Vancouver, B.C. April 1, 2019 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the three and twelve months ended December 31, 2018. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

FINANCIAL HIGHLIGHTS

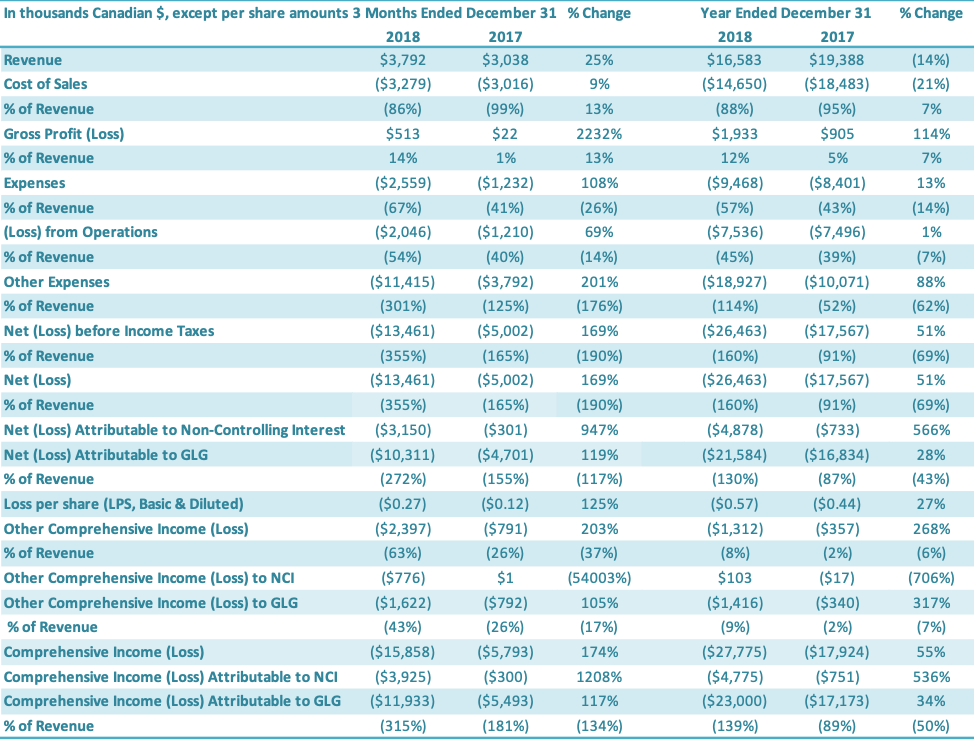

The Company reported improved gross profit margins for both the fourth quarter 2018 (14%) and full year 2018 (12%), relative to the same periods in 2017 (1% for fourth quarter 2017 and 5% for full year 2017). The Company attributed these improved margins to improvements in production efficiencies and a change in product mix towards higher margin valued-added stevia products. The change in product mix – selling more products with higher margins but lower prices – also contributed to lower revenues for the year, with $16.6 million in revenues for the full year 2018 against $19.4 million for the full year 2017. However, revenues were up $0.8 million for the fourth quarter 2018 year-over-year ($3.8 million in fourth quarter 2018 versus $3.0 million in fourth quarter 2017).

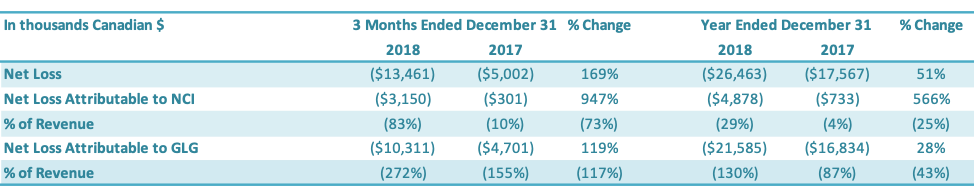

For the three months ended December 31, 2018, the Company had a net loss attributable to the Company’s shareholders of $10.3 million, an increase of $5.6 million or a 119% increase over the comparable period in 2017 ($4.7 million). The Company reported a net loss per share of $0.27 for the fourth quarter 2018, a $0.15 increase year-over-year.

For the full year 2018, the Company had a net loss attributable to the Company’s shareholders of $21.6 million, an increase of $4.8 million or a 28% increase over the comparable period in 2017 ($16.8 million loss). The Company reported a net loss per share of $0.56 for the full year 2018, a $0.13 increase year-over-year.

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the year ended December 31, 2018, are available on SEDAR and on the Company’s website at www.glglifetech.com.

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2018 and 2017.

Revenue

Revenue for the three months ended December 31, 2018, was $3.8 million compared to $3.0 million in revenue for the same period last year. Revenue for the quarter increased by $0.8 million or 25% relative to the fourth quarter last year.

This revenue increase is attributable to increased stevia volumes sold, despite lower average product prices for stevia extracts, with lower prices reflecting both competitive pricing pressures as well as variation in the types of products sold to customers. Monk fruit revenues increased in the fourth quarter 2018, relative to the fourth quarter 2017, although monk fruit sales represented a relatively small portion of revenues in both periods. International sales continue to be the predominant source of revenues for the Company (95% in fourth quarter 2018 versus 94% in fourth quarter 2017).

Revenue for the year 2018 was $16.6 million compared to $19.4 million for the same period last year. Revenue for the period decreased by $2.8 million or 14% relative to the prior year.

This revenue decrease is primarily attributable to lower average product prices for stevia extracts, with lower prices reflecting both competitive pricing pressures as well as variation in the types of products sold to customers. Stevia sales volumes held steady year-over-year. Monk fruit revenues increased moderately year-over-year, although monk fruit sales represented a relatively small portion of revenues in both periods. International sales continue to be the predominant source of revenues for the Company (93% in 2018 versus 94% in 2017).

Cost of Sales

For the quarter ended December 31, 2018, the cost of sales was $3.3 million compared to $3.0 million in cost of sales for the same period last year (an increase of $0.3 million or 9%). Cost of sales as a percentage of revenues was 86% for the fourth quarter 2018, compared to 99% for the comparable period (an improvement of 13 percentage points). The 13 percentage point improvement in cost of sales as a percentage of revenues for the fourth quarter, relative to the same period in 2017, is attributable to improved stevia margins on those sales resulting from improvements in production efficiencies and a change in product mix towards higher margin valued-added stevia products; these margin improvements were partially offset by a decrease in monk fruit margins.

For the twelve months ended December 31, 2018, the cost of sales was $14.7 million compared to $18.5 million for the year 2017 (a decrease of $3.8 million or 21%). Cost of sales as a percentage of revenues was 88% for the year 2018, compared to 95% for the year 2017 (an improvement of 7 percentage points). The 7 percentage point improvement in cost of sales as a percentage of revenues for the year 2018, relative to 2017, is attributable to improved stevia margins on those sales resulting from improvements in production efficiencies and a change in product mix towards higher margin valued-added stevia products; these margin improvements were partially offset by a decrease in monk fruit margins.

Capacity charges charged to the cost of sales ordinarily would flow to inventory and are a significant component of the cost of sales. Only two of GLG’s manufacturing facilities were operating during the year 2018, and idle capacity charges of $2.2 million were charged to cost of sales (representing 15% of cost of sales) compared to $2.2 million charged to cost of sales in 2017 (representing 12% of cost of sales).

The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period include:

- Capacity utilization of stevia and monk fruit manufacturing plants.

- The price paid for stevia leaf and monk fruit and their respective quality, which are impacted by crop quality for a particular year/period and the price per kilogram for which the stevia and monk fruit extracts are sold. These are the most important factors impacting the gross profit of GLG’s stevia and monk fruit business.

- Other factors which also impact stevia and monk fruit cost of sales to a lesser degree include:

- water and power consumption;

- manufacturing overhead used in the production of stevia and monk fruit extract, including supplies, power and water;

- net VAT paid on export sales;

- exchange rate changes; and

GLG’s stevia and monk fruit businesses are affected by seasonality. The harvest of the stevia leaves typically occurs starting at the end of July and continues through the fall of each year. The monk fruit harvest takes place typically from October to December each year. GLG’s operations in China are also impacted by Chinese New Year celebrations, which occur approximately late-January to mid-February each year, and during which many businesses close down operations for approximately two weeks. GLG’s production year runs October 1 through September 30 each year.

Gross Profit (Loss)

Gross profit for the three months ended December 31, 2018, was $0.5 million, compared to gross profit of $nil million for the comparable period in 2017 (an increase of $0.5 million). The gross profit margin was 14% in the fourth quarter 2018 and 1% for the same period in 2017, or an improvement of 13 percentage points. The 13 percentage point improvement in cost of sales as a percentage of revenues for the fourth quarter, relative to the same period in 2017, is attributable to improved stevia margins on those sales resulting from improvements in production efficiencies and a change in product mix towards higher margin valued-added stevia products; these margin improvements were partially offset by a decrease in monk fruit margins.

Gross profit for the year 2018 was $1.9 million, compared to $0.9 million for the year 2017 (an increase of $1.0 million). The gross profit margin was 12% for the year 2018 and 5% for the year 2017, or an improvement of 7 percentage points. The 7 percentage point improvement in cost of sales as a percentage of revenues for the year 2018, relative to 2017, is attributable to improved stevia margins on those sales resulting from improvements in production efficiencies and a change in product mix towards higher margin valued-added stevia products; these margin improvements were partially offset by a decrease in monk fruit margins.

Net Loss Attributable to the Company

For the three months ended December 31, 2018, the Company had a net loss attributable to the Company of $10.3 million, an increase of $5.6 million or a 119% increase over the comparable period in 2017 ($4.7 million loss). The $5.6 million increase in net loss attributable to the Company was driven by increases in (1) other expenses ($7.6 million) and (2) SG&A expenses ($1.3 million), which were offset by increases in (3) gross profit ($0.5 million) and (4) net loss attributable to the non-controlling interest ($2.8 million).

For the year 2018, the Company had a net loss attributable to the Company of $21.6 million, an increase of $4.8 million or a 28% increase over the year 2017 ($16.8 million loss). The $4.8 million increase in net loss attributable to the Company was driven by increases in (1) SG&A expenses ($1.1 million), (2) Interest expense ($2.8 million), (3) Property, plant and equipment impairment ($2 million), (4) Foreign exchange loss ($2.4 million) and (5) Reduction in government tax rebate ($2.1 million), which were offset by increases in (3) gross profit ($1.0 million) and (4) net loss attributable to the non-controlling interest ($4.1 million).

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.27 for the three months ended December 31, 2018, compared with a basic and diluted net loss from operations of $0.12 for the same period in 2017.

For the twelve months ended December 31, 2018, the basic loss and diluted loss per share from operations was $0.56, compared with a basic and diluted net loss of $0.44 for the same period in 2017.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on SEDAR (www.sedar.com). Additional information relating to the Company is also available on our website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 669-2602 ext. 101

Fax: +1 (604) 662-8858

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2017. In light of these factors, the forward-looking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply