Vancouver, B.C. August 8, 2018 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the three and six months ended June 30, 2018. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

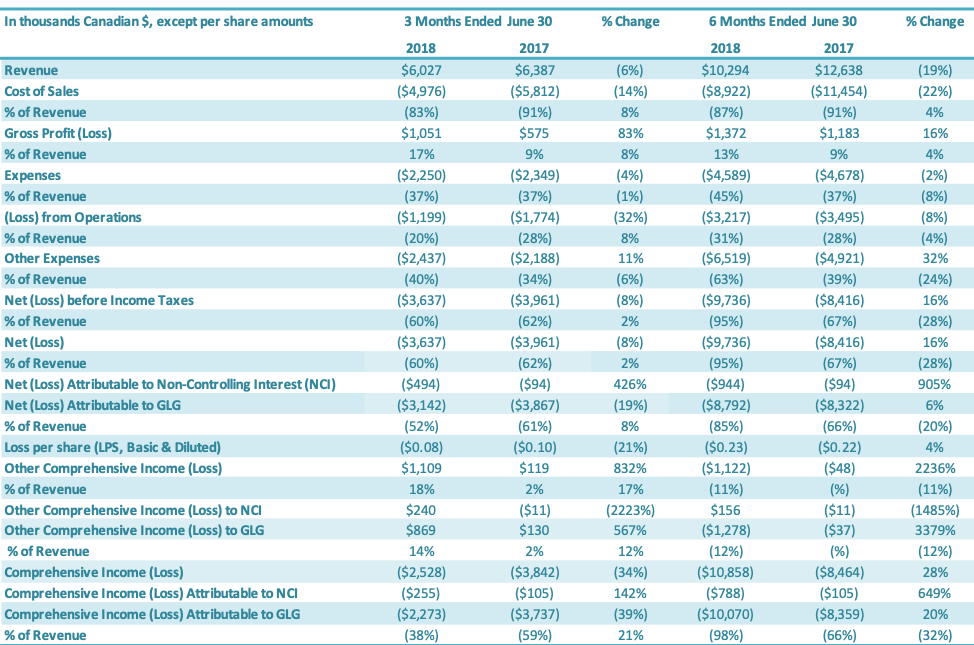

FINANCIAL HIGHLIGHTS

- Improved stevia margins drive increases in gross profit margins:

- Second quarter 2018 gross profit margin at 17%, up 8 percentage points year-over-year (gross profit before capacity charges – a non-IFRS measure – results in 27% gross profit margin).

- Six month gross profit margin at 13%, up 4 percentage points year-over-year (gross profit before capacity charges results in 24% gross profit margin).

- International stevia volumes delivered continue to grow:

- Second quarter 2018 international stevia volumes increased 14% year-over-year, more than compensating for first quarter 2018 lag in volume.

- Six month 2018 international stevia volumes up 3% year-over-year.

- Positive EBITDA in second quarter 2018 at 1% of revenues (up 8 percentage points year-over-year), driven by higher gross margins and reduced SG&A cash costs.

- Direct cash G&A reduced by 7% in the second quarter 2018 year-over-year; six months 2018 reduction of 3% year-over-year.

- Second quarter 2018 net loss attributable to the Company’s shareholders improved by 19% year-over-year to $3.1 million; net loss attributable to the Company’s shareholders for first six months of 2018 at $8.8 million or 6% increase year-over-year.

- Net loss per share improved by $0.02 to $0.08 per share for second quarter 2018; net loss per share for first six months increased by $0.01 to $0.23.

The Company reported improved gross profit margins for both the second quarter 2018 (17%) and first six months of 2018 (13%), relative to the same periods in 2017 (9% for both periods). The Company attributed these improved margins to improvements in production efficiencies for its stevia products. Gross profit was $1.1 million for the second quarter 2018 and $1.4 million for the first six months of 2018.

Despite lower revenues for both the second quarter 2018 (6% decrease at $6.0 million) and the first six months of 2018 (19% decrease at $10.3 million), relative to the same periods in 2017, the Company reported an increase in stevia sales volumes for both periods in 2018 (14% increase for the second quarter 2018 and 3% increase for the first six months of 2018). The decrease in revenues was driven by lower average product prices for its stevia extracts, reflecting both competitive pricing pressures as well as variation in the types of products it sold to customers.

The Company reported positive EBITDA of 1% in the second quarter 2018, an improvement of 8 percentage points year-over-year.

The Company continues to reduce its direct cash G&A expenses, which decreased by 7% in the second quarter year-over-year, and by 3% for the first six months year-over-year.

For the three months ended June 30, 2018, the Company had a net loss attributable to the Company’s shareholders of $3.1 million, a decrease of $0.7 million or a 19% improvement over the comparable period in 2017 ($3.9 million). The Company reported a net loss per share of $0.08 for the second quarter 2018, a $0.02 improvement year-over-year.

For the first six months ended June 30, 2018, the Company had a net loss attributable to the Company’s shareholders of $8.8 million, an increase of $0.5 million or a 6% increase over the comparable period in 2017 ($8.3 million loss). The Company reported a net loss per share of $0.23 for the first six months of 2018, a $0.01 increase year-over-year.

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the three and six months ended June 30, 2018, are available on SEDAR and on the Company’s website at www.glglifetech.com.

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2017 and the condensed interim consolidated financial statements for the six-month period ended June 30, 2018.

Revenue

Revenue for the three months ended June 30, 2018, was $6.0 million compared to $6.4 million in revenue for the same period last year. Revenue for the quarter decreased by $0.4 million or 6% relative to the second quarter last year. International stevia sales volumes, however, have continued to increase, growing by 14% in the second quarter of 2018 over the comparable period. The revenue decrease is attributable to lower average product prices for stevia extracts, reflecting both competitive pricing pressures as well as variation in the types of products sold to customers. The sales volume increase reflects continued growth in orders from both new and existing customers, driven in part by sales of new products to these customers. Monk fruit revenues also increased in the second quarter 2018, relative to the second quarter 2017, although monk fruit sales represented a relatively small portion of revenues in both periods. Overall, international sales represented 92% of total sales in the second quarter 2018, which is even with the second quarter 2017 (92% of sales). GLG Naturals+ accounted for $0.2 million in revenues in the second quarter 2018, compared to $nil in the second quarter 2017.

Revenue for the six months ended June 30, 2018, was $10.3 million, a decrease of $2.3 million or 19% compared to $12.6 million in revenue for the same period last year. This $2.3 million decrease was driven primarily by lower average product prices in the first six months of 2018 relative to the comparable period; a 67% decrease in monk fruit sales also contributed to the decrease. International stevia sales volumes, however, increased 3% over the same six-month period in the previous year. The sales volume increase reflects continued growth in orders from both new and existing customers, driven in part by sales of new products to these customers. International sales accounted for 93% of total sales in the first six months of 2018 compared to 93% in the comparable period of 2017. GLG Naturals+ accounted for $0.2 million in revenues in the second quarter 2018, compared to $0.1 million in the second quarter 2017.

Cost of Sales

For the quarter ended June 30, 2018, the cost of sales was $5.0 million compared to $5.8 million in cost of sales for the same period last year (a decrease of $0.8 million or 14%). Cost of sales as a percentage of revenues was 87% for the second quarter 2018, compared to 91% for the comparable period (an improvement of 9 percentage points). The 8 percentage point improvement in cost of sales as a percentage of revenues for the second quarter, relative to the same period in 2017, was driven primarily by improved stevia margins, resulting from improvements in production efficiencies; savings from these production improvements were partially offset by unfavorable movement in the RMB against the CAD and by a decrease in monk fruit margins.

For the six months ended June 30, 2018, the cost of sales was $8.9 million compared to $11.5 million for the same period of last year (an increase of $2.6 million or 22%). Cost of sales as a percentage of revenues was 87% for the first six months 2018, compared to 91% in the comparable period in 2017 (an improvement of 4 percentage points). The 4 percentage point improvement in cost of sales as a percentage of revenues for the second quarter, relative to the same period in 2017, was driven primarily by improved stevia margins, resulting from improvements in production efficiencies; savings from these production improvements were partially offset by unfavorable movement in the RMB against the CAD and by a decrease in monk fruit margins.

Capacity charges charged to the cost of sales ordinarily would flow to inventory and are a significant component of the cost of sales. Only two of GLG’s manufacturing facilities were operating during the first six months of 2018, and idle capacity charges of $1.1 million were charged to cost of sales (representing 12% of cost of sales) compared to $1.0 million charged to cost of sales in the same period of 2017 (representing 9% of cost of sales).

Gross Profit (Loss)

Gross profit for the three months ended June 30, 2018, was $1.1 million, compared to $0.6 million for the comparable period in 2017 or an 83% increase. The gross profit margin was 17% in the second quarter 2018 and 9% for the same period in 2017. The increase in gross profit for the second quarter of 2018, relative to the comparable period in 2017, is primarily attributable to both increased stevia sales volumes and improved stevia margins on those sales resulting from improvements in production efficiencies.

Gross profit for the first six months in 2018 was $1.4 million, compared to $1.2 million for the comparable period in 2017 or a 16% increase. The increase in gross profit for the six months ended June 30, 2018, relative to the comparable period in 2017, is primarily attributable to improved stevia margins resulting from improvements in production efficiencies, which were partly offset by a decrease in gross profits from monk fruit sales and an increase in idle capacity charges.

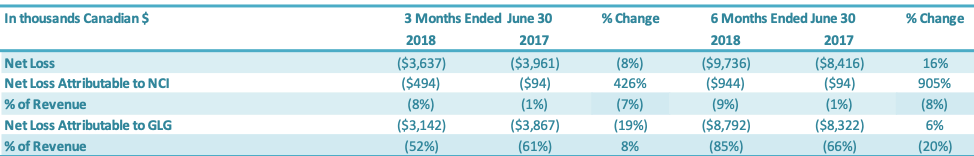

Net Loss Attributable to the Company

For the three months ended June 30, 2018, the Company had a net loss attributable to the Company of $3.1 million, a decrease of $0.7 million or a 19% improvement over the comparable period in 2017 ($3.9 million loss). The $0.7 million decrease in net loss was driven by (1) an increase in gross profit ($0.5 million), (2) a decrease in SG&A expenses ($0.1 million) and (3) an increase in net loss attributable to the non-controlling interest ($0.4 million), which were offset by (4) an increase in other expenses ($0.2 million).

For the three months ended June 30, 2018, the Company had a net loss attributable to the Company of $3.1 million, a decrease of $0.7 million or a 19% improvement over the comparable period in 2017 ($3.9 million loss). The $0.7 million decrease in net loss was driven by (1) an increase in gross profit ($0.5 million), (2) a decrease in SG&A expenses ($0.1 million) and (3) an increase in net loss attributable to the non-controlling interest ($0.4 million), which were offset by (4) an increase in other expenses ($0.2 million).

For the six months ended June 30, 2018, the Company had a net loss attributable to the Company of $8.8 million, an increase of $0.5 million or a 6% increase over the comparable period in 2017 ($8.3 million loss). The $0.5 million increase in net loss was driven by (1) an increase in other expenses ($1.6 million), which was offset by (2) an increase in gross profit ($0.2 million), (3) a decrease in SG&A expenses ($0.1 million) and (4) an increase in net loss attributable to the non-controlling interest ($0.8 million).

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.08 for the three months ended June 30, 2018, compared with a basic and diluted net loss of $0.10 for the comparable period in 2017.

The basic loss and diluted loss per share from operations was $0.23 for the six months ended June 30, 2018, compared with a basic and diluted net loss of $0.22 for the comparable period in 2017.

OUTLOOK

We continue to expect significant growth in our international stevia sales, driven by our partnership with our global distributor and our own direct sales in the dietary supplement market. Considering our distributor’s size and distribution reach, we expect that the partnership will continue to deliver significantly higher sales to GLG.

As our global distributor leverages its existing customer relationships, distribution channels, and ingredient expertise in the food and beverage space, we expect international stevia revenues to continue to grow. We are seeing significant sales opportunities arise from this partnership. Moreover, the partnership presents opportunities to develop and deliver new stevia products that have not historically been part of our portfolio. These include the Company’s Reb M product line, recently announced in collaboration with ADM. These products are made from GLG’s proprietary high Reb M Dream Sweetener™ Stevia Leaf, and provide a clean and full-bodied sweetness experience that is remarkably close to sugar, allowing for deeper calorie reduction through reduced sugar formulations. The Company expects revenue from sales from Reb M products to commence in 2018 and to grow to be an important part of its stevia revenues over the next three to five years as more of these products become available. The Company is also working to bring to market other innovative stevia products to meet customer demand for great tasting zero-calorie sweetener extracts at attractive price points.

In addition, GLG is succeeding with its own direct sales efforts in the dietary supplement market, distinct from the food and beverage space covered by our distribution partnership. We have been successful in 2017 and into 2018 in developing our dietary supplement customers with our innovative ClearTaste product line that delivers better tasting stevia and monk fruit. Our ClearTaste stevia and monk fruit products provide better tasting stevia extracts that remove a number of the taste issues typically associated with stevia extracts, including bitter and astringent notes. A number of these customer wins have replaced their existing stevia and monk fruit suppliers with our ClearTaste products, citing improved sensory performance – in particular, reduced bitterness and aftertaste compared to their previous suppliers’ products.

We expect that these two sales channels will bring continued growth in the next twelve months for our international stevia sales.

Finally, the Company continues to progress on its two-phase plan designed to eliminate approximately $100 million in outstanding debt and interest, with the first phase being approved by the Shareholders in May 2017 and fully implemented in the fourth quarter of 2017. The Company is progressing well towards completing the second phase of debt restructure and expects to reach a final agreement to convert all third-party debt into equity in GLG’s Subsidiary.

On July 23, 2018, the Company announced that it had reached a pivotal milestone in its efforts to restructure the Company’s Chinese-held debt. In its announcement, the Company provided an update to its February 2018 news release, in which the Company announced that it had received an official letter from China Cinda Assets Management Corporation Anhui Branch (“Cinda”) confirming Cinda’s intention to move forward in 2018 as a new shareholder in GLG’s new joint stock company – Anhui Runhai Biotechnology Joint Stock Company, Ltd. (“Runhai”) – and to resolve the Company’s Chinese bank debt obligations.

Earlier in July, the Company’s two largest Chinese debtholders – Cinda and China Hua Rong Assets Management Shandong Branch (“Hua Rong”) – executed an agreement for the cash purchase of approximately RMB 231 million in principal and interest, or approximately CAD $45 million, with respect to the Company’s Chinese bank debt held by one of its Chinese subsidiaries. Under the terms of the agreement, this amount is now payable by the Company, through its Chinese subsidiary, to Cinda instead of Hua Rong. The Company retains an approximately RMB 18 million or CAD $3.6 million interest liability payable to Hua Rong through that subsidiary.

Cinda’s addition of approximately CAD $35.8 million in debt principal rights (along with approximately CAD $9.6 million in interest rights) substantially increases its total debt principal holding to CAD $47.6 million or an increase of over 300%. Cinda’s cash purchase of Hua Rong’s debt holdings in the Company’s subsidiary, along with its plans to acquire all remaining Chinese bank debt before converting the full debt position into equity and becoming a shareholder in Runhai, reflects its belief in the Company’s ability to become profitable, to continue acquiring market share through innovation and global sales efforts, and to continue improving the Company’s position as a leading global zero-calorie, natural sweetener producer.

As previously noted, the Company plans to provide all necessary public disclosure once the final plan is agreed by all parties including GLG’s Board of Directors. Once the Company finalizes the restructuring plan with Cinda Anhui, the Company will have a strong financial partner in Cinda Anhui, which will further strengthen our position in the market and fundamentally restructure our balance sheet by converting our bank loans into equity in our China subsidiary.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on SEDAR (www.sedar.com). Additional information relating to the Company is also available on our website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 669-2602 ext. 101

Fax: +1 (604) 662-8858

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2017. In light of these factors, the forward-looking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply