Vancouver, B.C. March 31, 2017 – GLG Life Tech Corporation (TSX: GLG) (“GLG” or the “Company”), a global leader in the agricultural and commercial development of high-quality zero-calorie natural sweeteners, announces financial results for the three and twelve months ended December 31, 2016. The complete set of financial statements and management discussion and analysis are available on SEDAR and on the Company’s website at www.glglifetech.com. .

FINANCIAL HIGHLIGHTS

This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form for the financial year ended December 31, 2016. In light of these factors, the forwardlooking events discussed in this press release might not occur. Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

OUTLOOK

We expect to see significant growth in our international stevia and monk fruit sales in 2017, driven by our global partnership with ADM. 2016 has proven to be a year of transition for GLG’s sales. International sales were down 32%, driven by lower monk fruit and lower other natural ingredient sales. Although we saw large reductions in monk fruit sales in 2016, through our distribution partnership with ADM we expect to make solid progress on monk fruit sales in 2017. Our experience with the distribution agreement to date is very positive and is tracking our earlier disclosure that GLG sales are expected to increase in 2017 from their 2016 levels. Considering ADM’s size and distribution reach, we expect that the ADM partnership will help deliver significantly higher sales than GLG could have achieved working on its own. In addition to greater customer reach through ADM, we are also seeing significant new stevia product sale opportunities in areas where GLG has not traditionally supplied product; for example, enzymatically modified stevia. As ADM leverages its existing customer relationships, distribution channels, and ingredient expertise in the food and beverage space, we expect international stevia revenues to continue to grow. We see significant sales opportunities arising from our partnership with ADM. Moreover, the partnership presents opportunities to develop and deliver new stevia products that have not historically been part of our portfolio. Between new products, immediate product demand from ADM, and, with ADM’s global presence, the great sales potential to supply many more customers worldwide, we expect to see continued growth in the next twelve months. For example, as of March 31, 2017, we expect our Q1 2017 international stevia sales – in terms of both dollar value and quantity delivered – to be double that of Q1 2016. ADM’s decision to partner with GLG validates our long-held position that GLG is the agricultural leader in the stevia space and a leading product innovator. ADM cited our “demonstrated advantage in developing non-GMO stevia varietals” and our “pipeline of future innovative products” as two reasons for its decision to partner with GLG. We similarly expect that the ADM relationship will benefit our monk fruit product line. Over the past several months, we have transitioned from our prior monk fruit distribution partner to ADM as our distribution partner, in addition to direct sales in the dietary supplement sector. While the transition resulted in a decline in monk fruit sales in 2016, we expect monk fruit volumes and sales levels will show strong growth in 2017. We saw a rebound in monk fruit volumes in the fourth quarter of 2016 from a variety of new customers, including ADM. Further, with ADM now selling our monk fruit products, we already see good growth opportunities ahead for our monk fruit product line over the next twelve months. We also believe that we now offer the best tasting monk fruit extract in the market with the recent launch of our Cleartaste Monk Fruit product-line. This unique product removes citrus and astringent notes that otherwise complicate product formulators’ efforts to use monk fruit as a prime sweetener. We have received a lot of positive feedback from a variety of customers who prefer Cleartaste Monk Fruit over regular monk fruit extracts. We now have a pipeline of customers who are actively trialing this product, including some who have begun ordering our Cleartaste Monk fruit products. In addition, GLG is succeeding with its own direct sales efforts in the dietary supplement market, distinct from the food and beverage space covered by the ADM partnership. We had a very successful fourth quarter in landing new accounts in this market for both stevia and monk fruit products. This new business stream began placing PO’s starting in the fourth quarter of 2016, and we continue to expect significant growth in the dietary supplement sector. We are also now adding customers who are purchasing Cleartaste stevia products. These products provide better tasting stevia extracts that remove a number of the taste issues typically associated with stevia extracts, including bitter and astringent notes. We have developed a large pipeline of prospective customers in the fall of 2016 and are now seeing customers placing orders in the first quarter of 2017. With respect to our Naturals+ product line, we expect to develop sales with new/differentiated products such as our P-Pro Plus product as well as select natural ingredients that our customer base is currently sourcing. Another important event the Company expects to complete in 2017 is the restructuring of our China bank debt. In July 2016, we disclosed an important milestone for the path to a debt restructure with the consolidation of four of five Chinese subsidiaries into a single entity (Chuzhou Runhai Stevia High Tech Company Limited or “Runhai”). Significantly, Runhai was approved to become a Joint Stock Company (“JSC”). This form of corporation, under Chinese law, provides the JSC considerable opportunities to raise capital. For example, Runhai will now be able to add Chinese investors, raise equity capital in China, and convert China-based debt into equity in the JSC. With this foundational milestone completed, GLG’s plan is to restructure its China debt in 2017 by converting bank debt into equity in Runhai. More information will be provided to Shareholders in the next few months on this plan.

CORPORATE / SALES DEVELOPMENTS

ADM, GLG Partner to Bring Low-Calorie Stevia, Monk Fruit Sweeteners to Customers Worldwide

On June 6, 2016, Archer Daniels Midland Company (NYSE: ADM) and GLG Life Tech Corporation announced a new partnership to manufacture, market, sell and distribute low-calorie stevia and monk fruit sweeteners to customers around the globe. Under the terms of the agreement, GLG will produce an extensive array of low-calorie sweeteners made from stevia and monk fruit, while ADM will be the exclusive global marketer and distributor of those ingredients to food and beverage companies worldwide. Representatives of the companies had the following to say: “More and more consumers are looking for healthier foods that are made with natural ingredients and taste great,” said Rodney Schanefelt, Director, sugar and high intensity sweeteners, for ADM. “ADM is already helping customers meet that growing demand with our comprehensive portfolio of ingredients and flavors. Now, we’re expanding that portfolio even further by offering customers around the world a wide array of great stevia and monk fruit sweeteners. We are pleased to partner with GLG, which has a demonstrated advantage in developing non-GMO stevia varietals and a pipeline of future innovative products.” “This partnership—combining GLG’s capabilities and reputation as one of the largest, most trusted manufacturers of low-calorie sweeteners with ADM’s global distribution capabilities and existing ingredient portfolio—offers tremendous opportunities for both companies and their customers,” said Brian Meadows, GLG President and CFO. “Consumers are demanding healthy, delicious foods and drinks with clean labels, natural ingredients, and reduced added sugar—together, ADM and GLG will be the goto source for food and beverage companies looking to meet that demand.” On March 15, 2017, ADM announced that they are bringing two new sweetener brands, SweetRight stevia and VerySweet monk fruit, to market. These two new additions to the ADM portfolio, sourced through ADM’s partnership with GLG, offer food and beverage product developers all the benefits of stevia and monk fruit, as well as access to ADM’s extensive ingredient portfolio, formulation expertise and blending capabilities. ADM’s global distribution network provides the added assurance that these ingredients are readily available. “As consumers continue to look for great-tasting, healthier, lower-calorie products, we are pleased to meet formulator’s needs by offering a range of sweetener solutions that help them meet consumer demand,” said Rodney Schanefelt, director, Sugar and High Potency Sweeteners, ADM. “This expansion of our high-potency sweetener portfolio will help meet the ever-growing demand for natural, lower calorie, ‘no added sugars’ foods and beverages. We are committed to providing food and beverage formulators with ideas and solutions to address the taste, cost, calories and labeling preferences of today’s consumers.” “Now, with SweetRight stevia, VerySweet monk fruit and VivaSweet sucralose available from one global source, formulators have access to even more sweetener options from ADM as they create products to meet the ever-evolving tastes and preferences of today’s consumers,” Schanefelt added. SweetRight stevia, sourced from the stevia leaf, is clean-label friendly and provides a high quality of sweetness, making it ideal to help reduce sugar while still maintaining desirable taste and sweetness. SweetRight offers a range of stevia ingredients extracted from the stevia leaf using a proprietary process. SweetRight stevia is up to 250 times as sweet as sugar and offers a clean-label, GRAS (Generally Recognized as Safe), non-GMO, and plant-based sweetener solution. It blends well with other sweeteners, is process and shelf-stable, and is available in three forms—RA, RA granular, and EMS Enzymatically Modified Stevia—to meet a variety of needs. VerySweet monk fruit has a delicious sweet taste without bitterness, making it an ideal choice for reducing sugar in a wide range of food and beverage products. VerySweet is sourced from the luo han fruit and is up to 200 times as sweet as sugar. This low calorie, GRAS sweetener solution may be used alone, blended or as part of a complete sweetening system.

