Vancouver, B.C. November 12, 2019 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the three and nine months ended September 30, 2019. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

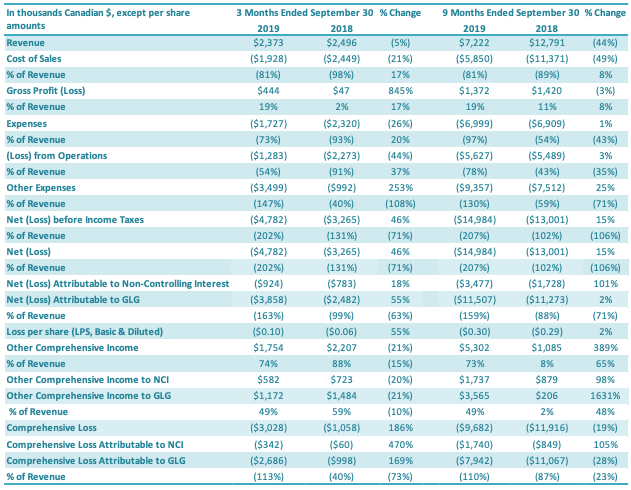

FINANCIAL SUMMARY

The Company reported revenues of $2.4 million in the third quarter of 2019, a $0.1 million decrease compared to the third quarter of 2018 ($2.5 million). However, the Company reported an increase of seventeen percentage points in gross profit margin for the third quarter 2019 (19%), relative to the same period in 2018 (2%).

The Company reported revenues of $7.2 million in the first nine months of 2019, a $5.6 million decrease compared to the comparable period in 2018 ($12.8 million). However, the Company reported an increase of eight percentage points in gross profit margin for the first nine months of 2019 (19%), relative to the same period in 2018 (11%).

The improvement in gross profit margin was driven by a change in mix of products sold, with a greater percentage of sales of higher-margin stevia products, and improvements in cost management and production efficiency.

The Company continues to closely manage its SG&A expenses, resulting in reduced G&A expenses in both the three- and nine-month periods of 2019 relative to the same periods in 2018.

For the three months ended September 30, 2019, the Company had a net loss attributable to the Company’s shareholders of $3.9 million, an increase of $1.4 million or 56% over the comparable period in 2018 ($2.5 million). The Company reported a net loss per share of $0.10 for the third quarter 2019, a $0.04 increase year-over-year.

For the nine months ended September 30, 2019, the Company had a net loss attributable to the Company’s shareholders of $11.5 million, an increase of $0.2 million or 2% over the comparable period in 2018 ($11.3 million). The Company reported a net loss per share of $0.30 for the first nine months of both 2019, which was the same net loss per share as for the first nine months of 2018.

CORPORATE DEVELOPMENTS

New Executive Management Team

Earlier this year, under the guidance of the Company’s Board of Directors, including its Chairman and Chief Executive Officer, Dr. Luke Zhang, the Company formed a new executive management team to help the Company improve its financial position, develop new strategic initiatives, and implement best practices in corporate governance, financial planning and analysis, and sales and operations planning.

On January 2, 2019, the Company announced that it had hired one of its Directors, Mr. Paul Block, to serve as President of the Company. Mr. Block assumed that role when the former President, Mr. Brian Meadows, resigned from that role. At that time, the Company also announced that it had promoted Mr. Simon Springett to Chief Operating Officer of the Company. On April 11, 2019, the Company announced that it had hired Mr. Eric Finnsson to serve as Chief Financial Officer of the Company. Together, Dr. Zhang, Mr. Block, Mr. Springett, and Mr. Finnsson make up the Company’s executive management team.

Company Outlook

One of the most critical items that management is addressing is the development and implementation of plans to stem the losses that the Company has suffered in recent years and to ameliorate the Company’s financial position. As a result of those sustained losses, the Company lacks the cash necessary to fully fund the business operations and its strategic product initiatives. The Company is managing its cash flows carefully to mitigate risk of insolvency. Management has been successful in improving the Company’s cash outlook during the third quarter, compared to earlier in the year. Nevertheless, without an infusion of cash in the months ahead, the Company may not be able to realize its strategic plans and could eventually cease to be a going concern.

To address that cash need, management has prioritized the sale of its idle assets to generate cash. This will also significantly improve the Company’s balance sheet. Management expects that it will close on the sale of its idle Qingdao “Runhao” secondary purification facility in the first half of 2020, although there is uncertainty as to that timing as well as to the final closing of the deal. Upon closing, Management expects that the Company will retain some of the proceeds from that sale to help fund its operations while the remaining proceeds will extinguish a significant portion of the debt held by China Cinda Assets Management (which owns 98% of the Company’s Chinese bank debt). Management is also evaluating options for the sale of its idle “Runyang” primary processing facility in Jiangsu province to further address those same goals.

Another factor contributing to the Company’s financial situation is the competitive price pressure in the stevia market over the last year that has reduced mainstream “Reb A” products (such as Reb A 80 and Reb A 97) to the lowest price levels in years. While these products have historically formed the core of the

Company’s product sales, the margins on sales of these products have grown increasingly slim. To address this, the Company is taking a three-pronged approach.

First, the Company has taken decisive steps to reduce its SG&A costs as well as its production costs. Its North American operations have already reduced SG&A costs and the Company is in the process of eliminating non-essential costs in its Chinese operations. For the last several years, the Company’s production capacity has been far greater than its projected order levels as it had sought rapid increases in orders for Reb A products. The Company’s goal is now to “right-size” its Chinese operations – i.e., to optimize its staffing and production planning to meet the Company’s projected production requirements while retaining the ability to accommodate growth in future order volumes. Management expects that this will enable the Company to sell its goods at more competitive and/or more profitable prices to secure additional order volumes and/or retain additional margin.

Second, the Company is increasing its focus on specialty stevia products, relative to its Reb A products. These specialty products are more differentiated than Reb A products and can bring more revenue opportunities and more meaningful margin contributions to the Company’s bottom line. The Company is also progressing well on implementing a new line of business in the sweetener space distinct from its bulk stevia sales that has the potential to significantly increase the Company’s revenues and margins.

Third, the Company is exploring options to enter the CBD market, where it could leverage its production expertise and equipment towards an investment that would jump start its ability to quickly begin producing high-quality low-cost CBD products. While it does not expect to begin any CBD operations in 2019, it is anticipating significant revenues and margins for the second half of 2020 and beyond. Management continues to work on securing the necessary funding to close on this investment.

While the Company continues to face substantial risks and 2019 remains a pivotal year for the Company, management remains optimistic about the future opportunities for the Company. With the expected land sale heading towards closing, right-sizing efforts underway, the optimization of production efficiencies, costs, and planning, and the Company’s refocused product strategies, management is proceeding down the best available path to increased financial stability and profitability.

Finalization of Plan To Improve the Company’s Capital Structure

On September 9, 2019, the Company announced a newly signed agreement with its primary debtholder, China Cinda Assets Management Corporation Anhui Branch (“Cinda”), through which the Company expects to greatly reduce its Chinese bank debt.

In line with the Company’s restructuring goals, the Company has developed a plan to improve its capital structure, achieve major reductions in its debt load, and improve its working capital resources. Two key components of this plan are the reduction of its Chinese bank debt and the sale of assets not essential to the Company’s business plans.

Through extensive negotiations with Cinda, GLG and Cinda have signed an agreement that is expected to result in a 78% reduction of the Company’s Chinese bank debt, which is approximately CAD 99 million (RMB equivalent). Under the agreement, the Company will complete a schedule of payments over a two year period totaling approximately CAD 51 million, which will then result in the waiver of an additional approximately CAD 25 million in principal and interest owed to Cinda.

Further, as GLG, Cinda, and an interested buyer have jointly been finalizing contracts for the sale of GLG’s “Runhao” facility (buildings and land use rights) to the buyer, Cinda has agreed to defer commencement of the two-year pay schedule until the sale of Runhao is consummated. This sale will both facilitate GLG’s payments under the contract with Cinda and enable GLG to optimize its production costs through the elimination of unneeded idle capacity.

Through this collaboration with Cinda and the resulting improvements to GLG’s capital structure, the Company will have more financial flexibility to improve working capital and fuel the growth of premium sweetener products.

Additionally, the Company is presently negotiating with Cinda to resolve the 22% remainder of the outstanding debt. The Company expects to reach a favorable resolution with Cinda on that remaining debt.

2019 AGM Voting Results

The Company held its Annual General Meeting on June 27, 2019, in Vancouver, B.C. The shareholders voted in all nominated directors, with favorable votes for each exceeding 99%. Dr. Luke Zhang continues as Chairman of the Board and Chief Executive Officer and Brian Palmieri continues as Vice Chairman of the Board. Mr. Simon Springett joins the Board for the first time, replacing Mr. He Fangzhen, who, after serving for many years, opted not to seek a Board position this year.

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the three and nine months ended September 30, 2019, are available on SEDAR and on the Company’s website at www.glglifetech.com.

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2018 and the condensed interim consolidated financial statements for the nine-month period ended September 30, 2019.

Revenue

Revenue for the three months ended September 30, 2019, was $2.4 million compared to $2.5 million in revenue for the same period last year. Sales decreased by 5% or $0.1 million for the period ending September 30, 2019, compared to the prior period. The sales decrease of $0.1 million was driven by a 15% decrease in international stevia sales, partly offset by increases in monk fruit sales and China domestic stevia sales. International sales continue to be the predominant component of the Company’s revenues (85% in third quarter 2019 versus 90% in third quarter 2018).

Revenue for the nine months ended September 30, 2019, was $7.2 million, a decrease of $5.6 million or 44% compared to $12.8 million in revenue for the same period last year. This $5.6 million decrease was driven by a 46% decrease in stevia sales, primarily resulting from a significant decrease in orders from the Company’s distribution partner. The Company attributes this decrease to reduced customer demand due to existing inventories and to competitive price pressure in the global stevia market. Monk fruit sales increased significantly in the first nine months of 2019, versus the same period in 2018, although monk fruit sales were only a small fraction of total revenues. China sales held steady between the 2019 nine month and 2018 nine-month periods. International sales made up 86% of nine-month 2019 revenues, versus 92% for the same period in 2018.

