Vancouver, B.C. April 2, 2018 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the three and twelve months ended December 31, 2017. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

FINANCIAL HIGHLIGHTS

• Full-year international stevia sales increased 47%

• Full-year international stevia sales volumes increased 82%

• Full-year gross profit increased by $1.3 million; gross profit margin increased by 7 percentage points

• Full-year revenues up 2% to $19.4 million; robust growth in stevia segment offsets lower monk fruit sales

• Full-year SG&A reduced by 29%

• Full-year net loss reduced by 29% • $16.3 million in debt and liabilities eliminated due to Phase 1 Debt Restructuring

• Company remains on track to complete its Phase 2 Debt Restructuring

GLG sales for the year ended December 31, 2017, increased by 2% to $19.4 million, resulting from robust growth in the Company’s international stevia segment, which produced increases of 47% in revenue and 82% in sales volume. Lower sales in the Company’s monk fruit segment largely offset the stevia revenue growth. The decrease in monk fruit sales reflects the Company’s previous disclosure that the Company has seen a decline in the size of the monk fruit market and that the expected sales growth will be in the international stevia market. The growth in international stevia sales and deliveries reflects the Company’s successful acquisition of new customers, both directly and through the Company’s global distributor.

Gross profit for 2017 was $0.9 million, an increase of $1.3 million over 2016. The gross profit margin for the year ended December 31, 2017, was 5%, up 7 percentage points from the previous year. Improved margins on international stevia sales as well as monk fruit sales drove the improvement in gross margin.

The Company continues to realize savings in SG&A, having reduced SG&A by 29% in 2017 over the previous year. These savings were driven by reductions in salaries and wages and professional services, a one-time reduction in land use right taxes in China and reductions in other consulting services. For the year ended December 31, 2017, the Company had a net loss attributable to the Company of $16.8 million, a decrease of $7.0 million or an improvement of 29% over the comparable period in 2016 ($23.8 million loss). Loss per share improved to $0.44 per share, compared to $0.63 loss per share in 2016.

For the three months ended December 31, 2017, the Company had a net loss attributable to the Company of $4.7 million, a decrease of $5.4 million or a 54% improvement over the comparable period in 2016 ($10.1 million loss). Loss per share improved to $0.12 per share, compared to $0.27 loss per share in the comparable period in 2016.

As previously announced, in 2017, the Company successfully completed Phase One of its debt restructuring plan, resulting in the removal of $16.3 million in related party and other debt and liabilities. The Company remains on track to complete Phase Two of the plan, which involves restructuring of the Chinese bank debt.

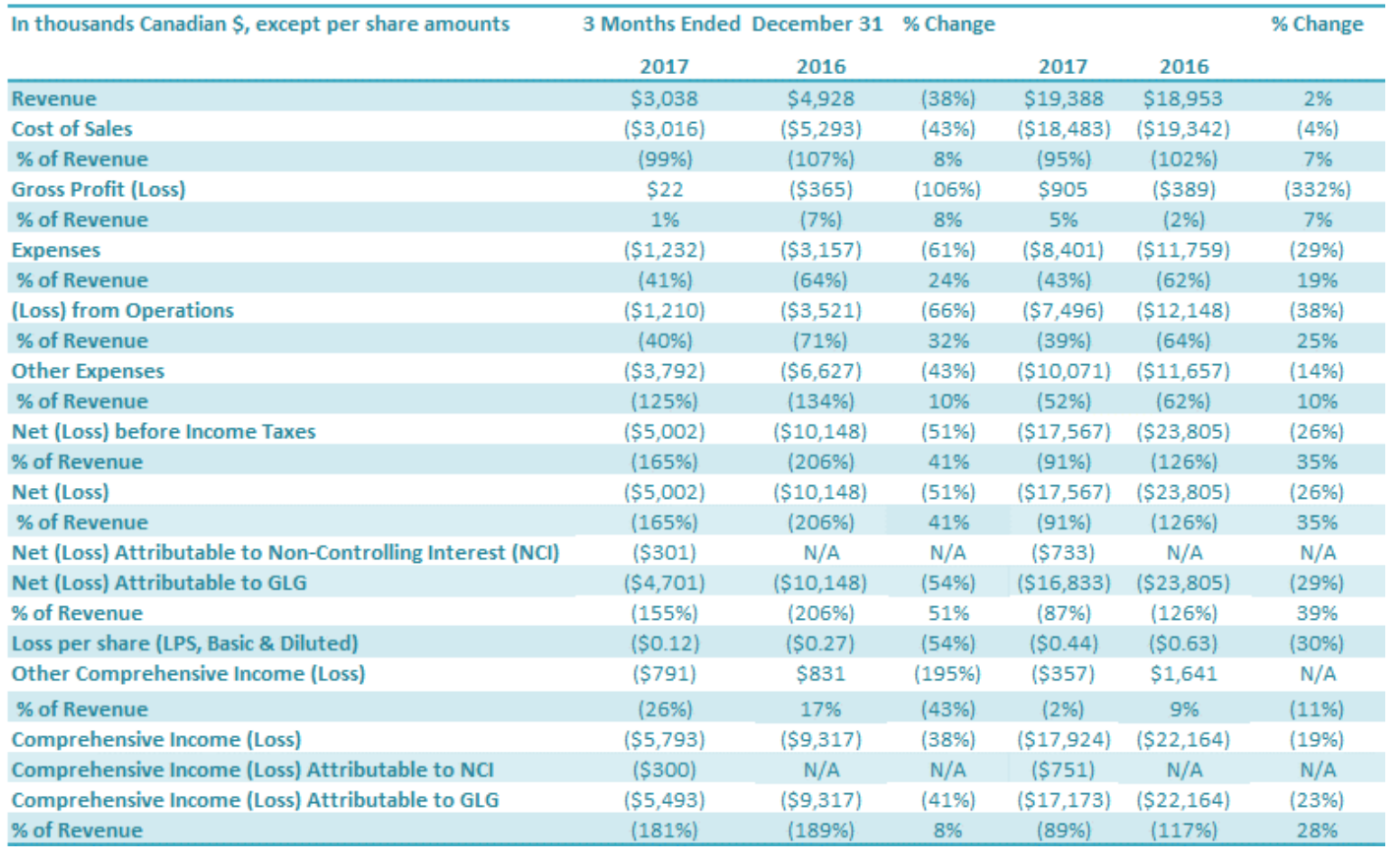

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for

the year ended December 31, 2017, are available on SEDAR and on the Company’s website at

www.glglifetech.com.

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2017 and 2016.

Revenue

Revenue for the three months ended December 31, 2017, was $3.0 million, a decrease of 38% compared to $4.9 million in revenue for the same period last year. International sales contributed 94% of fourth quarter 2017 revenues compared to 96% in the same period in 2016. The 38% decrease in sales, comparing the fourth quarter of 2017 to the same period in 2016, was driven almost entirely by a decrease in monk fruit sales (decrease of $2.1 million over previous year monk fruit sales) to international customers. The decrease in monk fruit sales reflects the Company’s previous disclosure that the Company has seen a decline in the size of the monk fruit market and that the company continues to be focused on international stevia sales, where it sees the most potential for growth in the zero-calorie natural sweetener market. Despite the decrease in revenues for the quarter, international stevia sales rose by 4% in the fourth quarter. International stevia sales were impacted negatively by the installation of a new gas boiler at one of GLG’s key manufacturing facilities. This facility was shut down for approximately 4 weeks during the installation period, negatively impacting fourth quarter production and deliveries. The gas boiler installation, converting from coal to gas power, was important to GLG, reflecting GLG’s commitment to both the environment and compliance with local government. Revenue for the year 2017 was $19.4 million, an increase of 2% compared to $18.9 million in revenue for the prior year. This 2% increase in sales, comparing 2017 to 2016, was driven by a number of factors including an increase of 47% in international stevia sales, which was offset by a 26% decrease in China stevia sales and an 85% decrease in monk fruit sales. The decrease in monk fruit sales reflects the Company’s previous disclosure that the Company has seen a decline in the size of the monk fruit market and that the expected sales growth will be in the international stevia market. International sales contributed 94% of full year 2017 revenues, which is up 3 percentage points from the amount for the same period in 2016 (91%). Full-year international stevia sales increased by $5.5 million or a 47% year over year increase reflecting strong sales through its global distribution partner (ADM) in 2017 and is the key result that is expected to further grow sales into 2018 and beyond. International stevia volumes increased 82% year over year, reflecting the Company’s successful acquisition of new customers, both directly and through the Company’s partnership with ADM.

Cost of Sales

For the quarter ended December 31, 2017, the cost of sales was $3.0 million compared to $5.3 million in cost of sales for the same period last year ($2.3 million or 43% decrease). Cost of sales as a percentage of revenues was 99% for the fourth quarter 2017, compared to 107% for the comparable period. Cost of sales as a percentage of revenues improved by 8 percentage points in the fourth quarter compared to the previous year. The main factor contributing to the improvement in cost of sales as a percentage of revenues wasimprovements in the costs to produce stevia products. This improvement was partly offset by an increase in idle capacity costs charges in the fourth quarter of 2017 compared to the prior period charges. Cost of sales for the twelve months ended 2017 was $18.5 million compared to $19.3 million for 2016 ($0.8 million or 4% decrease). Cost of sales as a percentage of revenues was 95% in 2017 compared to 102% in 2016, an improvement of 7 percentage points. The improvement to cost of sales as a percentage of revenue was driven entirely by the improved lower cost to produce stevia extracts in 2017 compared to the previous year. Idle capacity charges ($2.2 million) contributed to 12% of cost of sales for the full year 2017, compared to 13% of prior year cost of sales. Capacity charges charged to the cost of goods sold ordinarily would flow to inventory and is the largest factor on reported gross margin. Only two of GLG’s manufacturing facilities were operating during 2017. The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period include:

1. Capacity utilization of stevia and monk fruit manufacturing plants.

2. The price paid for stevia leaf and monk fruit, and their respective quality which is impacted by crop quality for a particular year/period, and the price per kilogram for which the stevia and monk fruit extracts are sold. These are the most important factors that will impact the gross profit of GLG’s stevia and monk fruit business.

3. Other factors which also impact stevia cost of sales to a lesser degree include:

• water and power consumption;

• manufacturing overhead used in the production of stevia and monk fruit extract,

including supplies, power and water;

• net VAT paid on export sales;

• exchange rate changes; and

• depreciation and capacity utilization of the extract processing plants.

Gross Profit (Loss)

Gross loss for the three months ended December 31, 2017, was $0.0 million, compared to a negative $0.4

million gross profit for the comparable period in 2016 or an improvement of $0.3 million. The gross profit

margin for the three-month period ended December 31, 2017, was 1% compared to negative 7% for the

prior period, or an improvement of 8 percentage points from the previous year. The major contributors

to the improvement in fourth quarter gross profit were improvements in both stevia and monk fruit

profitability in the fourth quarter of 2017 compared to the prior period, which was offset by higher

capacity charges in the fourth quarter of 2017 compared to the prior period. As previously stated, one of

the key production facilities was shut down for approximately 4 weeks during the fourth quarter of 2017

due to a new gas boiler installation.

Gross profit for 2017 was $0.9 million, an increase of $1.3 million from a negative $0.4 million gross profit

for the comparable period in 2016. The gross profit margin for the year ended December 31, 2017, was

5% compared to negative 2% for the year ended December 31, 2016, or an improvement of 7 percentage

points from the previous year. Gross margin was increased by improved margins on international stevia

sales as well as monk fruit sales compared to the prior period.

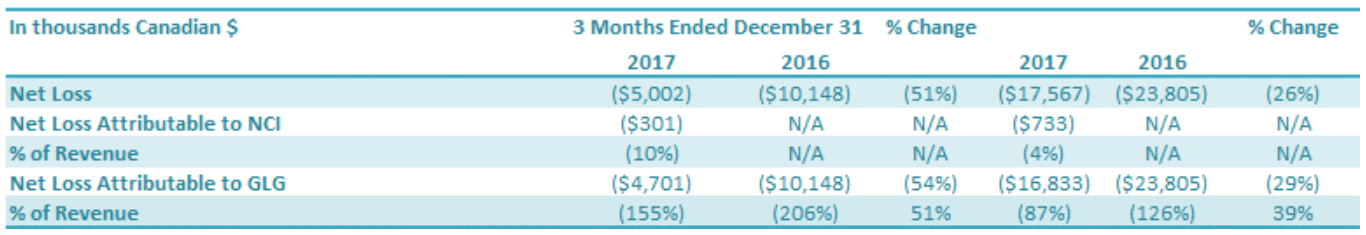

Net Loss Attributable to the Company

For the three months ended December 31, 2017, the Company had a net loss attributable to the Company

of $4.7 million, a decrease of $5.4 million or a 54% improvement over the comparable period in 2016

($10.1 million loss). The decrease in net loss was driven by (1) an increase in gross profit of $0.4 million,

(2) a decrease in SG&A expenses of $1.9 million, (3) a decrease in other expenses of $2.8 million and (4)

an increase in loss of $0.3 million attributable to non-controlling interests.

For the year ended December 31, 2017, the Company had a net loss attributable to the Company of $16.8

million, a decrease of $7.0 million or an improvement of 29% over the comparable period in 2016 ($23.8

million loss). The decrease in net loss was driven by (1) an increase in gross profit of $1.3 million, (2) a

decrease in SG&A expenses of $3.4 million, (3) a decrease in other expenses of $1.6 million and (4) an

increase in loss of $0.7 million attributable to non-controlling interests.

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.12 for the three months ended December 31, 2017, compared with a basic and diluted net loss from operations of $0.27 for the same period in 2016. For the twelve months ended December 31, 2017, the basic loss and diluted loss per share from operations was $0.44, compared with a basic and diluted net loss from both continuing and discontinued operations of $0.63 for the same period in 2016.

OUTLOOK

We continue to expect significant growth in our international stevia sales in 2018, driven by our partnership with our global distributor and our own direct sales in the dietary supplement market. Considering our distributor’s size and distribution reach, we expect that the partnership will continue to deliver significantly higher sales to GLG. Our international stevia revenues have increased significantly in fiscal 2017, up 47% over the same period in 2016. As our global distributor leverages its existing customer relationships, distribution channels, and ingredient expertise in the food and beverage space, we expect international stevia revenues to continue to grow. We are seeing significant sales opportunities arise from this partnership. Moreover, the partnership presents opportunities to develop and deliver new stevia products that have not historically been part of our portfolio. Recently, in collaboration with ADM, the Company announced the newest addition to its portfolio of great-tasting stevia extracts, the new high Reb M product line. Made from GLG’s proprietary high Reb M Dream Sweetener™ Stevia Leaf, this next generation stevia product line facilitates sugar replacement with better-tasting, low-calorie natural sweetening systems and solutions that provide a sugar-like sensory experience. These products provide a clean and full-bodied sweetness experience that is remarkably close to sugar, allowing for deeper calorie reduction through reduced sugar formulations. And with its sucrose-like sweetness, these high Reb M products enable formulators to reduce sugar more than ever before and provide the end consumer with better-tasting healthier choices. The Company expects revenue from sales from Reb M products to commence in 2018 and to grow to be an important part of its stevia revenues over the next three to five years as more of these products become available. In addition, GLG is succeeding with its own direct sales efforts in the dietary supplement market, distinct from the food and beverage space covered by our distribution partnership. We have been successful in 2017 developing our dietary supplement customers with our innovative ClearTaste product line that delivers better tasting stevia and monk fruit. Our ClearTaste stevia and monk fruit products provide better tasting stevia extracts that remove a number of the taste issues typically associated with stevia extracts, including bitter and astringent notes. As of April 2, 2018, we have secured 50 customers in the past 12 months and we expect to more than double this customer base in 2018. A number of these customer wins have replaced their existing stevia and monk fruit suppliers with our ClearTaste products, citing improved sensory performance – in particular, reduced bitterness and aftertaste compared to their previous suppliers’ products. We expect that these two sales channels will bring continued growth in the next twelve months for our international stevia sales. Finally, the Company has developed a two-phase plan designed to eliminate approximately $100 million in outstanding debt and interest, with the first phase being approved by the Shareholders in May 2017 and fully implemented in the fourth quarter of 2017. (See the Related Party Debt Conversion section in the MD&A for details.) The Company is progressing well towards completing the second phase of debt restructure and, as noted above, expects to reach a final agreement to convert all third-party debt into equity in GLG’s Subsidiary. The Company provided a progress update on February 27, 2018, in which it announced that the Company received an official letter from China Cinda Assets Management Corporation Anhui Branch (“Cinda Anhui”) confirming their intention to move forward in 2018 as a new shareholder in GLG’s new joint stock company – Anhui Runhai Biotechnology Joint Stock Company, Ltd. (“Runhai”) – and to resolve Runhai’s bank debt obligations. Cinda Anhui has taken the lead in consolidating GLG’s Chinese debt amongst the other Chinese banks and has been actively engaged in negotiations with the Company to convert all the outstanding bank debt into equity into Runhai. Indeed, Cinda Anhui’s letter highlights its involvement in the debt restructuring process, including its work with the other Chinese banks that have held debt in Runhai. Significantly, this letter also formally communicates Cinda Anhui’s intent to move forward in 2018 to resolve the Company’s Chinese debt positions. As previously noted, the Company plans to provide all necessary public disclosure once the final plan is agreed by all parties including GLG’s Board of Directors. Once the Company finalizes the restructuring plan with Cinda Anhui, the Company will have a strong financial partner in Cinda Anhui, which will further strengthen our position in the market and fundamentally restructure our balance sheet by converting our bank loans into equity in our China subsidiary.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on

SEDAR (www.sedar.com). Additional information relating to the Company is also available on our

website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 669-2602 ext. 101

Fax: +1 (604) 662-8858

Email: [email protected]

About GLG

Life Tech Corporation GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com

Leave a Reply