Vancouver, B.C. November 16, 2015 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the nine months ended September 30, 2015. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com.

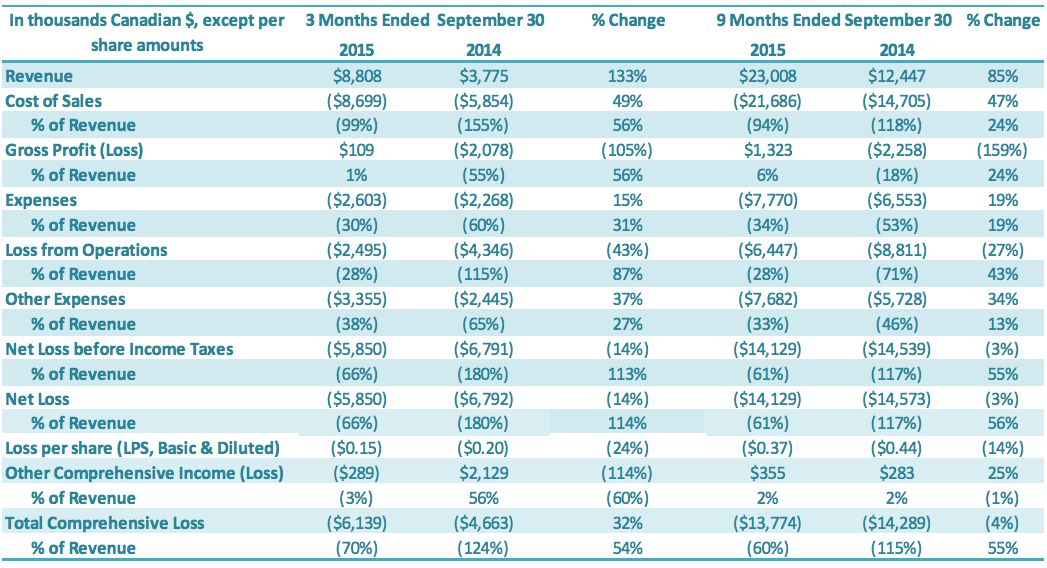

FINANCIAL HIGHLIGHTS

GLG Continues to Achieve Strong International Sales Growth in Quarterly Revenues Demonstrating

Clear Progress with its Sales Growth Strategy

For the three months ended September 30, 2015, GLG achieved 133% sales growth in its quarterly revenues over the comparable period last year, recording $8.8 million in revenue for the third quarter, compared to $3.8 million for the same quarter last year. In 2014, GLG developed a three-pronged sales growth strategy, designed to generate increased revenues from international sales in its three distinct product lines–stevia, monk fruit, and its GLG Naturals+ products. This quarter’s 133% year-over-year revenue growth reflects GLG’s successful execution of this growth strategy, as GLG’s international sales were up 309% from the comparable period last year, making up 94% of its overall third quarter sales. On a nine-month basis, ending September 30, 2015, revenue increased 85% to $23.0 million, up from $12.4 million in the comparable period in 2014. International sales year-to-date are at 88% of total sales (compared to 51% over the same period last year), and have increased by 218% from last year’s same-period international sales.

Increased International Sale Drive Improved Margins

The increase in international third quarter sales helped GLG improve its gross profit margin year over year by $2.2 million (loss of $2.1 million in the third quarter 2014 to $0.1 million gross profit for the third quarter 2015). On a nine-month year-over-year basis, gross profit margin year over year improved by $3.6 million (loss of $2.3 million for the nine month period in 2014 compared to $1.3 million for the nine month period in 2015).

Improvement in Net Loss for the Third Quarter

For the three months ended September 30, 2015, the Company had a net loss attributable to the Company of $5.9 million, a decrease of $0.9 million or a 14% improvement over the comparable period in 2014 ($6.8 million loss). The basic loss and diluted loss per share was $0.15 for the third quarter of 2015 compared with a basic and diluted net loss of $0.20 for the comparable period in 2014 (25% improvement over prior period).

GLG Continues To Make Progress in Debt Restructure with Its China Debt Holders

GLG has been working with two state-owned capital management companies (“SOCMCs”) in China to restructure much of its debt. GLG continues to make progress with these SOCMCs on transferring additional bank loans to the SOCMCs and progressing on structuring longer-term arrangements. During the third quarter, the Company saw the successful transfer of an additional $3.7 million from the Bank of China to China Cinda Asset Management (“Cinda”) bringing the total of China bank loans transferred from State Owned Banks to SOCMCs to 74% of short-term (on-demand) bank loans. The nature of the business of these SOCMCs differs from banks, in that they take a long-term outlook on management of debt. The SOCMCs aim to manage debts with greater flexibility, such as long-term loan terms, debt for equity arrangements, flexible debt retirement, and other long-term instruments. This debt is held at the Chinese subsidiary level, and any such potential arrangements would therefore be done at that level rather than at the corporate level. These SOCMCs also represent a potential source of future capital.

The Company’s main initiative to improve its negative working capital position is a potential debt restructuring involving the State Owned Capital Management Companies and Chinese Banks where the Company’s operating subsidiaries owe approximately $69 million in short-term debt. The Company is developing a plan to either restructure this short-term debt to longer term debt, or potentially convert all or a portion of this short-term debt into equity of the Company’s Chinese operating subsidiaries. The Company also successfully renewed the RMB 7 million loan with the Huishang Bank on July 1, 2015, for an additional one year term.

Additional Working Capital Funding Secured

Subsequent to the quarter, the Company secured a new loan for working capital purposes to purchase monk fruit and/or stevia leaf from a related party for up to USD 3 million; the Company received USD 2 million in funds shortly after the quarter ended. The Company also has received $5.5 million in cash from its quarter end A/R balance as additional financial resources to operate its business.

CORPORATE DEVELOPMENTS

Major Advances in High-Purity Leaf for Reb D and Reb M

On September 30, 2015, GLG announced a major agricultural breakthrough, one that significantly advances the global food and beverage industry toward utilizing naturally-sourced Rebaudioside D (“Reb D”) and Rebaudioside M (“Reb M”). Through GLG’s development of its Reb D seedling using its non-GMO patented breeding methodology, the GLG agriculture team has developed a new strain containing significantly higher levels of the highly-desired Reb D and Reb M glycosides.

GLG’s new Reb D seedling contains 320% more Reb D than conventional leaf strains, at 1.26% of dry leaf weight, and amounting to 9.4% of total steviol glycosides (“TSG”). Moreover, as expected, the increased Reb D levels brought a corresponding increase in the Reb M levels; Reb M levels increased by over 430% relative to the typical percentage in a leaf, at 0.53% of dry leaf weight, and amounting to 4% of TSG. Historically, conventional stevia leaf has had Reb D concentrations of around 0.3% of dry leaf weight, or 2.5% of TSG, and Reb M concentrations less than 0.1% of dry leaf weight, or less than 1% of TSG. The TSG in the Reb D seedling was 13.43% of dry leaf weight, and lab tests of this Reb D seedling also included a substantial amount of Reb A in the leaf (68% of the TSGs were Reb A).

This increase in Reb D and Reb M represents a major milestone in developing a commercially viable highReb D / high-Reb M seedling and is another significant leap forward in the natural, non-GMO agronomic development of the historically scarcer steviol glycosides. GLG made its first announcement in 2014 with its breakthrough in high Reb C seedlings, clearly demonstrating the promise of its patented non-GMO seedling hybridization technology. GLG expects further improvements in the near future with its Reb D seedling, given its proven patented hybridization process.

This Reb D/Reb M seedling breakthrough is important to the sweetener industry as the flavor profile of Reb D and Reb M has been shown to have a vastly superior profile to Reb A, providing a flavor profile much closer to that of sucrose. A natural stevia leaf source sufficiently high in Reb D and Reb M will bring production costs down significantly, as GLG has experienced with Reb C, enabling GLG to provide Reb D and Reb M extracts at commercially viable price points.

GLG is in the process of filing for patent protection for its new Reb D/Reb M seedling. GLG has previously filed two GRAS applications with the FDA for high-purity Reb D (GRN 548) and Reb M (GRN 512), with purity levels ranging from 80% to 95% to be used as a sweetener

GLG’s Monk Fruit Business Well Underway in 2015

Earlier this year, GLG shipped its first orders of high-purity monk fruit extracts, moving towards satisfaction of the contract it signed last year with Tate & Lyle. As of September 30, 2015, GLG has completed all deliveries of monk fruit extract under that contract. This year’s monk fruit harvest is now underway; GLG is presently purchasing fruit in multiple regions in China. GLG is commencing processing and expects to commence deliveries late in the fourth quarter.

Producing monk fruit products is a natural extension of GLG’s core stevia product line; these product lines are each naturally sourced sweetener ingredients and monk fruit is often used in tandem with stevia. GLG differentiates itself from other monk fruit producers in four ways: (1) its competitive advantage in establishing agriculture systems in China, including the introduction of Good Agriculture Practices (GAP) by its monk fruit farmers, superior monk fruit seedlings and its proven methods to expand the amount of farming in other crops such as stevia; (2) its commitment to its Fairness to Farmers program, whereby it aims to promote a healthy economy via fair, stable income for farmers in the monk fruit growing region; (3) its advanced processing and extraction technology, which will enable GLG to more efficiently and economically produce monk fruit extracts and (4) its large industrial processing capacity, which well positions GLG for anticipated growth in the monk fruit market driven by international food and beverage companies.

Corporate Rebranding

On January 27, 2015, the Company unveiled its new corporate brand and logo, in addition to the launch of its new website (www.glglifetech.com). GLG’s rebranding emphasizes the Company’s Canadian heritage and reflects its new business strategy, which encompasses three complementary product lines. The new website presents a renewed focus on GLG’s closed loop system that includes superior agriculture programs, production excellence, and our focus on sustainability and corporate social responsibility throughout the supply chain

The vision for the new brand and logo came together in a symbolization of several essential aspects of our Company’s strategy. The maple leaf, a beloved Canadian symbol, forms the centerpiece of our new logo symbolizing our roots as a public company in Canada. 2015 marks GLG’s 10th anniversary as a publically traded company in Canada. The outer portion of the logo – a circular trio of crescents – symbolizes GLG’s three core product lines; stevia extracts, long our flagship product; monk fruit, with GLG entering the market as the highest-capacity producer of this highly desired sweetener; and our Naturals+ line of ingredients that offers both functional ingredients complementary to the sweetener space as well as products tailored to meet particular market needs. The brand and logo well captures the essence of GLG as a proudly-Canadian innovator and leader in the world of natural zero calorie sweeteners.

The launch of GLG’s new website elaborates on these themes, and more. Visitors will find even greater emphasis on our world-class agricultural programs, including the development of superior non-GMO varietals of stevia and,soon, monk fruit, our technological prowess in the production and innovation arena and our commitment to sustainability and corporate social responsibility. Through the vision of its leaders, the excellence of its team members and the holistic nature of and demanding standards manifest throughout its supply chain, GLG leverages these assets to provide leading natural sweeteners and ingredient solutions to businesses globally.

Non-GMO Project Verified

On September 23, 2015, GLG announced that it had received Non-GMO Project Verification across both its stevia and monk fruit natural zero-calorie sweetener product lines. For over a decade, GLG has offered food and beverage companies, and their customers, great tasting natural zero-calorie sweeteners with an emphasis on quality and sustainability. It has done so through full vertical integration, strong partnerships with farmers and a commitment to improving the communities in which GLG operates. In an effort to further GLG’s commitment to serving its customers’ evolving needs while also demonstrating its social responsibility, GLG made achieving Non-GMO Project Verification a focus for 2015. The Non-GMO Project provides North America’s only independent verification to ensure that non-GMO products are produced according to rigorous best practices for GMO avoidance.

Latest Product Accomplishments Under FDA’s GRAS Program

Consistent with its role as a leader in the sweetener industry, GLG places great importance on adherence to the Generally Recognized as Safe (“GRAS”) program administered by the United States Food and Drug Administration (“FDA”). Through this program, for each of its core sweetener products, GLG undertakes expert studies and in-depth consultation through GRAS Associates, LLC, which convenes independent panels of scientists to spearhead safety assessments for each product to determine that the product is GRAS. The output of each study is then submitted to the FDA GRAS program, whereupon the submission is reviewed by the FDA. If the FDA finds no issues with the submission, it issues a Letter of No Objection, reflecting the FDA’s view that it has no issue with the Company’s determination that its product is GRAS.

Last year was a productive one for GLG’s GRAS submissions, with four different products garnering Letters of No Objection from the FDA. GLG has continued this trend; since the beginning of 2015, we have received additional Letters of No Objection from the FDA:

- On February 17, 2015, the Company announced that it had received a Letter of No Objection regarding its high-purity Rebaudioside C extract products. GLG is the first company to have Rebaudioside C products deemed GRAS in compliance with the FDA’s GRAS program. Furthermore, in late 2014, GLG announced its development of its “Reb C Gold” seedling – containing levels of Reb C many times higher than that found in prior stevia seedling strains. It expects to offer Reb C extract products commercially in late 2016.

- On April 27, 2015, the Company announced that it had received a Letter of No Objection regarding its high-purity Rebaudioside D extract products. To date, the supply availability and high price of Rebaudioside D extracts have been limiting factors for their broader use in the natural sweetener market. However, GLG is working on an agriculture R&D program to address both of these factors

GLG has the largest number of stevia extract products certified under the GRAS process, as well as GRAS status for its Monk fruit extract products. Pursuing and obtaining GRAS designations furthers GLG’s commitment to maintaining the highest quality standards for its products, and to ensure that each of its naturally-sourced sweetener products conforms to the GRAS compliance standards.

Launch of BevSweet™ and BakeZeroCal™

In February 2015, the Company announced two new products specifically formulated for two industry applications. BakeZeroCal™, for the baking industry, provides significant calorie reduction while also providing the bulking and browning attributes commonly desired by bakers and consumers alike. BevSweet™, for the beverage industry, allows food and beverage companies to reduce calories and naturally sweeten their products with decreased formulation time and with no solubility issues. Each product is a special blend providing an improved taste profile, including a well-rounded sucrose-like sweetness, and ease of use. BakeZeroCal and BevSweet will enable companies to formulate new products and reformulate existing products with less complexity and lower cost.

Appointment of Paul Block to GLG’s Board of Directors

On March 3, 2015, the Company announced the appointment of Mr. Paul R. Block to its Board of Directors. Mr. Block brings a wealth of experience in sales, marketing, and business development as a senior executive in the global food and beverage and sweetener industries. Mr. Block most recently served as Chief Executive Officer of Merisant Worldwide Company, Inc. and the Whole Earth Sweetener Co., LLC. While at Merisant, Mr. Block oversaw the company’s well-recognized line of sweeteners, including the Equal® sweetener brand. Prior to joining Merisant, Mr. Block held C-level positions at Sara Lee Coffee and Tea Consumer Brands, Allied Domecq Spirits USA and Groupe Danone. Mr. Block has been a key figure in developing the global stevia tabletop market through his role as CEO at Merisant and the Whole Earth Sweetener Co., LLC., launching the successful Pure Via® line of tabletop zero calorie stevia sweeteners. Mr. Block is an excellent strategist who complements our current Board makeup and skill set. He has a proven track record of innovation and building shareholder value in the sweetener and food and beverage industries.

Annual General Meeting

The Company held its Annual General Meeting on June 26, 2015, in Vancouver, B.C. The shareholders voted in all nominated directors, with favorable votes for each exceeding 97%. Dr. Luke Zhang continues as Chairman of the Board and Chief Executive Officer and Brian Palmieri continues as Vice Chairman of the Board.

SELECTED FINANICALS

As noted above, the complete set of financial statements and management discussion and analysis for the nine months ended September 30, 2015, are available on SEDAR and on the Company’s website at www.glglifetech.com

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2014 and the condensed interim consolidated financial statements for the nine-month period ended September 30, 2015.

The Company has restated the comparative December 31, 2014 balances to correctly treat a settlement of convertible debentures that occurred in the fourth quarter of fiscal 2014. During fiscal 2014, the Company recorded a gain of $2,000,857 on the settlement of the debentures that should have been reflected in equity, not net loss. The Company has also now recorded $443,000 of a loss provision on the amendment of the notes. The effect on the ending balance sheet is a reclassification of $2,443,857 between deficit and share capital. For the year ended December 31, 2014, net loss increased by $2,443,857 from $32,566,755 to $35,010,612. Loss per share changed from $0.95 to $1.02 per share. There was no effect to cash flow from operations, investing or activities. There was also no impact on the current or comparative period for the three-month and nine-month periods ended September 30, 2015 and 2014.

Revenue

For the three months ended September 30, 2015, revenue was $8.8 million, an increase of 133% compared to $3.8 million in revenue for the same period last year. This 133% increase in revenue was attributable to a mix of stevia extracts, monk fruit extract and sales of other natural ingredient products. Stevia and monk fruit extracts accounted for 87% of quarterly revenue. International sales accounted for 94% of third quarter 2015 revenue, compared to only 54% for the comparable period in 2014. International sales increased by 309% while China revenue was down 69% in the third quarter 2015, relative to the comparable period in 2014, reflecting the Company’s strategy of focusing on international sales of its products rather than the sale of lower purity stevia extracts in China to other stevia providers. Sales for the GLG Naturals+ product line accounted for 13% of third quarter revenue compared to nil in the comparable period. The Company continues to make significant progress in developing its GLG Naturals+ in 2015 with three month revenue climbing to $1.1 million from nil in the comparable period.

Revenue for the nine months ended September 30, 2015, was $23.0 million, an increase of 85% compared to $12.4 million in revenue for the same period last year. This 85% increase in revenue was driven by higher volumes of products sold internationally relative to the prior year. The Company also generated significant sales from monk fruit extracts in 2015. The GLG Naturals+ product line was launched in 2014; however, its contribution to international sales increased significantly in 2015. The main revenue increase came from international sales, reflecting the Company’s continuing strategy of moving away from sales of lower-purity stevia extract sales to other China-based stevia providers, instead pursuing international customers that generate monthly recurring revenues from higher-purity stevia and monk fruit extracts. International sales contributed 88% of year-to-date 2015 revenues, compared to 51% for the comparable period in 2014. While China revenue decreased 56% year-over-year for the nine-month period, international sales more than compensated, increasing 218% relative to the comparable period last year. Sales for the GLG Naturals+ product line accounted for 14% of revenue for the nine-month period in 2015 compared to nil in the comparable 2014 period. The Company continues to make significant progress in developing its GLG Naturals+ in 2015 with nine-month revenue climbing to $3.1 million from nil in the comparable 2014 period.

Cost of Sales

For the three months ended September 30, 2015, the cost of sales was $8.7 million compared to $5.9 million in cost of sales for the same period last year (a $2.8 million or 49% increase). Cost of sales as a percentage of revenues was 99% compared to 155% in the prior comparable period, an improvement of 56 percentage points. The decrease in cost of sales as a percentage of revenue for the three months ended September 30, 2015, compared to the prior comparable period, was driven by higher margin on international sales of monk fruit and stevia extracts as well as higher sales of GLG’s Natural+ ingredients compared to the higher mix of low-purity lower margin stevia products sold in the comparable period.

Idle capacity charges also impacted the cost of sales over the three-month period. Capacity charges charged to the cost of goods sold ordinarily would flow to inventory and have a significant impact on gross margin. Only two of GLG’s manufacturing facilities were fully operating in 2014 and 2015. This resulted in capacity charges for the third quarter of $0.8 million charged to cost of sales (representing 9% of overall cost of sales), compared to $0.9 million charged to cost of sales for the same period in 2014 (representing 15% of cost of sales).

A 133% increase in revenues for the three-month period ending September 30, 2015, relative to the same period in 2014, served to lessen the impact (on a percentage basis) of these idle capacity charges. Two other factors in the third quarter of 2015 impacted cost of sales, increasing costs by approximately $0.8 million: 1) there were higher impurities in the stevia leaf purchased in late 2014 and processed during the third quarter of 2015, which negatively impacted the stevia leaf yield ($0.5 million higher cost of sales impact) and 2) lower mogroside content in the monk fruit processed and sold during the third quarter compared to the monk fruit processed and sold in the first six months of 2015 ($0.3 million higher cost of sales impact). The Company expects these negative gross margin impacts to impact the third quarter only, given the improved quality of monk fruit purchased in 2015 and the lower levels of impurities in stevia leaf purchased in 2015.

Cost of sales for the nine months ended September 30, 2015, was $21.7 million compared to $14.7 million for the same period last year or an increase of 47%. Cost of sales as a percentage of revenues was 94% compared to 118% in the prior period, an improvement of 24 percentage points. The cost of sales as a percentage of revenue was lower for the nine-month period ended September 30, 2015, compared to the prior year period, due to the impact of higher margin international sales compared to a higher mix of lower purity lower margin stevia product sales made in the comparable period in 2014. Idle capacity charges also impacted the cost of sales for the nine-month period ending September 30, 2015. For the nine months ended September 30, 2015, GLG recorded idle capacity charges of $2.3 million, which were charged to cost of sales (representing 10% of cost of sales), compared to $2.2 million charged to cost of sales for the comparable period in 2014 (representing 15% of cost of sales). Increased revenues of 85% for the nine-month period ending September 30, 2015, relative to the comparable period in 2014, served to lessen the impact (on a percentage basis) of these idle capacity charges. As previously stated in the third quarter analysis of cost of sales, there were two higher cost factors that impacted the nine-month period results by $0.8 million due to higher stevia leaf impurities and lower mogroside content in monk fruit processed and sold during the third quarter.

The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period include:

- Capacity utilization of stevia and monk fruit manufacturing plants.

- The price paid for stevia leaf and monk fruit and their respective quality, which are impacted by crop quality for a particular year/period and the price per kilogram for which the stevia and monk fruit extracts are sold. These are the most important factors impacting the gross profit of GLG’s stevia and monk fruit business.

- Other factors which also impact stevia and monk fruit cost of sales to a lesser degree include:

- water and power consumption;

- manufacturing overhead used in the production of stevia and monk fruit extract, including supplies, power and water;

- net VAT paid on export sales;

- exchange rate changes; and

- depreciation.

GLG’s stevia and monk fruit business is affected by seasonality. The harvest of the stevia leaves typically occurs starting at the end of July and continues through the fall of each year. The harvest of monk fruit typically occurs starting in October and continues through December of each year. GLG’s operations in China are also impacted by Chinese New Year celebrations, which occur approximately late-January to mid-February each year, and during which many businesses close down operations for approximately two weeks.

Gross Profit(Loss)

Gross profit for the three months ended September 30, 2015, was $0.1 million, an increase of $2.2 million over $2.1 million gross loss for the comparable period in 2014. The gross profit margin for the threemonth period ended September 30, 2015, was 1% compared to negative 55% for the three months ended September 30, 2014, or an increase of 56 percentage points over the same period of last year. The gross margin for the three-month period ended September 30, 2015, increased as a result of higher gross profits contributed from international sales of monk fruit and stevia extracts and other natural ingredients. International sales increased by 309% and China sales decreased by 69% for the three-month period ended September 30, 2015, compared to the same period prior year

There were two factors in the third quarter of 2015 that impacted gross profit margins by approximately $0.8 million: 1) there were higher impurities in the stevia leaf purchased in late 2014 and processed during the third quarter of 2015, which negatively impacted the stevia leaf yield ($0.5 million gross profit impact) and 2) lower mogroside content in the monk fruit processed and sold during the third quarter compared to the monk fruit processed and sold in the first six months of 2015 ($0.3 million negative gross profit impact). The Company expects these negative gross margin impacts to impact the third quarter only, given the improved quality of monk fruit purchased in 2015 and the lower levels of impurities in stevia leaf purchased in 2015

Gross profit for the nine months ended September 30, 2015, was $1.3 million, an improvement of $3.6 million over the comparable period in 2014 ($2.3 million loss). The gross profit margin for the nine-month period ended September 30, 2015, was 6% compared to negative 18% for the nine months ended September 30, 2014, or an improvement of 24 percentage points from the previous year. The gross margin for the nine-month period ended September 30, 2015, was impacted primarily by a higher percentage of international sales in the nine months ended September 30, 2015, carrying higher margins than lower purity stevia sales made primarily in China. International sales increased 218% and China sales decreased by 56% for the nine-month period in 2015 compared to the same period prior year. Gross profit was also impacted by a small increase in capacity and other fixed charges to the cost of goods sold. As noted above, these capacity charges ordinarily would flow to inventory, but instead, capacity charges of approximately $2.3 million were incurred (compared to $2.2 million in 2014). As previously stated in the third quarter analysis of gross profit, there were two factors that impacted September 30, 2015, ninemonth period gross profit results by $0.8 million due to higher stevia leaf impurities and lower mogroside content in monk fruit processed and sold during the third quarter

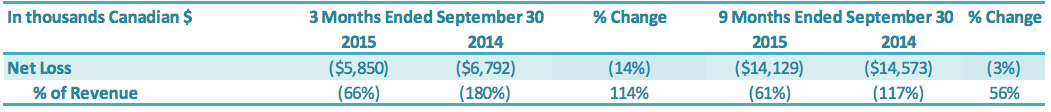

Net Loss Attributable to the Company

For the three months ended September 30, 2015, the Company had a net loss attributable to the Company of $5.9 million, a decrease of $0.9 million or a 14% improvement over the comparable period in 2014 ($6.8 million loss). The decrease in net loss was driven by (1) an increase in gross profit of $2.2 million which was offset by (2) increased G&A expenses of $0.3 million and (3) an increase in other expenses of $0.9 million.

For the nine months ended September 30, 2015, the Company had a net loss attributable to the Company of $14.1 million, a decrease of $0.5 million or a 3% improvement over the comparable period in 2014 ($14.5 million loss). The decrease in net loss was driven by (1) an increase in gross profit of $3.6 million which was offset by (2) increased G&A expenses of $1.2 million and (3) an increase in other expenses of $2.0 million.

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share was $0.15 for the third quarter of 2015 compared with a basic and diluted net loss of $0.20 for the comparable period in 2014. For the three months ended September 30, 2015, the Company had a net loss attributable to the Company of $5.9 million, a decrease of $0.9 million or a 14% improvement over the comparable period in 2014 ($6.8 million loss). The decrease in net loss was driven by (1) an increase in gross profit of $2.2 million which was offset by (2) increased G&A expenses of $0.3 million and (3) an increase in other expenses of $0.9 million.

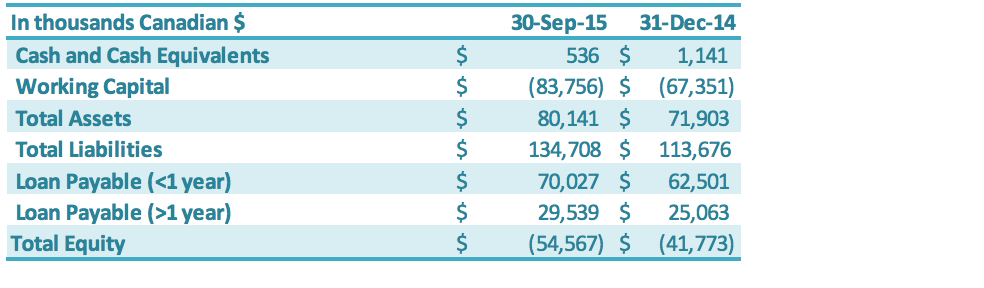

Liquidity and Capital Resources

The Company’s main initiative to improve its negative working capital position is a potential debt restructuring involving the State Owned Capital Management Companies and China Banks where the Company’s operating subsidiaries owe approximately $69,220,197 in short-term debt. The Company is developing a plan to either restructure this short-term debt to longer term debt, or potentially convert all or a portion of this short-term debt into equity of the Company’s Chinese operating subsidiaries (see also section on Short term and Long Term Loans).

The Company continues to be able to negotiate loans with its Directors and related family members to assist with short-term working capital requirements. The Company’s increase in sales in 2015 has significantly improved the cash from sales while simultaneously working to hold down sales, general and administration costs. For example, for the nine-month period ending September 30, 2015, relative to the comparable 2014 period, the gross profits improved by $3.6 million whereas SG&A expenses increased by $1.2 million. After factoring in the incremental improvement of $0.5 million in non-cash items such as depreciation and stock-based compensation for the nine-months ended September 30, 2015, the net cash improvement year over year is a $2.9 million higher cash contribution from nine-month results in 2015 compared to the prior period.

The $16.4 million increase in negative working capital for the nine months ended September 30, 2015, is primarily due to appreciation of both the Renminbi against the Canadian dollar (11.3% appreciation) and the USD against the Canadian dollar (13.4% appreciation). Appreciation alone resulted in an increase in current assets of $2.2 million and current liabilities of $10.7 million, netting to an $8.5 million appreciation-related increase in negative working capital. The $2.2 million appreciation-related increase in current assets includes a $1.8 million appreciation-related increase in the inventory and increases of $0.2 million in prepaid expenses and $0.1 million in accounts receivables. The $10.7 million appreciationrelated increase in current liabilities includes a $7.8 million appreciation-related increase in the shortterm loan balance and increases of $1.6 million in accounts payable and $1.3 million in interest payable. The remaining $7.9 million of non-appreciation-related increases in negative working capital results from increases in current assets of $2.1 million and increases in current liabilities of $5.8 million (mainly due to an increase in interest payable).

NON-GAAP Financial Measures

Gross Profit (Loss) before capacity charges

This non-GAAP financial measure shows the gross profit (loss) before the impact of idle capacity charges are reflected on the gross profit margin. GLG had only 50% of its production facilities in full operation in the first nine months of 2015 and idle capacity charges have a material impact on the gross profit (loss) line in the financial statements.

Gross Profit before capacity charges for the three months ended September 30, 2015, was $0.9 million or 10% of third quarter revenues, compared to negative $1.2 million or negative 32% of third quarter revenues for the same period in 2014.

Gross Profit before capacity charges for the nine months ended September 30, 2015, was $3.6 million or 16% of nine-month revenues, compared to a negative $0.1 million or 0% of nine-month revenues for the same period in 2014.

Gross Profit margin before capacity charges increased from the comparable periods due to the increase in international sales.

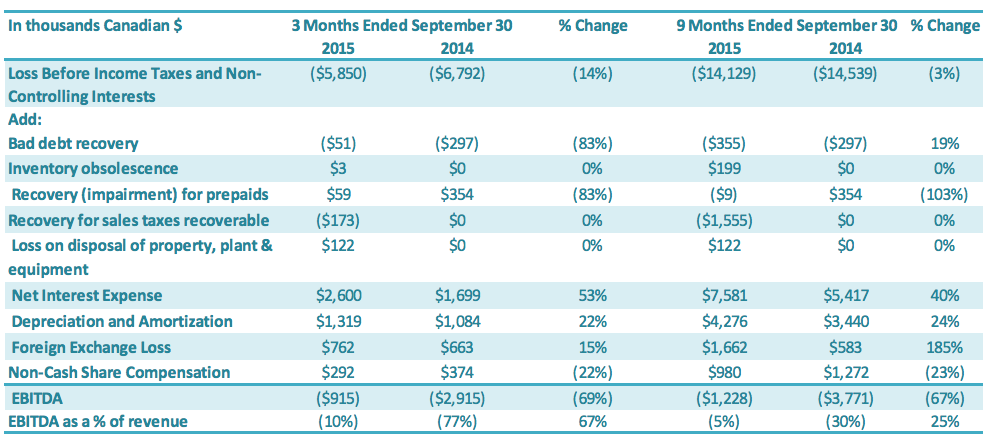

Earnings before Interest Taxes and Depreciation (“EBITDA”) and EBITDA Margin

Consolidated EBITDA

EBITDA for the quarter ended September 30, 2015, was negative $0.9 million, or negative 10% of revenues, compared to negative $3.0 million, or negative 77% of revenues, for the same period in 2014. EBITDA improved by 67 percentage points for the three-month period ended September 30, 2015, driven by significantly higher sales of international products in the third quarter of 2015 compared to the prior period and higher gross margins realized on stevia, monk fruit and GLG naturals+ product sales compared to the prior comparable 2014 period, which was dominated by lower purity stevia sales. EBITDA for the nine months ended September 30, 2015, was negative $1.2 million or negative 5% of revenues compared to negative $3.8 million or negative 30% of revenues for the nine months ended September 30, 2014. EBITDA improved by 25 percentage points for the nine-month period ended September 30, 2015, driven by significantly higher sales of international products and higher gross margins realized on stevia, monk fruit and GLG naturals+ product sales compared to the prior comparable 2014 period, which was dominated by lower purity stevia salesAbout GLG Life Tech Corporation

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on SEDAR (www.sedar.com). Additional information relating to the Company is also available on our website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 669-2602 ext. 101

Fax: +1 (604) 662-8858

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food and beverages. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest,

Forward-looking statements: This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2015. In light of these factors, the forwardlooking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Leave a Reply