Cost of Sales

For the quarter ended September 30, 2019, the cost of sales was $1.9 million compared to $2.4 million in cost of sales for the same period last year ($0.5 million or 21% decrease). Cost of sales as a percentage of revenues was 81% for the third quarter 2019, compared to 98% for the comparable period, an improvement of 17 percentage points. The improvement in cost of sales as a percentage of revenue for the three months ended September 30, 2019, compared to the prior comparable period, is attributable to two main factors: (1) a change in mix of products sold, with a greater percentage of sales of higher margin stevia products, and improvements in cost management and production efficiency, and (2) cost of sales in the third quarter was affected due to a difference in classification of depreciation between cost of sales and SG&A expenses from 2018.

For the nine months ended September 30, 2019, the cost of sales was $5.9 million compared to $11.4 million for the same period last year (a decrease of $5.5 million or 49%). Cost of sales as a percentage of revenues was 81% for the first nine months of 2019, compared to 89% in the comparable period in 2018, an improvement of 8 percentage points. The improvement in cost of sales as a percentage of revenue for the nine months ended September 30, 2019, compared to the prior comparable period, is attributable to two main factors: (1) a change in mix of products sold, with a greater percentage of sales of higher-margin stevia products, and improvements in cost management and production efficiency, and (2) cost of sales in the third quarter was affected due to a difference in classification of depreciation between cost of sales and SG&A expenses from 2018.

Capacity charges charged to the cost of sales ordinarily would flow to inventory and are a significant component of the cost of sales. Only two of GLG’s manufacturing facilities were operating during the first nine months of 2019, and capacity charges of $0.8 million were charged to cost of sales (representing 14% of cost of sales) compared to $1.6 million charged to cost of sales in the same period of 2018 (representing 14% of cost of sales).

Gross Profit (Loss)

Gross profit for the three months ended September 30, 2019, was $0.4 million, compared to a gross profit of $nil for the comparable period in 2018. The gross profit margin was 19% in the third quarter 2019 compared to 2% for the same period in 2018, a 17 percentage point improvement. This 17 percentage point improvement in gross profit margin for the third quarter of 2019, relative to the comparable period in 2018, is attributable to two main factors: (1) a change in mix of products sold, with a greater percentage of sales of higher-margin stevia products, and improvements in cost management and production efficiency, and (2) cost of sales in the third quarter was affected due to a difference in classification of depreciation between cost of sales and SG&A expenses from 2018.

Gross profit for the nine months ended September 30, 2019, was $1.4 million, compared to a gross profit of $1.4 million for the comparable period in 2018. The gross profit margin was 19% in the first nine months of 2019 compared to 11% for the same period in 2018, an 8 percentage point increase. This 8 percentage point increase in gross profit margin for the first nine months of 2019, relative to the comparable period in 2018, is attributable to two main factors: (1) a change in mix of products sold, with a greater percentage of sales of higher-margin stevia products, and improvements in cost management and production

efficiency, and (2) cost of sales in the third quarter was affected due to a difference in classification of depreciation between cost of sales and SG&A expenses from 2018.

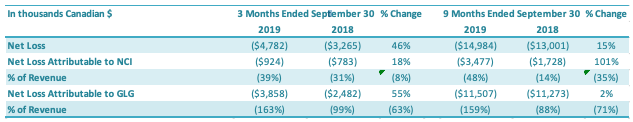

Net Loss Attributable to the Company

For the three months ended September 30, 2019, the Company had a net loss attributable to the Company of $3.9 million, an increase of $1.4 million or 56% over the comparable period in 2018 ($2.5 million). The $1.4 million increase in net loss attributable to the Company was driven by (1) an increase in other

expenses ($2.5 million), which was offset by (2) a decrease in loss from operations ($1.0 million) and (3) an increase in net loss attributable to non-controlling interests ($0.1 million).

For the nine months ended September 30, 2019, the Company had a net loss attributable to the Company of $11.5 million, an increase of $0.2 million or 2% over the comparable period in 2018 ($11.3 million). The $0.2 million increase in net loss was driven by increases in (1) other expenses ($1.8 million) and (2) loss

from operations ($0.1 million), which were offset by an increase in net loss attributable to non-controlling interests ($1.7 million).

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.10 for the three months ended September 30, 2019, compared with a basic and diluted net loss of $0.06 for the comparable period in 2018.

The basic loss and diluted loss per share from operations was $0.30 for the nine months ended September30, 2019, compared with a basic and diluted net loss of $0.30 for the comparable period in 2018.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on SEDAR (www.sedar.com). Additional information relating to the Company is also available on our website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Chief Operating Officer

Phone: +1 (604) 285-2602 ext. 101

Fax: +1 (604) 285-2606

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food, beverages, and dietary supplements. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage and supplement industries, GLG’s Naturals+ product line enables it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form published March 31, 2018. In light of these factors, the forward-looking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply