cost are initially recognized at fair value and subsequently carried at amortized cost less any impairment. They are classified as current assets or non-current assets based on their maturity date.

1. Impairment of financial assets at amortized cost

The Company recognizes a loss allowance for expected credit losses on financial assets that are measured at amortized cost. At each reporting date, the loss allowance for the financial asset is measured at an amount equal to the lifetime expected credit losses if the credit risk on the financial asset has increased significantly since initial recognition. If at the reporting date, the financial asset has not increased significantly since initial recognition, the loss allowance is measured for the financial asset at an amount equal to twelve month expected credit losses. For trade receivables the Company applies the simplified approach to providing for expected credit losses, which allows the use of a lifetime expected loss provision. Impairment losses on financial assets carried at amortized cost are reversed in subsequent periods if the amount of the loss decreases and the decrease can be objectively related to an event occurring after the impairment was recognized.

2. Derecognition of financial assets

Financial assets are derecognized when they mature or are sold, and substantially all the risks and rewards of ownership have been transferred. Gains and losses on derecognition of financial assets classified as FVTPL or amortized cost are recognized in the income statement. Gains or losses on financial assets classified as FVTOCI remain within accumulated other comprehensive income. The Company completed an assessment of its financial instruments as at January 1, 2018. The following table shows the original classification under IAS 39 and the new classification under IFRS 9:

Derivative Financial Instruments

Derivatives are recognized initially at fair value on the date the related contract is entered into. Subsequent to initial recognition, derivatives are remeasured at their fair value. The method of recognizing any resulting gain or loss depends on whether the derivative is designated as a hedging instrument and, if so, the nature of the item being hedged. Changes in the fair value of any derivative instruments that do not qualify for hedge accounting are recognized immediately in the statement of profit or loss.

b) New accounting standards issued but not yet effective

Trade Receivables

Trade receivables are amounts due from customers for the sale of stevia and monk fruit products in the ordinary course of business. Trade receivables are recognized initially at fair value and subsequently at amortized cost using the effective interest rate method. Trade receivables are recorded net of lifetime expected credit losses.

IFRS 16 – Leases

On January 13, 2016, the IASB issued the final version of IFRS 16 Leases. The new standard will replace IAS 17 Leases and is effective for annual periods beginning on or after January 1, 2019. IFRS 16 eliminates the classification of leases as either operating leases or finance leases for a lessee. Instead, all leases are treated in a similar way to finance leases applying IAS 17. IFRS 16 does not require a lessee to recognize assets and liabilities for short-term leases (i.e. leases of 12 months or less) and leases of low-value assets. The Company is evaluating the effect of this standard on the Company’s consolidated financial statements.

IFRIC 23 – Uncertainty Over Income Tax Treatments

This standard clarifies how to apply the recognition and measurement requirements in IAS 12 when there is uncertainty over income tax treatments. It is effective for annual periods beginning on or after January 1, 2019, with early adoption permitted. The Company does not expect that the adoption of this standard will have a material effect on the Company’s consolidated financial statements.

- ACCOUNTS RECEIVABLE

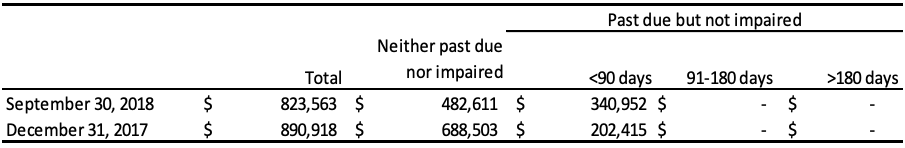

The aging analysis of trade receivables is s a follows:

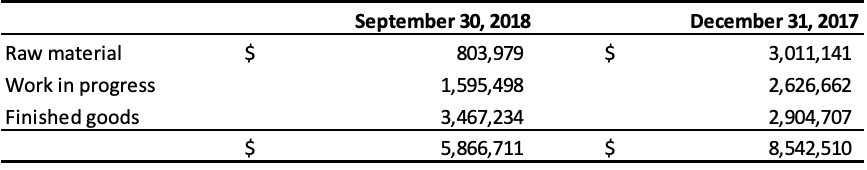

- INVENTORY

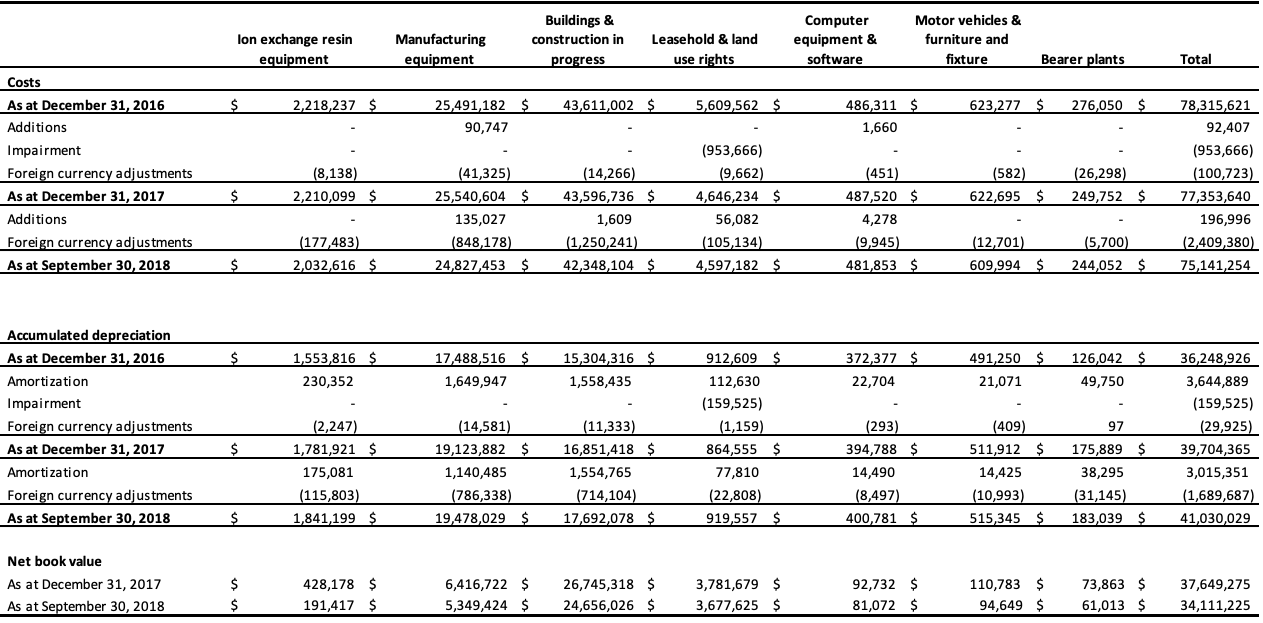

The Company assessed the net realizable value of inventory based on the following: the cost of raw materials is comprised of the purchase price, applicable taxes and other costs incurred in bringing inventory to its present location and condition; the cost of finished goods includes cost of materials and cost of conversion; the cost of conversion includes costs directly related to the units of production, such as direct labor, and fixed and variable production overheads, based on normal operating capacity. For the nine months ended September 30, 2018, the Company recorded an inventory impairment recovery of $63,917 (2017 – $253,109). For the nine months ended September 30, 2018, raw materials, changes in work in progress and finished goods included in cost of sales amounted to $7,341,896 (2017 – $11,772,739). The carrying amounts of inventory have been pledged as general collateral for the line of credit facilities available to the Company’s Chinese subsidiary. - PROPERTY, PLANT AND EQUIPMENT

Land use rights in China have remaining terms ranging from 40.50 to 40.75 years. Amortization expense is included in the unaudited condensed interim consolidated statement of operations under the following categories:

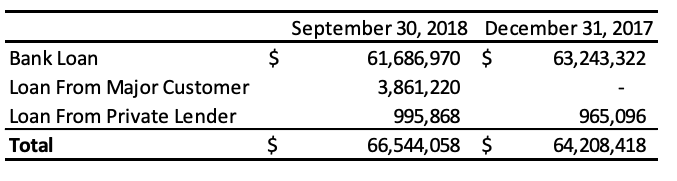

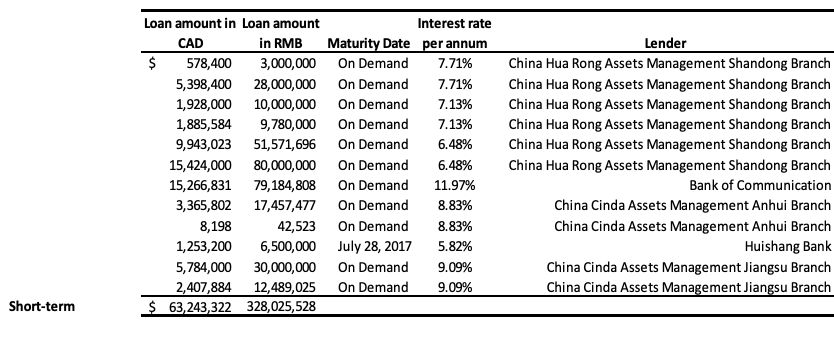

- SHORT-TERM LOANS

The Company’s short-term loans consisted of borrowings from various banks in China of $61,686,970 (December 31, 2017 – $63,243,322), a zero-interest loan from a major customer (Archer Daniels Midland Company or “ADM”) of $3,861,220 (2017 – $nil), and loans from private lenders of $995,868 (2017 – $965,096) as follows:

Bank loans as at September 30, 2018: The Company has been working with its Chinese banks and SOCMCs on restructuring its debt during the quarter ended September 30, 2018.Short-term borrowing from major customers:

The Company has been working with its Chinese banks and SOCMCs on restructuring its debt during the quarter ended September 30, 2018.Short-term borrowing from major customers:

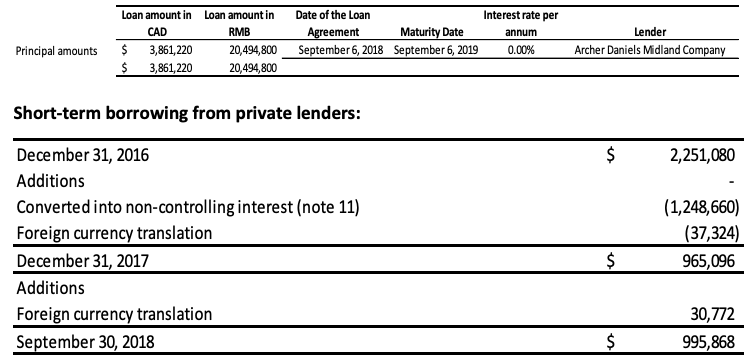

In the third quarter of 2018, ADM issued a zero-interest RMB-denominated loan to the Company to facilitate the purchase of raw materials for its stevia extracts. The loan principal amount as of September 30, 2018, is $3,861,220 (20,494,800 RMB) (2017 – $nil). Loan principal repayments are tied to the timing and amounts of those raw materials that are used in production.

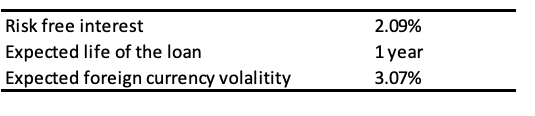

Short-term borrowing from private lenders consists of two loans. The first loan principal amount as of September 30, 2018, is $995,868 (2017 – $965,096) and bears interest at 11.50% per annum, compounding quarterly. The loan is due on demand and does not have any attached covenants. The second loan principal amount as of September 30, 2018, is $nil (2017 – $nil) and bears interest at 20% per annum, compounding quarterly. During 2017, the principal on the second loan was converted into equity interest in Runhai, the Company’s Chinese subsidiary (see Note 11). The interest payable on the loan remains due on demand and does not have any attached covenants. This interest payable provides a repayment option to the lender in either RMB or USD using a fixed foreign exchange rate of 6.1234 RMB/USD. This option results in a liability of $13,071 (2017 – $6,509), which is accounted as liabilities on derivatives and included in unrealized foreign exchange losses. The fair value of the liability on derivatives was calculated using the Black-Scholes model with the following assumptions:

- RELATED PARTIES TRANSACTIONS AND BALANCESa) Transactions with key management personnel

Key management personnel are those persons who have the authority and responsibility for planning, directing, and controlling activities of the Company directly or indirectly, including any external director of the Company.

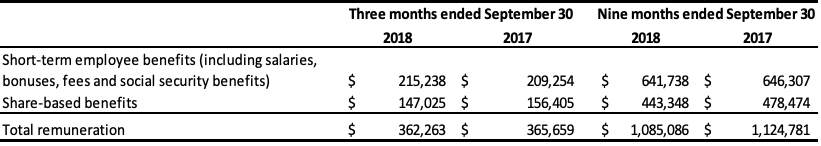

Remuneration of key management of the Company is comprised of the following expenses:

Certain executive officers are subject to termination benefits. Upon resignation at the Company’s request or in the event of a change in control, they are entitled to termination benefits ranging from 24 to 36 months of gross salary, totaling approximately $1,856,000. Key management exercised 154,000 stock options granted under the Company’s stock option plan in the nine months ended September 30, 2018.b) Amount due to related parties

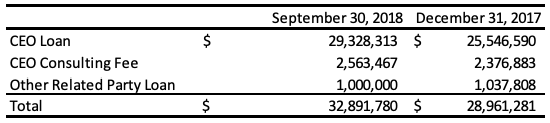

The amounts due to related parties are shown in the following table:

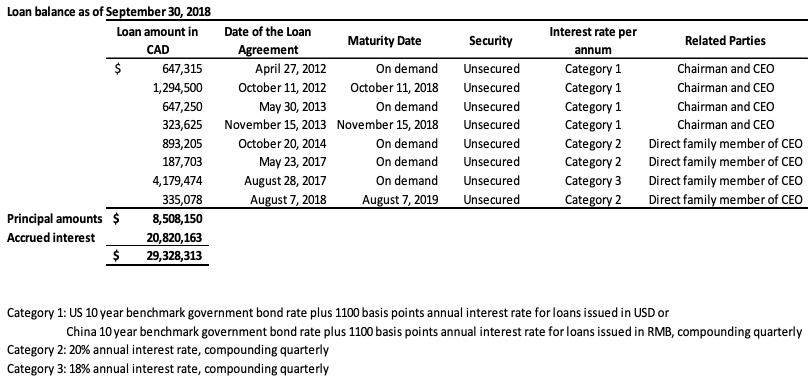

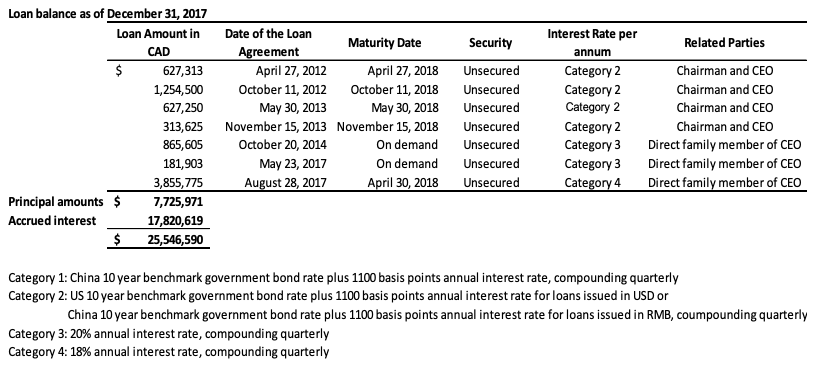

i) As of September 30, 2018, the Company has accrued $2,563,467 (2017 – $2,376,883) including 3% interest per annum in consulting fees to the Company’s Chairman and Chief Executive Officer.ii) The Company has obtained loans under numerous credit facility agreements from the Company’s Chairman and Chief Executive Officer (“CEO”). As at September 30, 2018, the total amount owed to the CEO under these facilities, including principal and accumulated interest, is $6,384,093 (2017 – $5,586,969). As at September 30, 2018, the entire balance owed is due within 12 months and is therefore classified as current on the statement of financial position.

The Company has also obtained loans under numerous credit facility agreements from a direct family member of the CEO. As at September 30, 2018, the total amount owed under these facilities, including principal and accumulated interest is $22,944,220 (2017 – $19,959,621). As at September 30, 2018, the entire balance owed is due within 12 months and is therefore classified as current on the statement of financial position. During fiscal 2017, there was a debt settlement of which $14,723,107, which related to loans made by the CEO and the direct family member, as outlined in Note 11. The combined total of the above loans still outstanding, including the accrued interest, is $29,328,313 (2017 – $25,546,590) in current liabilities. These loans will be repaid by either GLG or its Chinese subsidiary to the lender in the currency the loans were originally borrowed (either USD or RMB), or, at the lender’s discretion, in the alternate currency, depending on the terms of the specific credit facility. The terms of each individual loan are disclosed in the table below. These loans provide a repayment option to the lenders in either RMB or USD using a fixed foreign exchange rate specified in each credit facility. This option results in a liability of $359,313 (2017 – $152,538), which is accounted as liabilities on derivatives and unrealized foreign exchange losses. The assumptions for the fair value determination of the liability are the same as those outlined in Note 8.

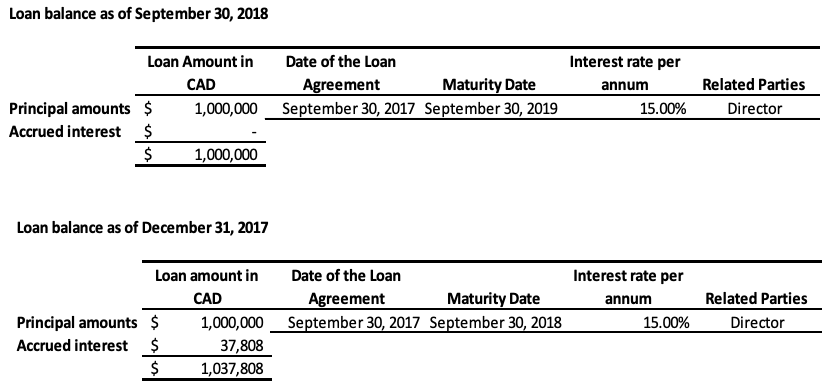

iii) As of September 30, 2018, the Company has a loan of $1,000,000 (2017 – $1,000,000) from a Director of the Company to provide working capital required for monk fruit extracts. The loan is secured by expected proceeds from monk fruit sales, bearing interest at 15% per annum and repayable in full within twenty-four months of the disbursement date. As of September 30, 2018, the total amount due to this related party including interest was $1,000,000 (2017 – $1,037,808) and is classified under current liabilities.

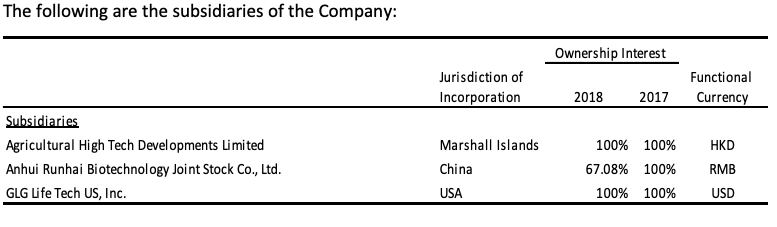

c) Subsidiaries

The following subsidiaries of the Company

- SHARE CAPITAL

a) Common Shares

In 2017, share capital increased by $11,400 as a result of the exercise of 30,000 stock options. For the nine months ended September 30, 2018, share capital increased by $211,612 as a result of the exercise of 473,887 stock options. An unlimited number of common shares are authorized with no par value. The holders of common shares are entitled to one vote per share. As at September 30, 2018, there are 38,394,223 common shares issued and outstanding with no par value.b) Share-based compensation

i) Share-based compensationShare-based compensation to employees is measured at fair value. Fair value is determined using the Company’s common share price, and the Black-Scholes option pricing model (“Black-Scholes model”). The Company is subject to the policies of the TSX, under which it is authorized to grant options and restricted shares to officers, directors, employees and consultants enabling them to purchase common stock of the Company. The Company has a stock option and restricted share plan (the “Plan”) amended and effective from May 16, 2008. The Plan is administered by the Board of Directors, which determines individual eligibility under the plan.

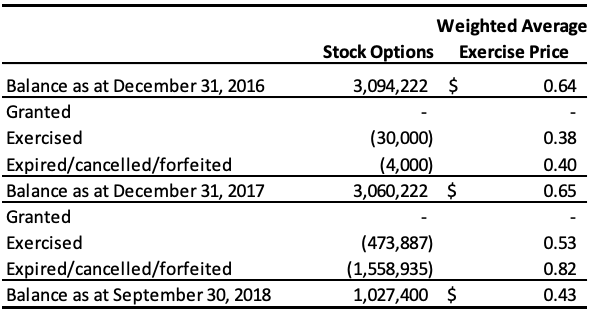

ii) Stock options

Under the Plan, options granted are non-assignable and the number of common shares available for issue is a maximum of 10% of the issued and outstanding common shares of the Company, inclusive of any restricted shares granted under the Plan. The maximum term of an option is five years after the date of grant. The exercise price may not be less than the closing price of the Company’s shares on the last business day immediately preceding the date of grant options, and options have a vesting period from 1 year to 3 years. Under the Plan, restricted shares granted are non-assignable and the number of common shares available for issue is a maximum of 10% of the issued and outstanding common shares in the Company inclusive of any stock options granted under the Plan. Holders of restricted shares are entitled to voting rights and dividends. The maximum vesting period for restricted shares is five years from the date of grant unless otherwise approved by the Board of Directors. Restricted shares are issued to certain employees and may have certain performance criteria, which are based on production and financial targets. The Company recorded share-based payments in the amount of $nil (2017 – $26,139), which all related to stock options granted in previous years.

A continuity of stock options is as follow:

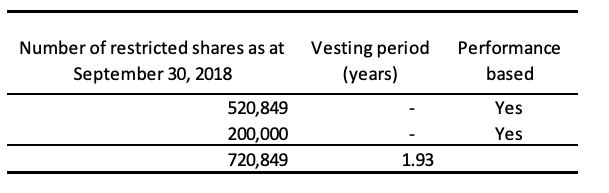

iii) Restricted Shares

The Company recorded share-based payments in the amount of $451,288 (2017 – $621,802), which all related to restricted shares granted in previous years. Those were valued using the stock price at the date of issue, recognized over the vesting period of the restricted shares.

A continuity of Restricted Shares is as follows:

The vesting periods for restricted shares into unrestricted common shares as at September 30, 2018, are as follows:

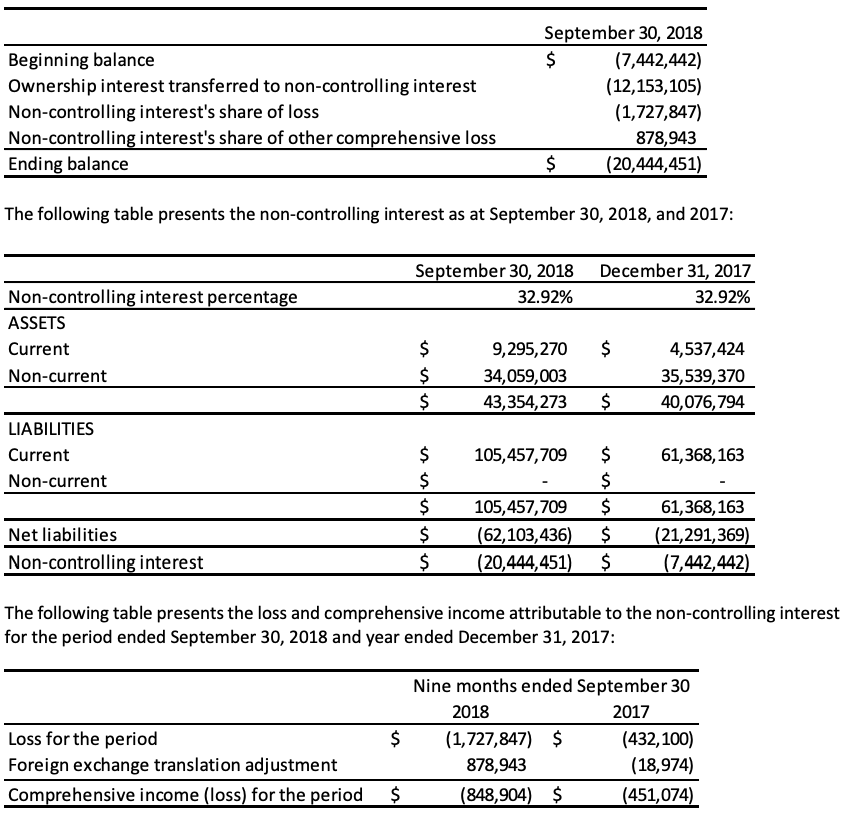

- NON-CONTROLLING INTEREST

During 2017, the Company disposed of 32.92% of its ownership in Runhai to its related parties in order to settle $15,971,767 (RMB 80,584,090) in related party loans. Accordingly, the Company de-recognized the derivative liabilities related to this portion of the loans totaling $274,538. The related party loans were converted to a 32.92% ownership share in Runhai. The reduction in the Company’s ownership interest in Runhai did not result in a loss of control and was recorded as equity transactions. In connection with the recognition of non-controlling interest, the proportionate share of the cumulative amount of foreign exchange translation differences recognized in other comprehensive income totaling $3,649,111 was reattributed to the non-controlling interest in Runhai. In addition, the Company incurred transaction costs totaling $563,154 and this amount was deducted from equity. The carrying amount of non-controlling interests was adjusted to reflect the change in the non-controlling interests’ relative interests in the subsidiary and the difference between the adjustment to the carrying amount of non-controlling interests and the Company’s share of proceeds received and/or consideration paid is recognized directly in equity and attributed to shareholders of the Company.

On June 1, 2018, the Company transferred its ownership interest in its Qingdao Runde Biotechnology Company, Ltd. (“Runde”) subsidiary to its Anhui Runhai Biotechnology Joint Stock Company, Ltd. (“Runhai”). As the Company has a 67.08% interest in Runhai, with 32.92% held by a related party, the effect of this transfer was a disposition of 32.92% of its ownership interest in Runde. The reduction in the Company’s ownership interest in Runhai did not result in a loss of control and was recorded as equity transactions. As a result of this transaction, all previous China subsidiaries are solely owned by Runhai and the Company owns 67.08% of Runhai.

The following table represents the equity attributable to the non-controlling interest:

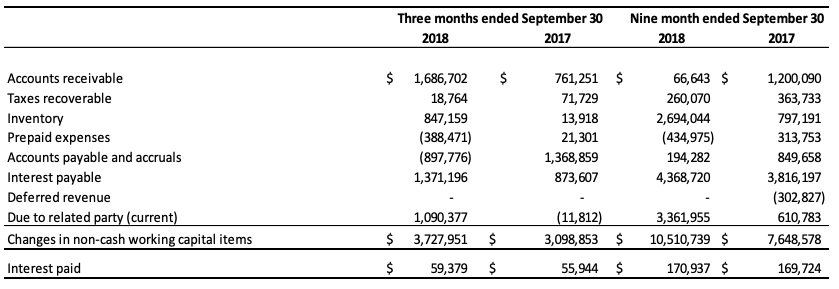

- SUPPLEMENTARY INFORMATION

Supplementary cash flow information is as follows:

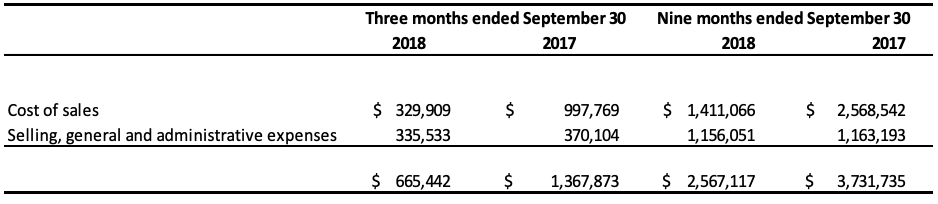

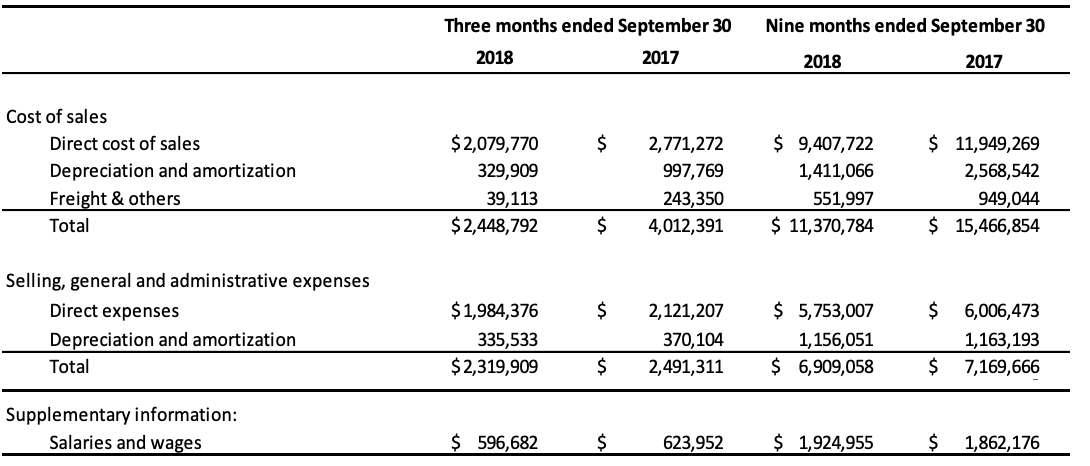

- COST OF SALES AND EXPENSES

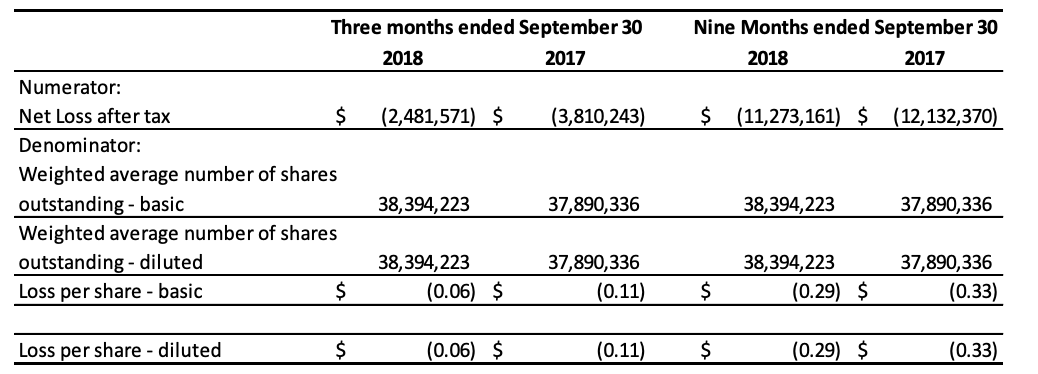

- LOSS PER SHARE

The following table sets forth the calculation of the basic and diluted loss per share for share for the nine months ended September 30, 2018 and 2017:

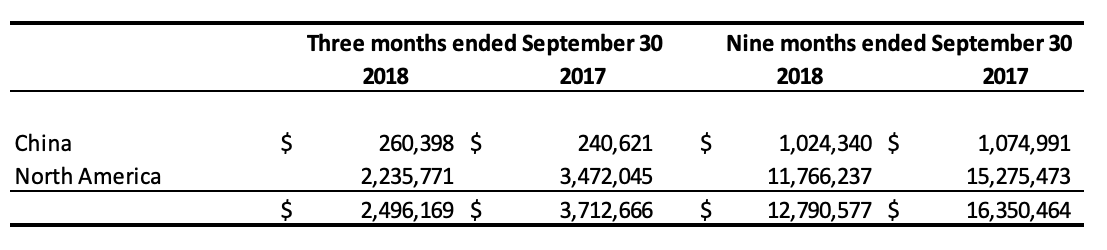

The total number of anti-dilutive options excluded from the calculation for the nine months ended September 30, 2018 was 1,027,400 (2017 – 3,090,222). - SEGMENTED INFORMATION

The Company’s business operates primarily through the Natural Sweeteners Products segment. The Natural Sweeteners Products segment is the manufacturing and sales of refined forms of stevia and monk fruit, which has operations in China and North America. The Company’s chief operating decision makers are the CEO and CFO. They review the operations and performance of the Company. Revenue to external customers by geographical location is as follows:

During the nine months ended September 30, 2018, two customers (2017 – one customer) of the Natural Sweeteners CGU represented 76% (2017 – 75%) of total consolidated revenue. - COMMITMENTS

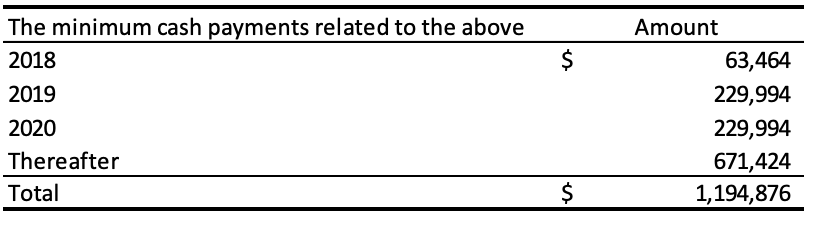

The Company renewed one five-year operating lease with respect to production equipment at the Qingdao Runde factory in China. The lease expires on December 31, 2021. The annual minimum lease payment is approximately $94,000 (RMB 500,000). The Company signed a twenty-year land rental agreement in Qingdao. The agreement was signed on February 16, 2005, and expires on February 16, 2025. Currently, the Company is in the third five-year period of that agreement with rent expense of approximately $2,570 (RMB 13,642) per year. In the fourth five-year period, the rent expense is approximately $3,002 (RMB 15,934) per year. With the same vendor the Company also signed another rental agreement for the adjacent land from November 8, 2006, to November 7, 2036. The annual rental expense is approximately $5,384 (RMB 28,576). The Company’s current office premises are leased under an eight-year agreement beginning August 1, 2016, and will expire on July 31, 2024. The nine-month lease payments ended September 30, 2018, total $131,980 (2017 – $130,035).

- NATURE OF OPERATIONS

The Company has been working with its Chinese banks and SOCMCs on restructuring its debt during the quarter ended September 30, 2018.Short-term borrowing from major customers:

The Company has been working with its Chinese banks and SOCMCs on restructuring its debt during the quarter ended September 30, 2018.Short-term borrowing from major customers:

Leave a Reply