Major Advances in High-Purity Leaf for Reb M

On February 29, 2016, GLG announced a major agricultural breakthrough in its agricultural R&D program. Through this program, GLG aims to revolutionize the global food and beverage industry by providing companies with the ability to replace sugars and artificial sweeteners with naturally-sourced Rebaudioside M (“Reb M”). The program’s latest accomplishment is a stevia leaf strain with Reb M levels more than ten times higher than conventional stevia leaf. Reb M, one of several steviol glycosides found in the stevia plant, is highly desired in the industry as a natural, zero-calorie sugar and sweetener replacement, one that very closely resembles sugar. To date, the impediment to utilizing Reb M has been its scarce presence in the stevia leaf, making commercial use cost-prohibitive. Bringing a naturally-sourced Reb M extract to the market on a commercial scale requires a dramatic increase in the presence of Reb M glycosides in the leaf. A dramatic increase in Reb M is just what GLG achieved. Through development of its Reb M seedling using its non-GMO patented breeding methodology, GLG has now produced more than a 1000% increase in Reb M levels in stevia leaf. Conventional stevia leaf has Reb M concentrations at less than 0.1% of dry leaf weight, and less than 1% of total steviol glycosides (“TSG”). In GLG’s seedling, Reb M constitutes over 1% of dry leaf weight, and over 8% of the TSG’s. Further, TSGs constitute about 13% of dry leaf weight in GLG’s new seedling, which is above the industry average of 10-12% of dry leaf weight. The 1000% increase in Reb M glycosides in its new variety is the result of two key factors: (1) an expanded Reb M seedling development program that GLG undertook in 2015 and (2) the 25 years’ experience of its chief agronomist. The 2015 program involved evaluating thousands of different stevia strains, requiring an extensive program to identify and promote the most promising strains. GLG’s 2014 breakthrough with its high Rebaudioside C (“Reb C”) seedlings clearly demonstrated the promise of its patented Non-GMO seedling hybridization technology to significantly increase scarce glycosides. And in 2015, GLG announced a stevia leaf strain with significantly enhanced levels of both Rebaudioside D (“Reb D”) and Reb M. This latest achievement, focused specifically on Reb M, further demonstrates GLG’s agricultural prowess. GLG is in the process of filing for patent protection for its Reb D and Reb M seedlings. And GLG has filed two GRAS applications with the FDA for high-purity Reb D (GRN 548) and Reb M (GRN 512), with purity levels ranging from 80% to 95% to be used as a sweetener. On October 5, 2016, GLG announced another significant update from its agricultural breeding program. Through its continued development of its Reb C Gold varietal, GLG has produced a Reb C varietal with unprecedented levels of Reb C – over 79% – relative to total steviol glycosides. The TSG content on a dry weight basis is an impressive 13% of leaf weight. This success builds on GLG’s prior achievement, announced in late 2014, of the first strain of Reb C Gold with Reb C levels at 53%. Reb C (short for Rebaudioside C) has historically been a scarce glycoside, typically found in leaf at levels of only 5 to 10%. GLG’s 2014 announcement demonstrated its ability to achieve multiple factor increases in the levels of relatively scarce glycosides. That GLG has been able to up the levels by another 50% reflects well on GLG’s agricultural prowess. It also bolsters GLG’s ability to efficiently produce commercial quantities of high-purity Reb C extracts. GLG’s agricultural program is an ambitious endeavor to produce – all through non-GMO breeding – a number of specialized stevia varietals especially rich in one or more of Reb A, Reb C, Reb D, or Reb M. Last year, this program worked with over 5,000 samples and varieties of leaf. In the 2016 program, the GLG agriculture R&D team is expecting to have over 10,000 samples and varieties to analyze for plants with high amounts of Reb A, C, D, or M. Given the size and scope of GLG’s program, its many years of specialized experience in breeding stevia, and its past successes, GLG expects to announce further achievements from this program later this year. Whether Reb A, Reb C, Reb D, or Reb M – or all of the above – the development of GLG’s specialized varietals could be transformative for the stevia industry. The Reb C Gold varietal has proven a great success. GLG has demonstrated its ability to go from discovery to initial planting in approximately two years. GLG has also confirmed its ability through lab trials with recently harvested Reb C Gold leaf to use simplified production processes that produce high-purity Reb C extracts at greatly reduced costs. These results underscore the promise made by GLG in 2014 – that Reb C Gold would enable it to achieve economically viable commercial production of high-purity Reb C extracts. In 2017, GLG expects to plant commercial scale quantities of the Reb C Gold seedling. Dr. Luke Zhang, CEO and Chairman of GLG, commented: “We are excited to begin producing high-purity Reb C in commercial quantities this coming year. Today’s announcement of even greater Reb C levels highlights GLG’s unique strengths in stevia agronomics. Given the increasing pace in the development of specialized varieties, I expect that we will continue to see a number of exciting new varieties coming from GLG’s research team. These future varieties, with particular focus on Reb D and Reb M, are expected to make a big splash in the stevia industry.” In February 2015, GLG received its FDA Letter of No Objection regarding its high-purity Reb C extracts as GRAS (Generally Recognized as Safe) for use as a sweetener. (GRN 536.)

GLG Achieves Major Milestone in Debt Restructuring Plan

On July 26, 2016, GLG announced an important milestone in the Company’s plan to restructure its Chinabased bank loans. Additionally, the Company successfully renewed a RMB 7 million bank loan with the Huishang Bank on July 1, 2016. As of July 20th, 2016, four of five of the Company’s 100% owned Chinese Wholly-Owned Foreign Enterprises (“WOFEs”) were consolidated into a single entity (Chuzhou Runhai Stevia High Tech Company Limited or “Runhai”) under Chinese law – and, significantly, Runhai is approved to become a Joint Stock Company (“JSC”). This form of corporation, under Chinese law, provides it considerable opportunities to raise capital. For example, Runhai will now be able to add Chinese investors, raise equity capital in China, and convert China-based debt into equity in the JSC. Post consolidation of the four China subsidiaries, the Company retains its 100% ownership of Runhai and all of the consolidated assets of the previous four China subsidiaries. The three subsidiaries consolidated into Runhai are: Anhui Bengbu HN Stevia High Tech Development Company Limited Qingdao Runhao Stevia High Tech Company Limited Dongtai Runyang Stevia High Tech Company Limited One of the key outcomes of the conversion of Runhai into a JSC was the underlying agreed valuation of the consolidated Runhai entity. Runhai’s total investment approval by the China Government is USD 120 million and its net assets are valued at USD 42 million. The difference between the asset valuation and net assets value provides Runhai USD 78 million available for debt conversion, additional working capital or equity raises. GLG’s subsidiary Qingdao Runde Biotechnology Co., Ltd. remains a 100% owned WOFE of GLG. One particular benefit of reforming the Company’s Chinese holdings into a JSC is that the limitations previously foreclosing the Company from access to Chinese debt and capital markets are gone. As a JSC, Runhai will be eligible to have its Chinese-held debt converted into equity shares at the subsidiary level, such that a major portion of that debt could be removed from the Company’s balance sheet. GLG, with the PRC government’s support, is in active discussions with Runhai’s Chinese debt-holders to negotiate terms for a debt-equity swap, and is exploring multiple options for access to valuable working capital. The Company expects to retain a majority controlling interest in Runhai after any expected debt conversion into equity in Runhai. Further, Runhai will have the ability to solicit Chinese capital markets and investors for working and other capital, bolstered by a more attractive balance sheet and a strong appetite in China for growth opportunities. The process to convert the four WOFEs into a single consolidated Joint Stock Company was unusually complex. To give perspective on this major accomplishment, GLG management had to work through ten different government agencies across three provinces and four cities in order to obtain the relevant approvals necessary to accomplish this important milestone. With this foundational milestone completed, GLG’s plan is to restructure its China debt by availing itself of one or more options now open to the Company. The Company also expects to gain access to new sources of working capital to facilitate its plans for substantial growth in its stevia, monk fruit, and GLG Naturals+ businesses.

Partnership with MycoTechnology Corporation for Improved Taste of Stevia

On January 7, 2016, GLG, in conjunction with MycoTechnology Corporation (“MycoTech”), together announced a commercial partnership agreement to incorporate MycoTech’s ClearTaste™ product to improve the taste of stevia and monk fruit. The partnership combines GLG’s strengths in the natural sweetener space with the benefits of MycoTech’s innovative ClearTaste product, a certified USDA organic bitter blocking technology, in order to improve the taste of stevia and monk fruit. There is a major trend underway in which mass produced, low nutritional quality foods, loaded with added sugar, salt and fat are being replaced with healthy, natural, low and zero-calorie alternatives. The changing consumer landscape has food manufacturers looking for natural high-intensity sweetener alternatives such as stevia and monk fruit. However, food manufacturers have also struggled with stevia’s aftertaste and astringent flavor profile. MycoTech developed ClearTaste, derived from mushrooms, which as to stevia has the effect of removing its less desirable aftertaste. ClearTaste is a natural, GMO-free and chemical-free ingredient solution that works by harnessing the natural extracts found in gourmet mushrooms. The compounds are unique to fungi and are highly effective at improving the flavor profiles of stevia and monk fruit. The initial term of the agreement is five years during which GLG will be MycoTech’s preferred vendor of stevia and monk fruit products. GLG further enjoys certain exclusivities in the commercial agreement with MycoTech products and the agreement also allows GLG to work directly with MycoTech to produce new products using both companies’ technology in return for purchase commitments with MycoTech.

GRAS Status for GLG’s Enzymatically Modified Stevia

On October 6, 2016, GLG announced that the United States Food and Drug Administration (“FDA”) had issued a Letter of No Objection for GLG’s enzymatically modified stevia (“EMS”) product – specifically “EMS95”. (Filing No. GRN 656). The FDA’s Letter of No Objection provides that the FDA has no questions regarding GLG’s conclusion – supported by extensive studies, research, and in-depth consultation with GRAS Associates, LLC – that its EMS95 product is Generally Recognized As Safe (“GRAS”) as a general purpose sweetener. EMS95 is part of GLG’s TasteBoostTM product line, which consists of a series of enzymatically modified stevia products. GLG’s EMS – a natural low-calorie sweetener – is produced through the enzymatic addition of glucose moieties to the original steviol glycoside structure, resulting in a mix of glucosylated steviol glycosides and steviol glycosides. The presence of glucoyslated steviol glycosides benefits products using EMS by providing enhanced taste quality and sweetness. This enhancement in taste and flavor provides a well-rounded, sugar-like low-calorie solution appropriate for a wide variety of food applications, such as dairy, snacks, baked goods, cereals, sports nutrition products, and many more. Furthermore, GLG’s EMS products can be used synergistically with other caloric and non-caloric sweeteners for enhanced sweetness and taste. GLG’s EMS products provide an array of choices for food manufacturers targeting consumers of all ages who are looking for healthier, tastier options. To date, GLG has received ten GRAS Letters of No Objection covering its broad array of high-purity stevia products. No other stevia company can claim such a mark.

Launch of P-Pro Plus

On October 6, 2016, GLG announced that the United States Food and Drug Administration (“FDA”) had issued a Letter of No Objection for GLG’s enzymatically modified stevia (“EMS”) product – specifically “EMS95”. (Filing No. GRN 656). The FDA’s Letter of No Objection provides that the FDA has no questions regarding GLG’s conclusion – supported by extensive studies, research, and in-depth consultation with GRAS Associates, LLC – that its EMS95 product is Generally Recognized As Safe (“GRAS”) as a general purpose sweetener. EMS95 is part of GLG’s TasteBoostTM product line, which consists of a series of enzymatically modified stevia products. GLG’s EMS – a natural low-calorie sweetener – is produced through the enzymatic addition of glucose moieties to the original steviol glycoside structure, resulting in a mix of glucosylated steviol glycosides and steviol glycosides. The presence of glucoyslated steviol glycosides benefits products using EMS by providing enhanced taste quality and sweetness. This enhancement in taste and flavor provides a well-rounded, sugar-like low-calorie solution appropriate for a wide variety of food applications, such as dairy, snacks, baked goods, cereals, sports nutrition products, and many more. Furthermore, GLG’s EMS products can be used synergistically with other caloric and non-caloric sweeteners for enhanced sweetness and taste. GLG’s EMS products provide an array of choices for food manufacturers targeting consumers of all ages who are looking for healthier, tastier options. To date, GLG has received ten GRAS Letters of No Objection covering its broad array of high-purity stevia products. No other stevia company can claim such a mark.

Launch of GoZero™ Solutions

On February 1, 2016, GLG announced the launch of GoZero™ Solutions. This innovative portfolio provides GLG’s customers with unparalleled natural and Non-GMO zero-calorie sweetener options and proprietary formulations tailored to our customers’ specific calorie reduction needs. The challenges to global food and beverage companies are well documented with respect to the need for reduced amounts of sugar in formulations. The global per capita sugar consumption peaked in the late 1990’s; however, it has been declining ever since due to an increase in health awareness and prevalence of diet-related health conditions, such as diabetes. Moreover, government regulations and guidelines, such as sugar taxes in the US and Mexico, and new dietary guidelines limiting the amount of added sugar in foods have made it challenging for food and beverage manufacturers to continue to use the same amounts of sugar in their formulations as they have used in the past. Added to this challenge, consumers’ willingness to consume artificial sweeteners has been declining due to a general mistrust in synthetic chemical compounds. In fact, consumers are increasingly looking to incorporate natural, plant-based ingredients in their diets. The movement of the market toward zero-calorie, natural sweeteners has placed immense pressure on marketing, R&D and procurement teams to reformulate to reduce sugar and artificial sweeteners in their products.

However, the transition to stevia as a natural zero calorie sweetener has proved challenging due to its

known aftertaste issues such as astringency and bitterness. But things are changing for the better, as GLG

introduced its newest product line to global food and beverage companies – GoZero™ Solutions – to

address all these challenges with going zero.

GLG’s GoZero™ Solutions offer:

1. Largest portfolio containing the most complete set of zero-calorie, natural sweeteners including

stevia, enzymatically modified stevia, monk fruit and bitter blockers

2. Better tasting stevia and monk fruit with ClearTaste™ natural bitter blocker

3. Custom formulations for customers

4. Fast prototyping of reduced or zero calorie formulations for R&D groups

5. Superior taste and flavor profile tailored to specific food matrices

6. Fast response and support from our experienced support team

7. Cost effective solutions

8. Clean labels

9. Reduction in use of sugar while maintaining taste

10. Removal of artificial sweeteners from the formulation

11. Halal, Kosher, Non-GMO, and natural solutions

12. Organic and conventional format

GoZero™ Solutions is the result of over 15 years’ hard work of more than 60 agricultural scientists, product innovation and food application specialists, and food engineers. This concerted effort enabled GLG to formulate a diverse product portfolio applicable to a wide range of food, beverage, and dietary supplement products that are cost-effective and superior in taste, flavor, and quality. Annual General Meeting The Company held its Annual General Meeting on June 28, 2016, in Vancouver, B.C. The shareholders voted in all nominated directors, with favorable votes for each exceeding 99%. Dr. Luke Zhang continues as Chairman of the Board and Chief Executive Officer and Brian Palmieri continues as Vice Chairman of the Board.

SELECTED FINANCIALS

As noted above, the complete set of financial statements and management discussion and analysis for the year ended December 31, 2016, are available on SEDAR and on the Company’s website at www.glglifetech.com.

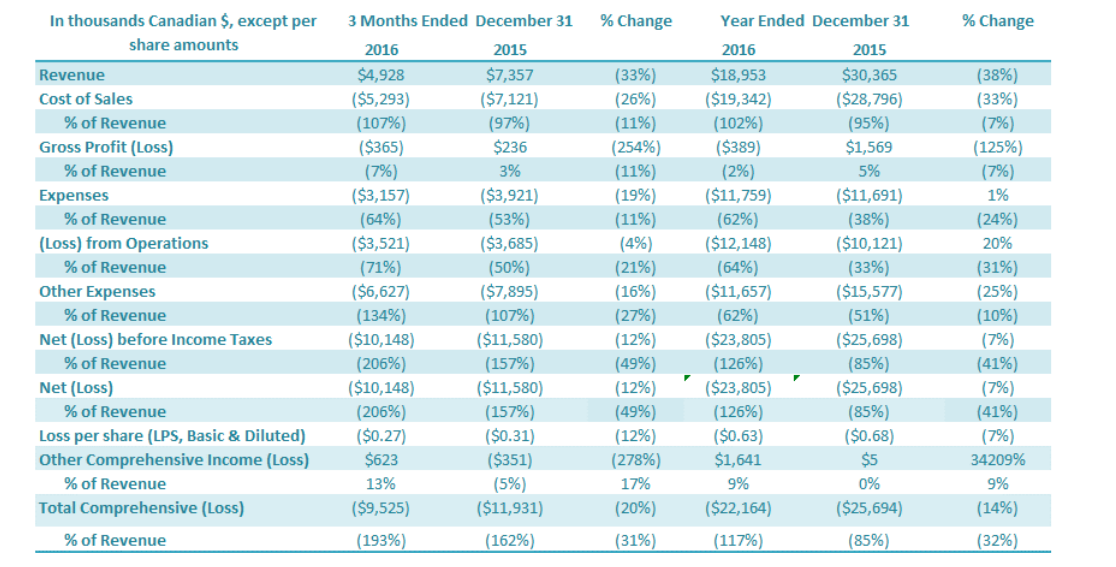

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company’s annual consolidated financial statements for 2016 and 2015.

Revenue

Revenue for the three months ended December 31, 2016, was $4.9 million, a decrease of 33% compared to $7.4 million in revenue for the same period last year. International sales contributed 96% of fourth quarter 2016 revenues, which is up 29 percentage points compared to the same period in 2015 (67%). The 33% decrease in sales, comparing the fourth quarter of 2016 to the same period in 2015, was driven by a number of factors including significant increases in monk fruit sales (increase of $2.3 million over previous year monk fruit sales) to international customers offset by declines in stevia sales (78% of sales decrease) and sales of other natural ingredients (22% of sales decrease). International sales contributed 96% of fourth quarter 2016 revenues, which is up 8 percentage points from the amount for the same period in 2015 (83%) reflecting the Company’s continuing strategy of moving away from sales of lowerpurity stevia extract sales to other China-based stevia providers, instead pursuing international customers that generate monthly recurring revenues from higher-purity stevia and monk fruit extracts. Revenue for the year 2016 was $18.9 million, a decrease of 38% compared to $30.0 million in revenue for the prior year. This 38% decrease in sales, comparing 2016 to 2015, was driven by a number of factors including increases in stevia sales to international customers, offset by cumulative declines in monk fruit sales (37% of decline), sales of other natural ingredients (35% of decline), and China low purity stevia extract sales (28% of decline). International sales contributed 91% of full year 2016 revenues, which is up 8 percentage points from the amount for the same period in 2015 (83%). The increase in the percentage of sales coming from international sales reflects the Company’s continuing strategy of focusing on increasing its sales of high purity stevia extracts to international customers.

Cost of Sales

For the quarter ended December 31, 2016, the cost of sales was $5.3 million compared to $7.1 million in cost of sales for the same period last year ($1.8 million or 26% decrease). Cost of sales as a percentage of revenues was 107% for the fourth quarter 2016, compared to 97% for the comparable period. Cost of sales as a percentage of revenues was 10 percentage points higher in the fourth quarter compared to the previous year. The main factor contributing to the increase in cost of sales as a percentage of revenues was the increase of monk fruit cost of sales as a percentage of revenues in the fourth quarter of 2016 driven by lower monk fruit pricing in the market in late 2016 compared to earlier in the year. Cost of sales for the twelve months ended 2016 was $19.3 million compared to $28.8 million for 2015 or a decrease of $9.5 million or 33%. Cost of sales as a percentage of revenues was 102% in 2016 compared to 95% in 2015, an increase of 7 percentage points. Idle capacity charges ($2.5 million) contributed to 13% of cost of sales for the full year 2016 compared to 8% of prior year cost of sales, accounting for the majority of the increase in cost of sales as a percentage of sales. Capacity charges charged to the cost of goods sold ordinarily would flow to inventory and is the largest factor on reported gross margin. Only two of GLG’s manufacturing facilities were operating during 2016. The key factors that impact stevia and monk fruit cost of sales and gross profit percentages in each period include:

- Capacity utilization of stevia and monk fruit manufacturing plants.

- The price paid for stevia leaf and monk fruit and their respective quality, which are impacted by crop quality for a particular year/period and the price per kilogram for which the stevia and monk fruit extracts are sold. These are the most important factors impacting the gross profit of GLG’s stevia and monk fruit business.

- Other factors which also impact stevia and monk fruit cost of sales to a lesser degree include:

- water and power consumption;

- manufacturing overhead used in the production of stevia and monk fruit extract, including supplies, power and water;

- net VAT paid on export sales;

- exchange rate changes; and

- depreciation.

GLG’s stevia and monk fruit businesses are affected by seasonality. The harvest of the stevia leaves

typically occurs starting at the end of July and continues through the fall of each year. The monk fruit

harvest takes place typically from October to December each year. GLG’s operations in China are also

impacted by Chinese New Year celebrations, which occur approximately late-January to mid-February

each year, and during which many businesses close down operations for approximately two weeks. GLG’s

production year runs October 1 through September 30 each year.

Gross Profit (Loss)

Gross loss for the three months ended December 31, 2016, was $0.4 million, compared to a $0.2 million gross profit for the comparable period in 2015 or a decrease of $0.6 million. The gross profit margin for the three month period ended December 31, 2016, was negative 7% compared to positive 3% for the prior period, or a decrease of 10 percentage points from the previous year. The major contributors to the fourth quarter gross profit decrease were the lower monk fruit pricing reflected in the fourth quarter and a reduction in gross margin from other natural ingredients, which was partly offset by an increase in margin from international stevia sales. Gross loss for 2016 was $0.4 million, a decrease of $2.0 million from a $1.6 million gross profit for the comparable period in 2015. The gross profit margin for the year ended December 31, 2016, was negative 2% compared to positive 5% for the year ended December 31, 2015, or a decrease of 7 percentage points from the previous year. Gross margin was reduced due to lower margin from monk fruit and lower gross margin from other natural ingredient sales, which was partly offset by an increase in margin from international stevia sales.

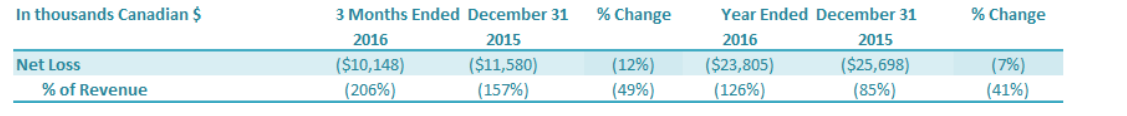

Net Loss Attributable to the Company

For the three months ended December 31, 2016, the Company had a net loss attributable to the Company of $10.1 million, a decrease of $1.4 million or a 12% improvement over the comparable period in 2015 ($11.6 million loss). The decrease in net loss was driven by (1) a decrease in other expenses of $1.3 million and (2) a decrease in SG&A expenses of $0.7 million, which were offset by (3) a decrease in gross profit of $0.6 million. For the year ended December 31, 2016, the Company had a net loss attributable to the Company of $23.8 million, a decrease of $1.9 million or an improvement of 7% over the comparable period in 2015 ($25.7 million loss). The decrease in net loss was driven by a decrease in other expenses of $3.9 million, which was offset by a decrease in gross profit of $2.0 million.

Quarterly Basic and Diluted Loss per Share

The basic loss and diluted loss per share from operations was $0.27 for the three months ended December 31, 2016, compared with a basic and diluted net loss from both continuing and discontinued operations of $0.31 for the same period in 2015. For the twelve months ended December 31, 2016, the basic loss and diluted loss per share from operations was $0.63, compared with a basic and diluted net loss from both continuing and discontinued operations of $0.68 for the same period in 2015.

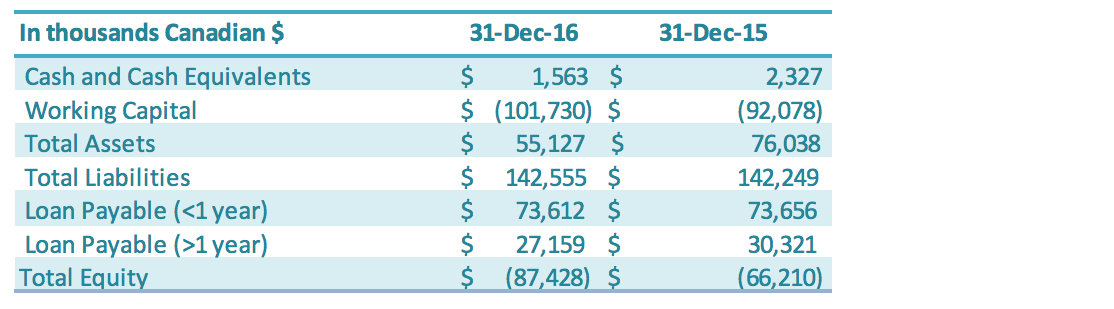

Liquidity and Capital Resources

The Company continues to progress with the following measures to manage cash flow of the Company: paying down short-term loans, reducing accounts payable, negotiating with creditors for extended payment terms, working closely with the banks to restructure its loans, arranging financing with its Directors and other related parties, and reducing operating expenditures including general and administrative expenses and production-related expenses. Total loans payable (both short-term and long-term) is $100.8 million as of December 31, 2016, a decrease of $3.2 million compared to the previous year ($103.9 million). The decrease in loans was driven by the depreciation of the RMB against the Canadian dollar. The Company continued to work with its Chinese banks on restructuring its Chinese debt in 2016. The total of all China bank loans transferred to state-owned capital management company (“SOCMC”) now accounts for approximately 74% of the Company’s outstanding debt with Chinese banks. The nature of the business of these SOCMCs differs from banks, in that they take a long-term outlook on management of debt. For example, instead of simply requiring loan principal and interest payments, the SOCMCs aim to manage debts with greater flexibility, such as long-term loan terms, debt for equity arrangements, flexible debt retirement, and other long-term instruments. This debt is held at the Chinese subsidiary level, and any such potential arrangements would therefore be done at that level rather than at the corporate level. These SOCMCs could also be a source of possible future capital. The Company is still in discussions with these SOCMCs as to final terms – including interest rate and term of the debt – for the transferred debt. Until such terms are confirmed in a formal agreement, the terms of the original loan are represented in the financial statements. The Company’s main initiative to improve its negative working capital position is a potential debt restructuring involving the State Owned Capital Management Companies and China Banks where the Company’s operating subsidiaries owe $63.4 million in short-term debt. The Company is developing a plan to restructure this short-term debt by converting all or a portion of this short-term debt into equity of the Company’s Chinese operating subsidiary (see also section on Short-term and Long-term Loans). The Company continues to be able to negotiate loans with its Directors and related family members to assist with short-term working capital requirements.

Additional Information

Additional information relating to the Company, including our Annual Information Form, is available on

SEDAR (www.sedar.com). Additional information relating to the Company is also available on our

website (www.glglifetech.com).

For further information, please contact:

Simon Springett, Investor Relations

Phone: +1 (604) 669-2602 ext. 101

Fax: +1 (604) 662-8858

Email: [email protected]

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high-purity zero calorie natural sweeteners including stevia and monk fruit extracts used in food, beverages, and dietary supplements. GLG’s vertically integrated operations, which incorporate our Fairness to Farmers program and emphasize sustainability throughout, cover each step in the stevia and monk fruit supply chains including non-GMO seed and seedling breeding, natural propagation, growth and harvest, proprietary extraction and refining, marketing and distribution of the finished products. Additionally, to further meet the varied needs of the food and beverage and supplement industries, GLG’s Naturals+ product line enables it to supply a host of complementary ingredients reliably sourced through its supplier network in China. For further information, please visit www.glglifetech.com.

Forward-looking statements:

This press release may contain certain information that may constitute “forward-looking statements” and “forward looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes” or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations, industry supply levels, competitive pricing pressures and misjudgments in the course of preparing forward-looking statements. Specific reference is made to the risks set forth under the heading “Risk Factors” in the Company’s Annual Information Form published March 31, 2018. In light of these factors, the forward-looking events discussed in this press release might not occur.

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Leave a Reply