Vancouver, B.C. November 14, 2017 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global and agricultural leader in the natural zero-calorie sweetener industry, committed to the sustainable development of high-quality zero-calorie natural sweeteners, announces financial results for the three and nine months ended September 30, 2017. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

FINANCIAL HIGHLIGHTS

- Nine-month international stevia sales volumes doubled year-over-year

- Nine-month international stevia sales increased 59% year-over-year (63% when adjusted to

remove impact of exchange rate changes) - Nine-month gross profit margin improved by 5 percentage points year-over-year

- Nine-month gross profit improved by $0.9 million year-over-year

- Nine-month SG&A expenses cut by 17% year-over-year

- Three-month interest expenses reduced by 18% related to Phase 1 Debt Restructuring

Company remains on track to complete its Phase 2 Debt Restructuring International stevia sales volumes grew by 65% in the third quarter 2017, year-over-year, and by 100% in the first nine months of 2017, year-over-year, continuing the trend of significant growth in international stevia sales volumes from the first two quarters of 2017. This trend reflects the increasing demand for GLG’s stevia extracts, resulting from the positive impact of GLG’s global distributorship agreement and its distributor’s success in the marketplace. International stevia revenues for the quarter rose to $3.5 million, up 22% from $2.8 million (up 28% when adjusting for foreign exchange rates; see foreign exchange rate discussion further below), and rose to $14.5 million for the first nine months of 2017, up 59% from $9.1 million (up 63% when adjusting for foreign exchange rates). The Company had previously forecast strong growth in its international stevia sales, based on the strength of its product portfolio and product demand from its global distributor. Nine-month revenues increased by 17% to $16.4 million year-over-year, up from $14.0 million in the first nine months of 2016 (up 20% when adjusting for foreign exchange rates). The revenue increase was driven by the two-fold increase in international stevia sales volumes, which was partly offset by a decrease in monk fruit sales and the impact of foreign exchange rate changes. International sales continue to be the dominant component of consolidated revenues, at 93% for the first nine months of 2017 (compared to 89% for the comparable period in 2016) – a result of both the Company’s continued focus on higherpurity stevia extract sales internationally and a decline in lower-purity extract sales in China. Gross profit and gross profit margins both improved significantly for the nine months ended September 30, 2017. For the nine-month period, gross profit was $0.9 million, compared to nil for the comparable period in 2016, and gross profit margin was 5% compared to nil for the comparable period. The increase in gross profit and gross profit margin for the nine months ended September 30, 2017, relative to the comparable period in 2016, is attributable to higher international stevia sales, lower production costs and decreased idle capacity charges in the third quarter of 2017 compared to the same period in 2016. The Company continues to be successful in reducing its SG&A expenses, having reduced these expenses by 4% (or $0.1 million) year-over-year in the third quarter of 2017 and by 17% (or $1.2 million) year-overyear for the first nine months of 2017 (each relative to the comparable period in 2016). This improvement results from the Company’s continued focus on tight cost controls on administrative expenses while simultaneously growing its revenues. Net loss for both the three and nine month periods ending September 30, 2017, improved by $1.5 million year-over-year. The third quarter net loss was $3.8 million compared to a $5.3 million net loss in third quarter 2016, and the nine month net loss was $12.1 million compared to a $13.6 million net loss for the first nine months of 2016. Interest expenses for the third quarter of 2017 were reduced by 18% year-over-year. This reduction was driven by the Company’s successful first phase of debt restructuring, described below. During the previous quarter, the Company had achieved a major milestone in its debt restructuring efforts. At the Company’s Annual General and Special Meeting (the “Meeting”), held on May 29, 2017, the shareholders overwhelmingly approved the first phase of a two-phase debt restructuring plan. The first phase was a related party transaction (the “Transaction”) eliminating Company’s related party Chinese debt held by the Company’s Chairman and CEO and family members; in exchange, the related parties received minority equity ownership in GLG’s primary Chinese subsidiary (the “Subsidiary”). The Company has since fully executed the Transaction, and as a result, it previously removed $15.9 million in debt liability from its balance sheet. Recently, the Company announced another major milestone, with the formal registration of the Runhai Joint Stock Company (the Subsidiary mentioned above). This, along with the Transaction described above, furthers the Company’s progress towards the second phase of its debt restructuring efforts, and it also enables additional China-based investors to participate in equity in the Subsidiary. The second phase involves restructuring the debt owed to the China-based lenders; under this phase two proposal, their debt holdings of $64.4 million, along with accrued interest and penalties of $19.6 million, will be eliminated in exchange for a proposed 25% stake in equity ownership in the Subsidiary. As part of its recent update on the Runhai Joint Stock Company, GLG provided an update on this second phase of debt restructuring, reporting that the negotiations are going well for a draft agreement with all the lenders and that the Company expects to reach a final agreement to convert all third-party debt into equity into GLG’s Subsidiary. The company plans to provide all necessary public disclosure once the final plan is agreed by all parties including GLG’s Board of Directors. Together, once the second phase is agreed to by all parties and completed, the Company expects to eliminate approximately $100 million in debt from its balance sheet and reduce approximately $8 million in annual interest expenses. Outlook We continue to expect significant growth in our international stevia sales in 2017, driven by our partnership with our global distributor. Considering our distributor’s size and distribution reach, we expect that the partnership will continue to deliver significantly higher sales to GLG. Our international stevia revenues have increased significantly for the nine months ended September 30, 2017, up 59% over the same period in 2016, and our international stevia volumes have doubled compared to that same period. As our global distributor leverages its existing customer relationships, distribution channels, and ingredient expertise in the food and beverage space, we expect international stevia revenues to continue to grow. We see significant sales opportunities arising from this partnership. Moreover, the partnership presents opportunities to develop and deliver new stevia products that have not historically been part of our portfolio. Between new products, immediate product demand from our distribution partner, and the global sales potential to supply many more customers worldwide, we expect to see continued growth in the next twelve months. We also continue to see sales opportunities for our monk fruit business. We believe that our ClearTaste Monk Fruit product line offers the best tasting monk fruit extract in the market today. This unique product removes citrus and astringent notes that otherwise complicate product formulators’ efforts to use monk fruit as a prime sweetener. We have received a lot of positive feedback from a variety of customers who prefer ClearTaste Monk Fruit over regular monk fruit extracts. We now have a pipeline of customers who are actively trialing this product, including some who have begun ordering our ClearTaste Monk Fruit products. However, despite the sales opportunities, we believe that the value of the monk fruit extract market has declined significantly from 2015/2016 due to lower pricing and lower volumes used in the food, beverage and supplement industry. Notwithstanding this year’s lower prices, the main driver of this industry decline in monk fruit volumes is the relatively high price of monk fruit compared to stevia. There are new solutions available in the market to make stevia taste better that offer lower cost in use than the use of monk fruit extract or blends of stevia and monk fruit. One of those solutions that GLG offers is ClearTaste Stevia. In addition, GLG is succeeding with its own direct sales efforts in the dietary supplement market, distinct from the food and beverage space covered by our distribution partnership. We have been successfully landing new accounts in this market for both stevia and monk fruit products. This new business stream began placing orders starting in the fourth quarter of 2016 and we continue to expect significant growth in the dietary supplement sector. We continue to grow the number of customers interested in ClearTaste Stevia, and have successfully added a number of new customers in the first nine months of 2017, with a growing pipeline of prospective customers, and we expect to convert a percentage of these into paying customers. Our ClearTaste Stevia products provide better tasting stevia extracts that remove a number of the taste issues typically associated with stevia extracts, including bitter and astringent notes. With respect to our Naturals+ product line, we expect to develop sales with new/differentiated products such as our P-Pro Plus product as well as select natural ingredients that our customer base is currently sourcing. Finally, the Company has developed a two-phase plan designed to eliminate approximately $100 million in outstanding debt and interest, with the first phase subject to shareholder approval. The first phase was completed after the Shareholder Meeting held on May 29, 2017 (see the Related Party Debt Conversion section in the MD&A for details). The Company is progressing well to complete the second phase of debt restructure and, as noted above, expects to expects to reach a final agreement to convert all third-party debt into equity into GLG’s Subsidiary. Please see the Financial Highlights section above and our Management Proxy Circular, available on SEDAR and on the Company’s website (www.glglifetech.com), for further details.

Corporate and Sales Developments

GLG Announces Related Party Debt Restructuring Shareholder Approval and Completion of Transaction

The Company held its Annual General and Special Meeting (the “Meeting”) on May 29, 2017, in Richmond, British Columbia, at which shareholders were asked to vote on a major step in the Company’s debt restructuring plans. The Company’s Board of Directors had appointed an Independent Special Committee to oversee the debt restructuring process, which led to a two-phase plan to eliminate over 80% of the Company’s outstanding debt and interest. The process the Board utilized in developing its recommendation to shareholders for the restructuring of its China-based debt is described in the Meeting Circular. As part of the Special Shareholder Meeting, shareholders were asked to vote on the first phase of this two-phase plan. The first phase is a related party transaction (the “Transaction”) to eliminate the Company’s related party Chinese debt held by the Company’s Chairman and CEO and family members; in exchange, the related parties receive minority equity ownership in GLG’s primary Chinese subsidiary (the “Subsidiary”). As a related party transaction, under TSX rules, the Company was required to obtain majority shareholder approval from disinterested shareholders. On May 29, 2017, the Company reported that the shareholders had approved the Transaction. Of the eligible votes cast, 18,037,225 eligible voting shares, representing 99.64% of the eligible votes cast, voted in favor of the Transaction. The Company has since fully executed the Transaction. Completing this Transaction was not only important for reducing the Company’s related party debt; more significantly, it is a prerequisite of the Chinese bank debtholders to proceed with the second phase of the debt restructuring plan. As President and CFO Brian Meadows commented after the meeting: “We are pleased to have the required approval to complete this first phase of our debt restructuring plan. We will now turn our attention to completing the second phase, whereby we expect to eliminate the substantial debts held by Chinese banks and state-owned capital management companies. As our Board’s Independent Special Committee concluded, we view this restructuring plan as very beneficial for our shareholders and for our Company’s plans for growth.” The second phase involves restructuring the debt owed to the China-based lenders; under the proposal, their debt holdings of $64.4 million, along with accrued interest and penalties of $19.6 million, will be eliminated in exchange for an approximately 25% stake in equity ownership in the Subsidiary. Together, once the second phase is agreed to by all parties and completed, the restructuring plan will have eliminated approximately $80 million in debt principal, have waived approximately $20 million in accrued interest and penalties, and save approximately $8 million in annual interest expenses. The Company expects to retain management control of the Subsidiary after these two phases of debt restructure are complete. The Company aims to complete this second phase in Q3 or Q4 2017. Such substantial reduction in debt will greatly improve the Company’s balance sheet and its ability to generate new sources of working capital to fund sales expansion.

GLG Announces Completion of Major Milestone with Registration of Joint Stock Company; Provides

Update on Phase 2 Debt Restructure

On November 9, the Company announced that it has completed the China Government approval of the Joint Stock Company status and formerly registered the GLG-controlled new subsidiary – Anhui Runhai Biotechnology Joint Stock Company Limited (“RHJS”). This milestone allows GLG’s RHJS to add new investors to its capital base including the conversion of the third-party debt into equity holders and the potential to add new China-based investors. This formal approval of the Joint Stock Company is critical to the second phase of debt restructure. The Company is also pleased to provide an update on the second phase debt restructure. The negotiations are going well for a draft agreement with all the lenders and the Company expects to reach a final agreement to convert all third-party debt into equity into GLG’s RHJS. The company plans to provide all necessary public disclosure once the final plan is agreed by all parties including GLG’s Board of Directors. In addition, the Company has been in discussions with other potential investors who have shown interest in investing in GLG’s RHJS. Potential investments by additional third parties in GLG’s subsidiary are expected to close in 2018. Dr. Luke Zhang commented on the phase two debt restructuring, “We have made significant progress for our China operation from a wholly owned foreign enterprise (WOFE) into a Joint Stock Company. This approval by the Anhui Provincial Government marks many months of discussions and negotiations with various levels of Government and I am pleased to report to our shareholders that we believe that we are in the final stages of finalizing a deal with our lenders to convert all their debt and interest into equity in our Runhai Joint Stock Company. During this process we have demonstrated to our lenders and other potential investors the exciting opportunity that the stevia market represents and that GLG is well positioned within this market to gain good market share and continue to grow our sales. Our shareholders can be assured that the Company will work hard to complete the second phase of debt restructure and with it bring strong new shareholders in our Runhai subsidiary.”

GLG Announces Major Developments in High Reb M Stevia Plants and Product Innovations

On September 21, 2017, the Company announced an update on its major R&D programs for agriculture and, in collaboration with Archer Daniels Midland Company (“ADM”), a breakthrough in bioconversion that will enable commercialization of high purity Reb M and Reb D sweeteners found in the stevia leaf. First, GLG has achieved a major breakthrough in its agricultural R&D program for high Reb M stevia plants. Through this program, GLG aims to revolutionize the global food and beverage industry by providing companies with the ability to replace sugars and artificial sweeteners with naturally-sourced Rebaudioside M (“Reb M”). On February 29, 2016, GLG announced a new variety of stevia seedling that contained 8% Rebaudioside M out of the total steviol glycosides (“TSG”) present in that variety. Since then, GLG has developed high Reb M stevia varieties using non-GMO hybridization techniques. GLG was pleased to announce the latest results from this program – that it has five new seedlings that have Reb M content ranging from 56.8% to 61.6% of TSG. These results have already significantly exceeded our target of Reb M content of 50%. GLG measured fourteen glycosides including RM, RD, STV, RF, RN, RO, RN, RE, RA, STV Isomer, DA, RUB, RB and STB. The other notable glycosides present were RN (average 7.4%) and RF (average 17.0%). The TSG level in these five new varieties was much lower than our high Reb A plants and the next phase of the R&D program will be to focus on increasing TSG and Reb M levels. GLG has a great deal of experience in increasing TSG and plant size as it has done with its Reb A varieties. These are just the initial results of last year’s agriculture program, and GLG expects to have additional results in the coming weeks and will release any additional major findings and developments as it has them. The significance of these results cannot be understated. Reb M, one of several steviol glycosides found in the stevia plant, is highly desired in the industry as a natural, zero-calorie sugar and sweetener replacement, one that very closely resembles sugar. To date, the impediment to utilizing Reb M has been its scarce presence in the stevia leaf, making commercial use cost-prohibitive. With this level of Reb M content, GLG can cost effectively produce high Reb M stevia extract for costs similar to the cost of today’s high Reb A stevia extracts. GLG’s new high Reb M stevia varieties pave the way to bringing a naturallysourced Reb M extract to the market on a commercial scale. All hybridization techniques used to develop these new varieties are non-GMO, which will maintain the integrity of GLG’s leading stevia non-GMO product portfolio. These achievements have been accelerated with the utilization of advanced genomic screening techniques that result in a more efficient selection of candidate stevia lines and crossings with a number of patented GLG stevia varieties. This latest achievement further demonstrates GLG’s leading position in the global stevia industry. The next steps will be to propagate these seedlings and ultimately develop a seed variety that will be made available to farmers, which will reduce their cost of growing high Reb M stevia leaf as well as protect GLG’s intellectual property. GLG is in the process of filing for patent protection for its new high Reb M seedlings. GLG has a unique gene fingerprint for its stevia plants, which will be an integral part of protecting its intellectual property with these new Reb M varieties. Second, GLG and ADM, the exclusive global marketer and distributor of GLG’s stevia and monk fruit sweeteners, have achieved a major breakthrough in the co-development of high Reb M and high Reb D stevia extracts using bioconversion techniques. GLG and ADM expect that these products will fill the short-term market demand before the high Reb M stevia varieties are commercially available for planting (in approximately the next two to three years). The two companies, working together with several thirdparty partners, have achieved purity levels exceeding 98% for Reb M and 99% for Reb D stevia extracts. ADM and GLG expect to be in commercial production for high Reb M and high Reb D extracts starting in the first quarter of 2018 using a bioconversion production technology. This strategy will allow for earlier sale of high Reb M and high Reb D extracts until the leaf-based extracts are available from its high Reb M leaf. Dr. Luke Zhang, CEO and Chairman of GLG, commented: “We are so pleased to announce this breakthrough for high Reb M stevia plants. Based on GLG’s strong track record of developing high Reb A, high Reb C and high STV stevia varieties, I was always confident that we would develop a high Reb M variety using our core R&D patented technology. The team has exceeded my expectations in achieving these results in a little over 18 months since we kicked off our Phase II Reb M Seedling program. I am also excited by our Bioconversion R&D program, which will allow us to offer our customers high Reb M and high Reb D stevia extracts starting in 2018. These products will serve as an interim bridge until our high Reb M stevia leaf is grown commercially a few years later. We expect strong demand from international customers for these better tasting stevia extracts. A leaf that contains almost 60% Reb M will allow us to offer these products at very similar prices to today’s Reb A products.” “Consumers today are looking for natural, clean label foods and drinks that taste great,” said Rodney Schanefelt, director, sugar and high intensity sweeteners, for ADM. “We are excited about these breakthroughs, and look forward to expanding the array of innovative, low-calorie stevia and monk fruit sweeteners we can offer to customers around the globe.”

GLG Announces Breakthrough Development of Super RA Seed

On September 26, 2017, the Company announced another major breakthrough in its agricultural R&D program. GLG’s industry-leading agricultural team has successfully produced a seed that will grow its Super RA variety of stevia with unprecedented levels of RA content. In late 2014, the Company announced that it developed a new stevia seedling variety with approximately 75% Rebaudioside A (“Reb A”) content relative to the total steviol glycosides (“TSG”) present in the leaf. GLG dubbed this seedling variety – and its further progeny – Super RA, and proceeded to apply for patent protection for this variety. The Company has since been further developing this seedling into a mature robust plant, as well as the development of seed that will be used to grow the Super RA plants. Now the Company has announced that it has successfully developed the Super RA seed in another major stevia agriculture breakthrough. This major development carries three benefits. First, the extraordinarily high levels of Reb A levels present in the Super RA leaf are expected to dramatically cut GLG’s cost of production of Reb A extracts. The Reb A levels in the leaf grown from the Super RA seed are nearly 80% (79.36%) of TSG, with the TSG at an unusually high level of 15%. This results in the Super RA leaf itself comprising 12% Reb A content. Typical stevia leaf has Reb A levels of approximately 6%. Simply put, GLG’s Super RA leaf contains twice the amount of Reb A as typical stevia leaf. With leaf being the major cost component of stevia extracts, and with only half the amount of leaf required to produce GLG’S Reb A extracts made from Super RA leaf, GLG expects to achieve significant lower production costs by using the Super RA leaf. Second, the ability to grow the plant from seed is crucial for preventing third parties from the unauthorized use of the Company’s patent-protected Super RA leaf. In addition to patent protections, GLG’s seeds, including the Super RA seed, produce plants that will not themselves generate the same Super RA seeds; any plants grown from such second-generation seeds will be vastly inferior. In other words, in order to plant for successive seasons, farmers must be given access to GLG’s original seeds. This puts GLG in a unique position to control, and to benefit from, its Super RA agriculture achievement, without the risks of intellectual property loss inherent to seedlings alone. Third, this new seed brings great benefits for farmers as well. The cost of utilizing seed over seedlings is about 80% lower for seed. Based on GLG’s experience with its prior H3 seed family, which has proven to be extremely popular among Chinese farmers, given its lower cost of growing, vigorous plants, and larger biomass produced per acre, farmers will have strong incentive to grow the Super RA plants for GLG. With a lower cost basis, GLG also expects to contract with farmers at highly favorable prices while still providing the farmers with a great return for their efforts. Dr. Luke Zhang, CEO and Chairman of GLG, commented: “The development of the Super RA seed is a remarkable achievement by our GLG Agriculture subsidiary in China. Our team has had a number of major stevia agriculture developments since 2014 and the development of the Super RA seed is one our biggest achievements to date. GLG is the only stevia company in China that has a subsidiary dedicated to the development of enhanced stevia seeds and seedlings and has received a number of patents on its work and awards. GLG first successfully patented its H3 seed five years ago and stevia farmers love working with it due to the lower cost compared to seedlings. GLG is also the only company in China to have achieved patented seed technology that grows single-use hybrids with high plant mass, high steviol glycosides and high Rebaudioside A. The Super RA seed will take over from our H3 seed and deliver two times the Reb A weight in our leaf compared to existing stevia seedlings available in the market. The farmers will only be able to buy the Super RA seed from GLG, which is expected to provide GLG more control over the stevia market in China. The lower cost of growing to the farmer will make the Super RA seed very appealing to the farmer resulting in a win for the farmer and a win for GLG. No other stevia competitor in China has this technology or a patent to develop seeds for high RA plants.” Brian Meadows, President of GLG, commented, “This Super RA seed achievement is truly a win-win-win. It is a win for GLG’s customers given expected lower costs of production. It is a win for the farmers given the 80% lower costs with stevia seeds rather than seedlings. And it is a win for the Company’s shareholders, given the Company’s expected ability to expand its customer base, revenues, and profits atop these substantially lower production costs and unique position to utilize the Super RA seeds. GLG expects the benefits from the development of the Super RA seed to flow for years to come. In 2018, the Company will begin rolling out its Super RA seed in limited quantities, and in 2019, the Company expects to begin planting the Super RA seed on a large, virtually unlimited, scale. “

GLG Announces Re-Election of Board of Directors

Concurrent with the May 29, 2017, related party transaction approval announcement described above, the Company also announced that the shareholders voted in all nominated directors, with favorable votes for each exceeding 99.9%. Dr. Luke Zhang continues as Chairman of the Board and Chief Executive Officer and Brian Palmieri continues as Vice Chairman of the Board.

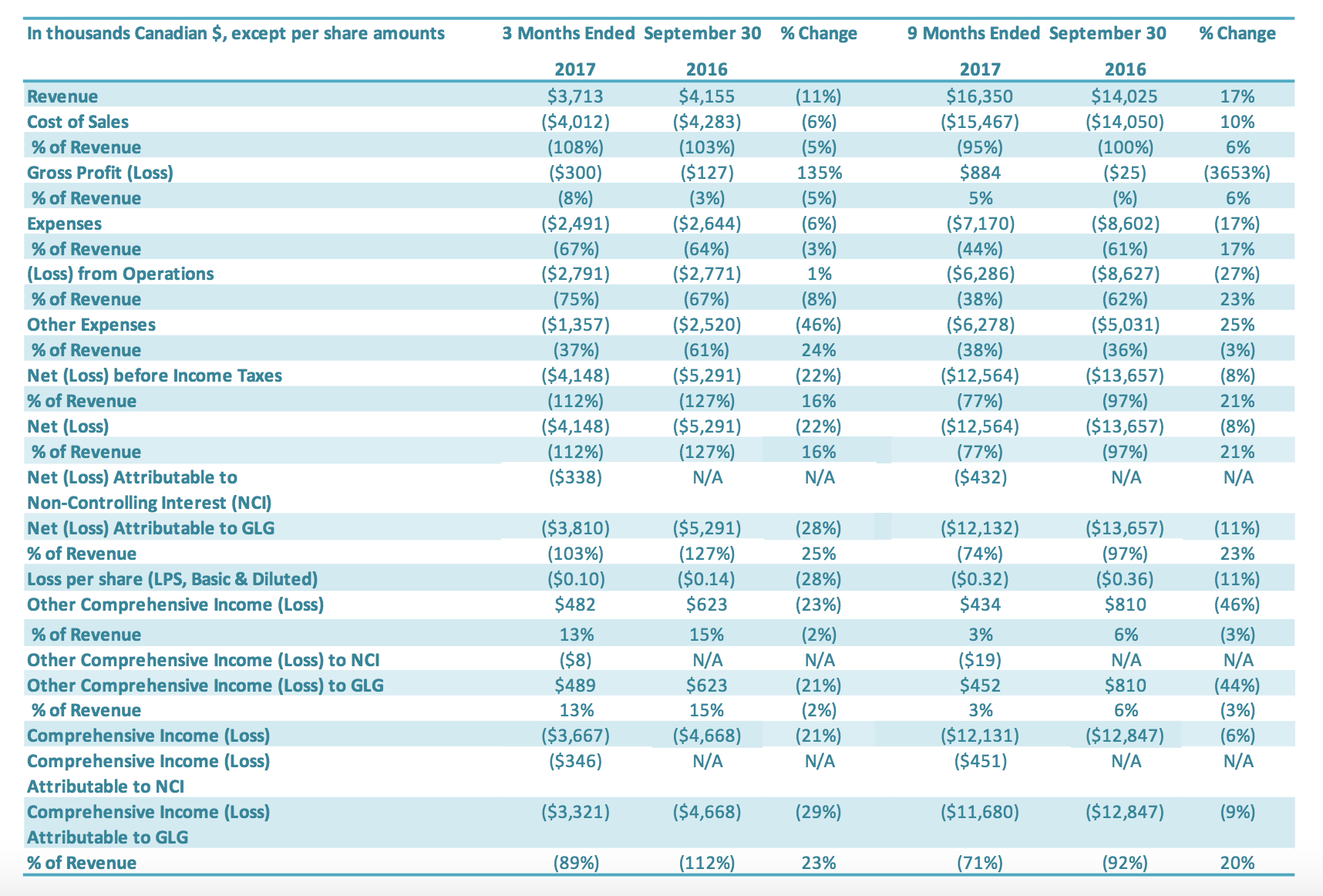

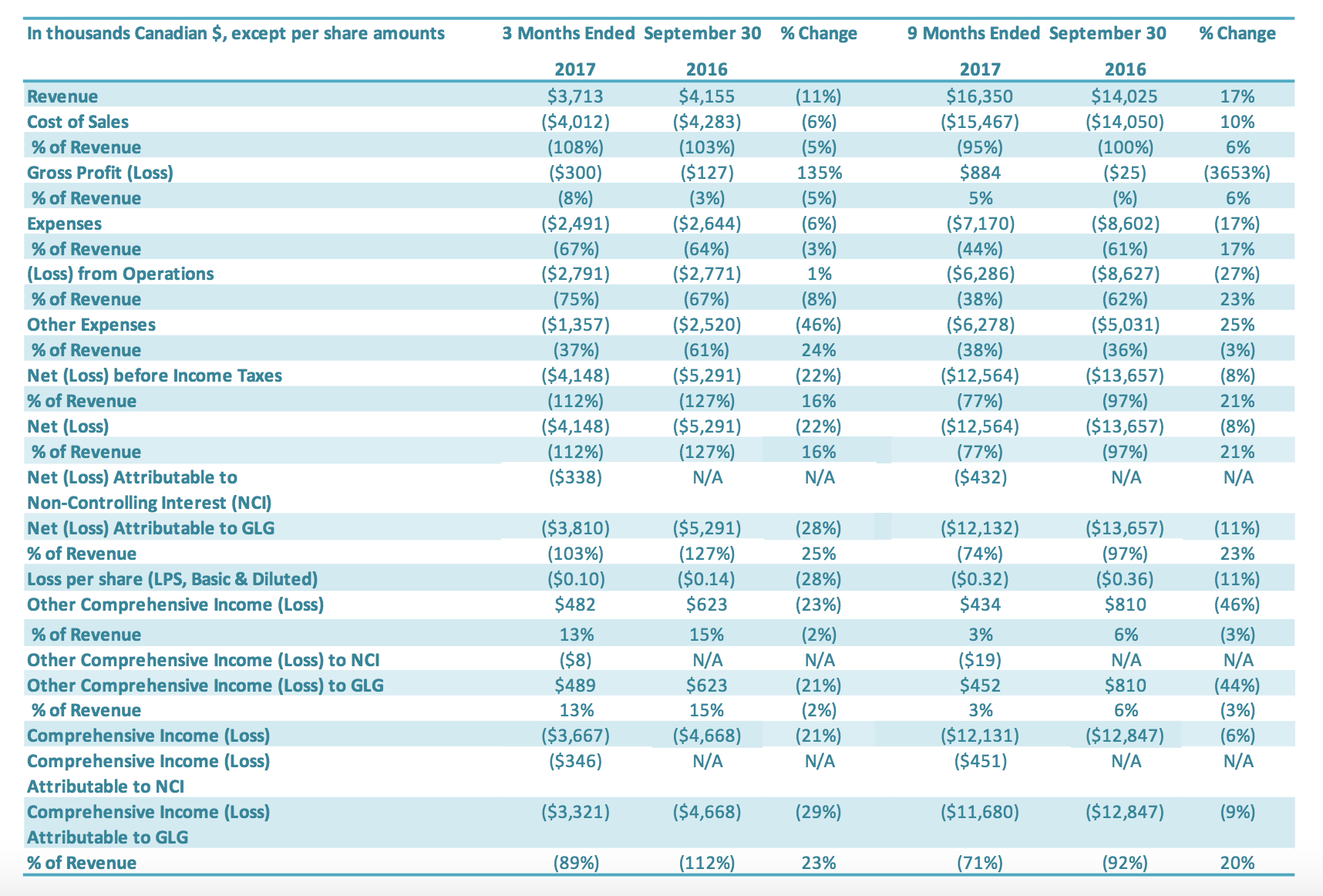

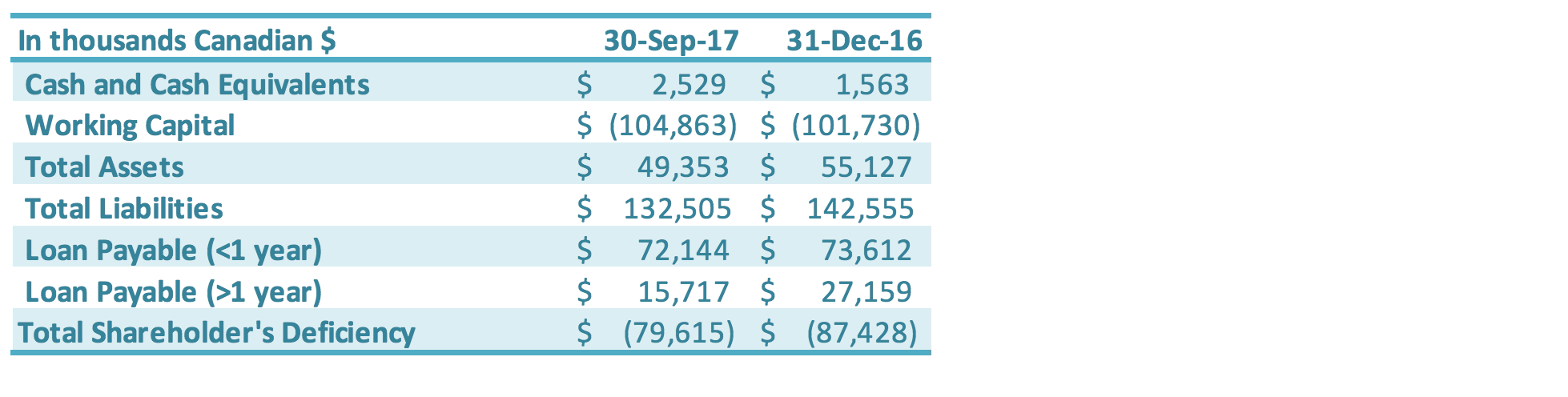

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the three and nine months ended September 30, 2017, are available on SEDAR and on the Company’s website at www.glglifetech.com.

Results from Operations

As noted above, the complete set of financial statements and management discussion and analysis for the three and nine months ended September 30, 2017, are available on SEDAR and on the Company’s website at www.glglifetech.com.

Revenue

Revenue for the three months ended September 30, 2017, was $3.7 million compared to $4.2 million in revenue for the same period last year, a decrease of 11%. International stevia sales volumes grew by 65% over the same period in the previous year. This increase in international stevia sales volumes continues to show the positive impact that GLG’s global stevia distribution partner – Archer Daniels Midland Company’s (“ADM”) – has had on GLG’s international stevia sales. Sales revenue for international stevia rose to $3.5 million in the third quarter compared to $2.8 million in the prior period or an increase of 22%. Depreciation of the USD relative to CAD impacted international stevia sales growth and quarterly revenue change overall. The USD relative to the CAD was down 4% from third quarter 2016 to third quarter 2017. Holding exchange rates constant, the third quarter 2017 international stevia sales would have had 28% growth (rather than 22%) over the comparable period, and third quarter 2017 revenues overall would have decreased by 7% (rather than 11%). International stevia sales increases reflect continued growth in both sales to new customers and sales of new products to existing customers. International stevia sales represented 93% of all stevia sales. Offsetting the increased international stevia sales was lower monk fruit sales. Our expectation is that there is a lower volume of monk fruit being purchased generally in the market compared to the previous two years. Even with lower market pricing, the cost of monk fruit extract is significantly higher – approximately 250% higher – than stevia. GLG has added new monk fruit customers during the quarter, however there were very few deliveries to these new customers during the third quarter. Revenue for the nine months ended September 30, 2017, was $16.4 million, an increase of 17% compared to $14.0 million in revenue for the same period last year. International sales increased by 23% and China sales decreased by 32%. International stevia sales volumes doubled over the same nine-month period in the previous year. International stevia sales rose to $14.5 million for the first nine months in 2017 compared to $9.1 million in the same prior year period or an increase of 59%. This increase in international stevia sales continues to show the positive impact of GLG’s global stevia distribution partner ADM’s on GLG’s international stevia sales. Sales increases reflected continued growth in both sales to new customers and sales of new products to existing customers. Depreciation of the USD relative to CAD impacted international stevia sales growth and quarterly revenue change overall. Holding exchange rates constant, the nine-month 2017 international stevia sales would have had 63% growth (rather than 59%) over the comparable period, and nine-month 2017 revenues overall would have increased by 20% (rather than 17%). Offsetting the increased international stevia sales was lower monk fruit sales which decreased for the nine-month period by 80% over the same period last year. The decrease in monk fruit sales reflects both significantly lower prices and lower sales volumes for monk fruit extracts in the nine-month period in 2017. Our expectation is that there is a lower volume of monk fruit being purchased generally in the market compared to the previous two years. Even with lower market pricing, the cost of monk fruit extract is significantly higher – approximately 250% higher – than stevia. GLG has added new monk fruit customers during the first nine months, however there were very few deliveries to these new customers during the nine months. International sales accounted for 93% of total sales in the first nine months of 2017 compared to 89% in the comparable period of 2016.

Cost of Sales

For the quarter ended September 30, 2017, the cost of sales was $4.0 million compared to $4.3 million in cost of sales for the same period last year (a decrease of $0.3 million or 6%). Cost of sales as a percentage of revenues was 108% for the third quarter 2017, compared to 103% for the comparable period (an increase of 5 percentage points). Cost of sales as a percentage of revenues for the third quarter, relative to the same period in 2016, decreased during the quarter due to a decrease in monk fruit sales, which was offset by lower idle capacity charges during the quarter. Only two of GLG’s manufacturing facilities were operating during the third quarter of 2017, and idle capacity charges of $0.6 million were charged to cost of sales (representing 17% of cost of sales) compared to $0.9 million charged to cost of sales in the same period of 2016 (representing 22% of cost of sales). For the nine months ended September 30, 2017, the cost of sales was $15.5 million compared to $14.1 million for the same period of last year (an increase of $1.4 million or 10%). Cost of sales as a percentage of revenues was 95% for the first nine months 2017, compared to 100% in the comparable period in 2016 (an improvement of 5% percentage points). Cost of sales as a percentage of revenues for the nine months ended September 30, 2017, relative to the same period in 2016, decreased during the quarter due to (1) lower production costs and (2) lower idle capacity charges (a 32% improvement). Capacity charges charged to the cost of sales ordinarily would flow to inventory and are a significant component of the cost of sales. Only two of GLG’s manufacturing facilities were operating during the first nine months of 2017, and idle capacity charges of $1.7 million were charged to cost of sales (representing 11% of cost of sales) compared to $2.5 million charged to cost of sales in same period of 2016 (representing 18% of cost of sales).

The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period

include:

- Capacity utilization of stevia and monk fruit manufacturing plants.

- The price paid for stevia leaf and monk fruit and their respective quality, which are impacted by crop quality for a particular year/period and the price per kilogram for which the stevia and monk fruit extracts are sold. These are the most important factors impacting the gross profit of GLG’s stevia and monk fruit business.

- Other factors which also impact stevia and monk fruit cost of sales to a lesser degree include:

- water and power consumption;

- manufacturing overhead used in the production of stevia and monk fruit extract, including supplies, power and water;

- net VAT paid on export sales;

- exchange rate changes; and

- depreciation.

GLG’s stevia and monk fruit businesses are affected by seasonality. The harvest of the stevia leaves typically occurs starting at the end of July and continues through the fall of each year. The monk fruit harvest takes place typically from October to December each year. GLG’s operations in China are also impacted by Chinese New Year celebrations, which occur approximately late-January to mid-February each year, and during which many businesses close down operations for approximately two weeks. GLG’s production year runs October 1 through September 30 each year.

Gross Profit

Gross profit for the three months ended September 30, 2017, was negative $0.3 million, compared to negative $0.1 million for the comparable period in 2016. The gross profit margin was negative 8% in the third quarter 2017 and negative 3% for the same period in 2016. The decrease in gross profit for the third quarter of 2017, relative to the comparable period in 2016, is attributable to lower monk fruit sales, which was offset by higher international stevia sales. Gross profit for the nine months ended September 30, 2017, was $0.9 million, compared to nil for the comparable period in 2016. The increase in gross profit for the nine months ended September 30, 2017, relative to the comparable period in 2016, is attributable to higher international stevia sales, lower production costs and decreased idle capacity charges in the third quarter of 2017 compared to the same period in 2016.

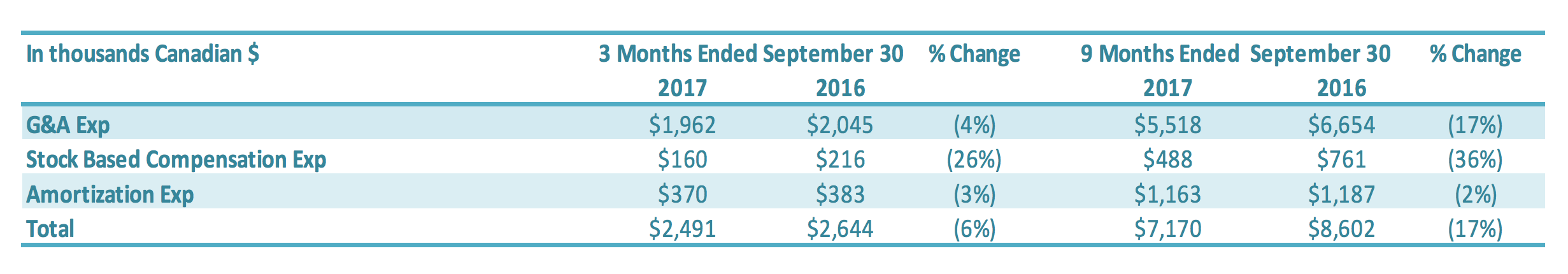

Selling, General, and Administration Expenses

Selling, General and Administration (“SG&A”) expenses include sales, marketing, general and administration costs (“G&A”), stock-based compensation, and depreciation and amortization expenses on G&A fixed assets. A breakdown of SG&A expenses into these components is presented below:

SG&A expenses for the three months ended September 30, 2017, was $2.5 million compared to $2.6 million in the same period in 2016 ($0.1 million decrease) or a 6% reduction. SG&A expenses excluding stock based compensation and amortization expenses (non-cash items) were $2.0 million for three months ended September 30, 2017 and 2016. Salary and wages were reduced by $0.2 million, which was offset by increased professional fees and consulting fees of $0.2 million related to debt restructure consulting fees. Stock-based compensation was $0.2 million for the three months ended September 30, 2017, compared to $0.3 million in the comparable period in 2016. The number of common shares available for issue under the stock compensation plan is 10% of the issued and outstanding common shares. During the quarter, compensation from vesting stock-based compensation awards was recognized, due to previously granted options and restricted shares. SG&A-related depreciation and amortization expenses for the three months ended September 30, 2017, were $0.4 million compared with $0.4 million for the same quarter of 2016. SG&A expenses for the nine months ended September 30, 2017, were $7.2 million compared to $8.6 million in the same period in 2016 or a 17% reduction. SG&A expenses excluding stock based compensation and amortization expenses (non-cash items) decreased by $1.2 million to $5.5 million for the nine months ended September 30, 2017 ($6.7 million for the nine months ended September 30, 2016). The main reductions were in (1) salary and wages ($0.5 million), (2) professional fees ($0.2 million), (3) office expenses and taxes ($0.3 million), (4) sales and marketing expenses ($0.2 million) and (5) research and development ($0.1 million). Stock-based compensation was $0.5 million for the nine months ended September 30, 2017, compared with $0.8 million in the same period for 2016. The number of common shares available for issue under the stock compensation plan is 10% of the issued and outstanding common shares. During the period, compensation from vesting stock-based compensation awards was recognized, due to previously granted options and restricted shares. SG&A-related depreciation and amortization expenses for the nine months ended September 30, 2017, were $1.2 million compared with $1.2 million for the same period of 2016.

Other Expensess

Other expenses for the three months ended September 30, 2017, was $1.4 million, a $1.1 million decrease compared to $2.5 million for the same period in 2016. The decrease in other expenses for the third quarter of 2017 of $1.1 million is attributable to (1) an increase in foreign exchange gains ($0.8 million), % Change % Change 2017 2016 2017 2016 G&A Exp $1,962 $2,045 (4%) $5,518 $6,654 (17%) Stock Based Compensation Exp $160 $216 (26%) $488 $761 (36%) Amortization Exp $370 $383 (3%) $1,163 $1,187 (2%) Total $2,491 $2,644 (6%) $7,170 $8,602 (17%) In thousands Canadian $ 3 Months Ended September 30 9 Months Ended September 30 (2) a decrease in interest expenses ($0.5 million) and (3) an increase in impairment recoveries ($0.1 million), which were offset by (4) a decrease in other income ($0.3 million). Other expenses for the nine months ended September 30, 2017, was $6.3 million, a $1.3 million increase compared to $5.0 million for the same period in 2016. The increase in other expenses for the nine months ended September 30, 2017, of $1.3 million is attributable to (1) a decrease in other income ($1.3 million) and (2) a decrease in recoveries from bad debt ($0.5 million), which were offset by (3) an increase in impairment recoveries ($0.3 million) and (4) a decrease in interest expenses ($0.2 million).

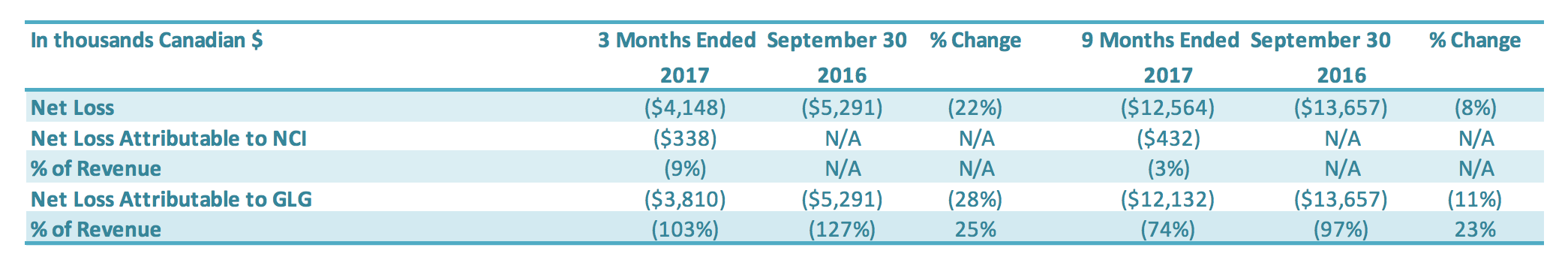

Net Loss

For the three months ended September 30, 2017, the Company had a net loss of $3.8 million, a decrease of $1.5 million or a 28% improvement over the comparable period in 2016 ($5.3 million loss). The $1.5 million decrease in net loss was driven by (1) a decrease in other income (expenses) ($1.2 million), (2) a decrease in SG&A expenses ($0.2 million) and (3) an increase in the net loss attributable to the noncontrolling interest ($0.3 million), which were offset by a decrease in gross profit ($0.2 million). For the nine months ended September 30, 2017, the Company had a net loss of $12.1 million, a decrease of $1.5 million or an 11% improvement over the comparable period in 2016 ($13.6 million loss). The $1.5 million decrease in net loss was driven by (1) an increase in gross profit ($0.9 million), (2) a decrease in SG&A expenses ($1.4 million) and (3) an increase in the net loss attributable to the non-controlling interest ($0.4 million), which were offset by (4) an increase in other income (expenses) ($1.2 million).

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.10 for the three months ended September 30, 2017, compared with a basic and diluted net loss of $0.14 for the same period in 2016. The basic loss and diluted loss per share from operations was $0.32 for the nine months ended September 30, 2017, compared with a basic and diluted net loss of $0.36 for the same period in 2016.

Liquidity and Capital Resources

The Company continues to progress with the following measures to manage cash flow of the Company: paying down short-term loans, reducing accounts payable, negotiating with creditors for extended payment terms, working closely with the banks to restructure its loans, arranging financing with its Directors and other related parties, and reducing operating expenditures including general and administrative expenses and production-related expenses. Total loans payable (both short-term and long-term) is $87.9 million as of September 30, 2017, a decrease of $12.9 million compared to the total loans payable as at December 31, 2016 ($100.8 million). The decrease in loans was driven by the conversion of a portion of the related party debt into equity in one of GLG’s China subsidiaries, which was approved at the May 29, 2017, GLG Special Shareholders Meeting. The debt restructuring reduced short-term loans by $5.1 million and long-term loans by $10.8 million (derivative liabilities were also reduced – see the Related Party Debt Conversion section herein for additional details); these reductions were partially offset by additional interest accrued over the period. The Company has worked with its Chinese banks on restructuring its Chinese debt. In 2015, the Construction Bank of China successfully transferred GLG’s debt to China Cinda Assets Management Co. and the Agricultural Bank of China successfully transferred GLG’s debt to China Hua Rong Assets Management Co., each of which is a state-owned capital management company (“SOCMC”). Prior to the Company’s Q2 2017 debt restructuring (see the Related Party Debt Conversion section), as of March 31, 2017, the total of all China bank loans transferred to SOCMCs accounted for approximately 74% of the Company’s outstanding Chinese debt. The nature of the business of these SOCMCs differs from banks, in that they take a long-term outlook on management of debt. For example, instead of simply requiring loan principal and interest payments, the SOCMCs aim to manage debts with greater flexibility, such as longterm loan terms, debt for equity arrangements, flexible debt retirement, and other long-term instruments. This debt is held at the Chinese subsidiary level, and any such potential arrangements would therefore be done at that level rather than at the corporate level. These SOCMCs could also be a source of possible future capital. The Company is working further with the Chinese banks and SOCMCs on restructuring its debt. The Corporate and Sales Developments section above describes a two-phase debt restructure plan. The first phase involved the conversion of related party debt into equity into one of the Company’s subsidiaries. The second phase is expected to involve the conversion of bank/SOCMC debt into equity in that same subsidiary. Ultimately, this two-phase plan is designed to eliminate approximately $100 million in debt and accrued interest.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on

SEDAR (www.sedar.com). Additional information relating to the Company’s related party debt

conversion transaction, as described in the Company’s Management Proxy Circular, is available on

SEDAR (www.sedar.com). Additional information relating to the Company is also available on our

website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 285-2602 ext. 101

Fax: +1 (604) 285-2606

Email: [email protected]

About GLG Life Tech Corporations

GLG Life Tech Corporation is a global leader in the supply of high-purity stevia extracts, an all-natural zero-calorie sweetener used in food and beverages. GLG’s vertically integrated operations cover each step in the stevia supply chain including Non-GMO stevia seed breeding, natural propagation, stevia leaf growth and harvest, proprietary extraction and refining, marketing and distribution of the finished product. GLG has similarly positioned itself, through parallel vertically integrated Luo Han Guo operations, to be a leader in the supply of high-purity Luo Han Guo extracts. Additionally, to further meet the varied needs of the food and beverage industry, GLG has launched its Naturals+ product line, enabling it to supply a host of complementary ingredients reliably sourced through its R8 supplier network in China. For further information, please visit www.glglifetech.com

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2015. In light of these factors, the forwardlooking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Leave a Reply